Is there life insurance for children with addiction?

There is no doubt that drug usage in the US and across the globe is a growing problem. Parents are faced with new challenges and unfortunately one of them is: are they able to buy life insurance for children with addiction? As

Unfortunately, there is no one sure answer that would fit every person. So, please reach out to us and let us take a look at your situation and help you and your family find a solution.

Drug addiction is a growing problem

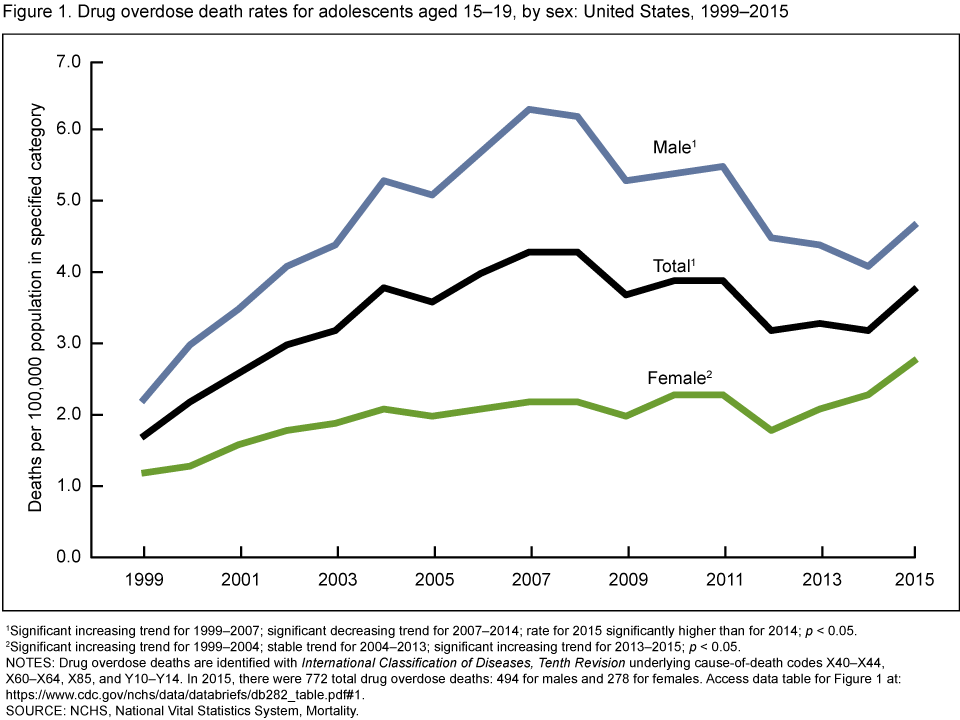

The stats on the subject are beyond alarming. Even though opioid use in teens has been on a decline, according to the Center for Disease Control and Prevention, deaths rates in adolescents are on the rise. Just look at the chart below.

It is important to acknowledge that addiction is a chronic medical condition, not an issue of willpower. Just like diabetes, arthritis, or asthma, it can not be cured, it is rather managed over time.

If you, a family member or a friend is battling addiction, there is hope. Please reach out to a local organization or your personal healthcare provider. Treatment could be a combination of all or one of these methods: therapy, medication, support groups, education on how to manage and etc. The sooner the condition is addressed, the better the chances are at recovery and management.

We would now turn our attention to what options are available to secure life insurance for children with addiction .

Please note that the following information would pertain to obtaining a policy if your child is 17 years old or below. Due to the vast difference in options, we would dedicate a separate guide for options available for people of age 18 and above.

So, why a person may be looking into purchasing life insurance for an adolescent?

Below are just some of the reasons to why this makes sense:

- Protect their future

Addiction is manageable. It is possible for your child to overcome addiction and have a healthy and productive life in the

- Cover future expenses – like student loans, vehicle loans, medical bills and etc.

As parents, we want what is best for our children. Often times we would co-sign on a loan for them or enter into any other financial obligation to help them in life. Unfortunately, life is unpredictable. Even though a person may overcome an addiction, there is no guarantee that he or she may not leave us unexpectedly.

- The unthinkable happens

What if the worst happens? What if you lose your child and have to bury him or her? The devastation would be tremendous. Allow yourself time to grieve. Allow yourself the ability to take financial obligations out of your struggle. Securing coverage for your children will give you peace of mind that you would be able to bury them and take some time off work to grieve.

This without a doubt a very difficult topic. However, we felt it is important and avoiding it would not make it disappear.

So, what are your options to purchase life insurance for children with addiction?

Due to the nature of the condition, many companies would not approve a stand-alone individual policy. Many carriers are asking on the application if the applicant:

- Used narcotics, barbiturates, amphetamines, hallucinogens, marijuana, heroin, cocaine, or other habit-forming drugs, except as prescribed by a physician

- Received medical treatment or counseling for, or been advised by a physician to discontinue, the use of alcohol or prescribed or non-prescribed drugs

- Been a member of any self-help group such as Alcoholics Anonymous or Narcotics Anonymous…

The exact

Therefore a good option to secure life insurance for your children is by purchasing a child rider on your policy.

In a nutshell, a child rider is an add-on feature to your life insurance policy. The cost is determined by the coverage amount you select. Typically, a rider offers coverage from $5,000 – $25,000 coverage.

The pros of these options are price and convertibility

Here are important things to consider when buying life insurance for children with addiction:

Not all child riders are equal – in other words, not every insurance company would approve coverage for a person battling addiction. You need to apply with a company that would approve the rider.

Pro Tip:

Work with an individual agent, who has the opportunity to shop for insurance coverage among several carriers and know their guidelines.

Exclusion of the riders – this may be one of the biggest things to consider. Almost all insurance policies have a 2-year suicide clause.

What does this mean?

If you purchase a policy with a child rider today and the child passes away within 2 years of the policy due to suicide, the carrier would deny the claim. This exclusion applies to EVERY policy.

It would be up to the coroner’s office and police to determine if the death was intentional or by accident and then afterward the claims department to make the decision. These situations are very delicate and difficult for the families and everyone involved.

If the death was determined to be suicide during the first 2 years of the policy, the carriers would deny the claim.

In conclusion,

Please remember life insurance for children with addiction is possible. It provides

Thank you.