How to get cheap life insurance

In many instances, price is a determining factor when deciding whether to buy something. This stands true even when we discuss life insurance. People want to get cheap life insurance and this is understandable. We all would like to save whenever we can. In this post, we will go over the 5 simple steps to ensure that you get the best value out of your life insurance.

Step 1 to get cheap life insurance: Life insurance 101 and know your needs

Many people are intimidated by discussing life insurance. Please, don’t be. There are a few major points that you need to be familiar with when shopping for coverage. This will ensure that you select a product that best fits your needs and your budget.

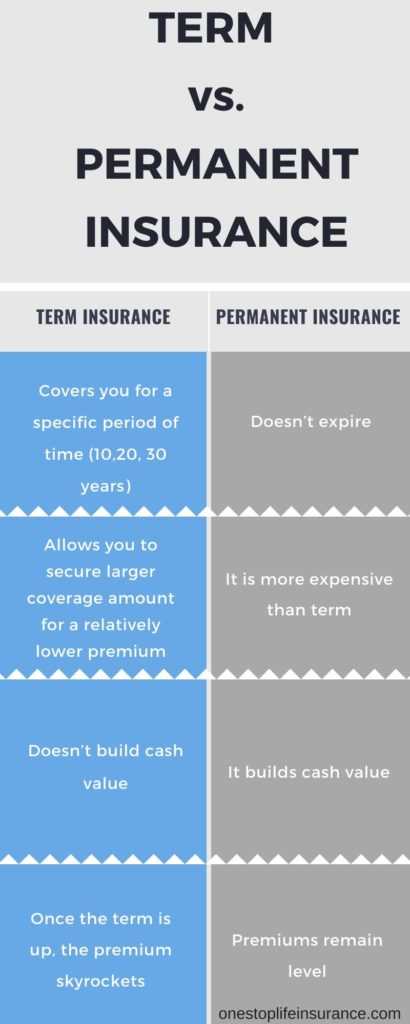

Decide between term and permanent insurance

Look at the table below to get a basic understanding of the different products. You can review our detailed comparison between term or permanent life insurance.

Know your needs

Another thing that you need to make sure you are aware of is your needs. In other words: “How much life insurance coverage do you actually need? Or do you even need life insurance?.” In many cases, people are underinsured. This means that if they die unexpectedly, their family might be left with a financial burden. It is not uncommon for premiums to increase by very little when increasing the death benefit.

For example: Ryan is a healthy 35-year-old man. If he purchases a $250,000 20-year term policy, his monthly rate will be around $17. However, if he decides to increase the coverage to $500,000 20-year term, his monthly rate will increase by only about $10 per month. This is a $10 increase for $250,000 coverage!!!

Please keep in mind that not knowing your needs can also leave you over-insured. Having more coverage than you actually need costs you money.

So, how can you determine your life insurance needs? There are countless life insurance needs calculators out there. We would like to use LIFE. Please keep in mind that this tool will only give you a basic idea of your needs, your best bet is to follow up with a licensed insurance professional.

L – living expenses (car loan, credit card balance, mortgage and etc.)

I – income replacement (usually 10x the annual income)

F – final expense (the average funeral in the United States vary between $5,000-$10,000)

E – education (college fund for the kids)

For more information on life insurance basics and tips, you can review our 5 Dos and don’ts when buying life insurance guide.

Step 2 to get cheap life insurance: Shop around

It is always beneficial to shop around for coverage. Even though you might have a friend who sells life insurance, it will be in your best interest to check out other companies. The reason: every life insurance will look at your situation, health, and lifestyle, differently. In other words, different carriers will charge a different rate, based on their underwriting guidelines. By shopping around, you get rates from more carriers and get to see which one offers the best value insurance for you.

Not to mention that there are many companies offering policies with NO medical exams and living benefits.

Example: Below is a quote comparison for a 37-year-old woman in a little above-average health. As you can see, she can select between different carriers at different prices.

You can see how much your life insurance policy would cost, by using the instant quoting tool on our page. If you have any questions about it, you can share them in the comments section, send us an e-mail, or give us a call.

Step 3 to get cheap life insurance: Get healthy

Now, we understand that living a healthier lifestyle doesn’t happen overnight. However, you can start by making small changes in your everyday life that could have a huge impact. Sometimes, even losing 2-5 pounds can put you at a different height to the weight category. This means that you will be in a better rating class and therefore save money.

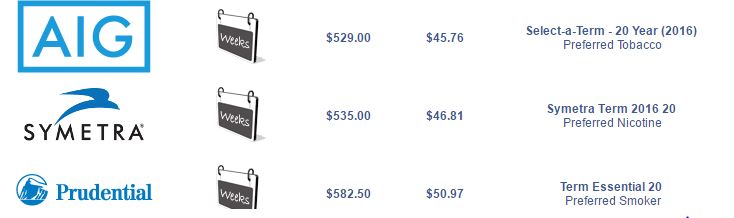

Quit smoking – smoking is a huge factor when determining your rate. It could double your rates. Please see the quotes below. They are for the same 37-year-old female in a little above average health, but who now smokes.

Get moving – Exercising has countless benefits for our bodies. It helps our brain, lungs, kidneys, heart, and blood pressure, and it also helps us sleep better. According to an article published by the Huffington Post

“When you work out regularly, the brain gets used to this frequent surge of blood and adapts by turning certain genes on or off. Many of these changes boost brain cell function and protect from diseases such as Alzheimer’s, Parkinson’s or even stroke, and ward off age-related decline.“

Eat better – we understand that in today’s fast-paced life, it is very easy to reach for fast food vs. fresh cooked healthy meals. According to an article U.S. Department of Human and Health Services, the smarter choices we make every day can have countless benefits.

“Even for people at a healthy weight, a poor diet is associated with major health risks that can cause illness and even death. These include heart disease, hypertension (high blood pressure), type 2 diabetes, osteoporosis, and certain types of cancer. By making smart food choices, you can help protect yourself from these health problems…”

Step 4 to get cheap life insurance: Be honest about your health and medical history with the insurance advisor

You need to be completely honest and answer all of the questions truthfully. Why is this so important and can it save you money? The answer is simple. Every insurance company looks at you differently. In other words, your heart condition may be considered as a standard risk class with one carrier or be rated for it with another. By providing all of the information upfront, an experienced agent will know which carrier is best suited for you. This could not only save you time but also A LOT of money. Learn if life insurance is expensive.

At One Stop Life Insurance, we understand that the subject can be sensitive. Therefore, we want to assure you that we will keep any information you disclose to us confidential and we use it only to find the best product for you.

Step 5 to get cheap life insurance: Don’t wait

This is probably one of the best advice we have for you. There are several reasons why you can save by not putting off getting life insurance:

Age – the best rate you can get for your life insurance is today. Even if you wait as little as 6 months, this could put you in a different age bracket and increase your rate.

Health condition – unfortunately, we are not guaranteed tomorrow, nor do we know what the future holds for us. You might get diagnosed with a condition that makes you rated or even uninsurable.

Die without coverage – it could be a huge financial burden to your family if you die without life insurance coverage.

In Conclusion,

What we would like you to take from this article is that life insurance is a powerful financial tool. There are many ways you can save on your life insurance premium. You just have to do your research, know what you need, and get in touch with us to get your policy.

Thank you!

2 Comments

Ms Nina Virani

Need a life insurance policy as soon as possible. Thank you.

One Stop Life Insurance

Hello Ms. Virani,

Thank you for reaching out. I've sent you an email with the basic information I need. You can also call me directly at my number below.

Thank you,

Zhaneta Gechev

Direct 702-342-8727