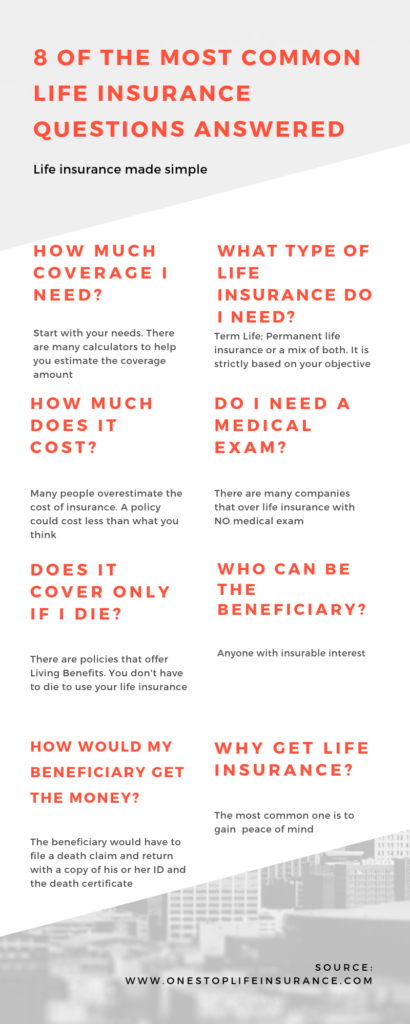

Most common life insurance questions answered

Why get life insurance? How much does it cost and how much does it cover….

These are just some of the life insurance questions one may ask when hearing the words life insurance. In this post, we will go over each and one of them and provide you with the answer. We strongly believe that you need to need to understand the basics of life insurance in order to select the best product for you and your family.

Before we dive into the topic, we wanted to advise you we help people from all over the nation navigate the challenging and often confusing world of life insurance. We are contracted with top insurance providers to offer the best possible rate based on each individual situation. We are here to answer any questions you may have and provide you with professional advice.

How much coverage do I need?

This should be the very first question you need to ask yourself. It will determine the best type of policy for you and that you are not overpaying for coverage. You need to focus on the options that fit your individual’s budget and needs.

There are many ways you can calculate approximately how much coverage you need. One of these ways is using the LIFE calculator. By completing an analysis, we can ensure that the coverage amount is adequate and sufficient. An experienced agent will guide you in completing these questions and account for what you already have in place to meet these needs.

L – living expenses (car loan, credit card balance, mortgage and etc.)

I – income replacement (usually 10x the annual income)

F – final expense (the average funeral in the United States vary between $5,000-$10,000)

E – education (college fund for the kids)

What type of life insurance do I need?

To fully answer this question you need to understand why are you looking for coverage in the first place and how much coverage you need. There is no one size fits all insurance.

Here are 2 major categories of life insurance: term insurance and permanent insurance. For some, based on their needs, term insurance makes the most some, for others a permanent plan will be a better fit. In many instances, a combination of the two would be the best solution. It all comes down to your needs and budget.

Let’s look a little bit closer into the 2 options:

Term Insurance:

As the name suggests, term insurance is for a specified period of time. It could be for as little as 1 year all the way up to 30 years.

For example, if a 25-year-old purchases a 20-year term, he or she would have coverage with level payments for the next 20 years. Once the term is up, based on the different companies, the policy would either cancel or the premiums would increase.

This type of protection generally offers the largest insurance protection for your premium dollar. Many insurance companies allow the option to convert a term policy into a permanent one, during the conversion period. This is usually done without having to prove insurability.

Keep in mind that companies calculate the new rate based on the age at the time of conversion.

Permanent insurance:

On the other hand, permanent insurance is just that, permanent. A policyholder can purchase permanent insurance and have the peace of mind that he or she would not “outlive” the policy. Many of these policies build cash value, that can be used while still alive. There are several different kinds of permanent policies. Some are whole life, guaranteed universal life, and etc.

We’ve created a separate guide to help you understand whether term insurance or a permanent option is best for you.

How much does it cost?

Did you know that many people overestimate the cost of life insurance? In fact, 63% believe that Life Insurance is “expensive” and they probably can’t afford it. Also, 74% of customers over-estimated the actual cost of insurance by 2 times the amount! (according to the 2018 LIMRA Barometer study)

Unfortunately, a lot of people think they cannot afford life insurance. Therefore, they are either not insured or significantly underinsured. Cost is a concern for many people, so we’ve created a comprehensive guide on how is your life insurance rate determined. That way you would have a better understanding of the factors playing into your rate.

Do I need a medical exam?

No, you don’t. There are many companies that could offer life insurance without requiring the additional step of a medical exam. Just keep in mind, for some options an exam will be required.

Did you know that now you can even self-complete your application in less than 15 minutes?

Does it cover only if I die

This one of the very common life insurance questions we get? The answer is not necessarily. There are many companies offering life insurance policies with living benefits built into the coverage. In other words, you don’t have to die to use your life insurance. In fact, living benefits is one of the 4 ways you can collect from a life insurance policy.

Who can be the beneficiary?

A beneficiary could be anyone who might suffer a financial loss due to one’s death. For example, a spouse, kids, business partner and etc. The policy owner selects the beneficiary at the time of the application process. In most cases, the beneficiary can be changed simply by requesting and signing a one-page document. There are cases when the beneficiary can be irrevocable and the owner can’t make any changes.

How would my beneficiary get the money?

Typically, when a person passes away, his or her beneficiary will contact the company and file a death claim. The company will send out a death claim package. The beneficiary would have to fill it out and return it along with a copy of his or her ID and the death certificate. That it. The company would review the information if no additional information is needed, they will process the payment.

Let’s just point out the biggest advantage of life insurance: the death benefit is generally tax-free the beneficiary. That’s right. They won’t have to worry about paying upwards of one-third in taxes.

Please keep in mind, that this process may take a bit longer than we hope for. Some of the reasons could be how long the policy has been in force, is the company contesting the claim, and is there any foul play is involved.

Why get life insurance?

We covered some of the questions on “how” to get life insurance, but we feel it’s equally important to cover why get life insurance? The answers to this question vary, but the most common one is to gain peace of mind. We want to make sure that our loved ones would not suffer financial hardship in an event of our unexpected and untimely death. Having the right life insurance gives us the confidence to know that we are not going to be a burden to our family. Life insurance can be one of the many ways we plan for the future. Many people can use the policy as an estate planning tool.

Common mistakes to avoid when shopping for life insurance

Even though this is not a question, we felt it is important enough to touch on it. Purchasing life insurance is an important financial decision. Your family counts on it. Here are the 5 Dos and Don’ts when shopping for life insurance.

In conclusion,

You might have many questions when it comes to life insurance. Don’t hesitate to reach out to us and explore the best option for you. We will walk you through the process of getting life insurance and guide you every step of the way. We strive to provide you with personable customer service while incorporating the conveniences of today’s modern technology.