Children and Family

For many, having children and family is the true meaning of life. However, please take a moment and ask yourself: “Should something happen to me today, will my family have enough funds to survive?” It is an unpleasant thought; we understand that, but an important one.

At One Stop Life Insurance, we are truly passionate about protecting your most precious: your children and your family. We want you to have all the tools to make the best financial decision for you and your loved ones. Therefore, we created this life insurance guide to answer some of your questions when it comes to life insurance. You can go through it or click the topic that is of most interest to you.

Table of contents:

- As your family change so does your life insurance needs

- Types of life insurance policies

- Why consider life insurance on your children

- Life insurance option for children

- Common mistakes to avoid

Before we dive into it, we wanted you to know that you can always reach out to us, if you have any additional questions. We are available via phone, e-mail or the comments section on the website.

As your family change so does your life insurance needs

As different life events happen in our lives, our priorities and needs change. But why needs are important when it comes to life insurance? Well, a good life insurance policy will be customized around what is important to you in life and what are your needs. Having the wrong kind of policy could leave you under or even over-insured.

Neither of the two instances is a good option. If you do not have sufficient life insurance coverage, your family might be left with a huge financial burden. On the other hand, if you have too much coverage, you are overpaying for life insurance.

We know from our experience, that many people believe $100,000 or even $250,000 in life insurance coverage is more than enough for their family. The reality, however, is different.

Here is an example,

A funeral alone is around $8 – $10,000; According to a publication by Nerdwallet , the average household credit card debt is $16,425 and the average auto loan is $29,058. We will not even go into mortgage balance, medical bills, colleague funds and etc. Now, you get a clear picture of just how fast these expenses add up.

This is why it is important to take time and calculate how much life insurance you need. An experienced agent will walk you through the process to ensure that your coverage is tailored to your specific needs. Below, we will provide you with a simple life insurance needs calculator. Please keep a note that this is not extensive and all-inclusive. Yet, it will give you an idea of your personalized needs.

L – living expenses (car loan, credit card balance, mortgage and etc.)

I – income replacement (usually 10x the annual income)

F – final expense (the average funeral in the United States vary between $8,000-$10,000)

E – education (college fund for the kids)

Life events that change life insurance needs:

Here is a list of just some of the life events that change one’s life insurance needs. There are many more examples, but when you go through it, you will get the idea.

Marriage/divorce – there is no doubt that one’s life changes when his or her marital status changes. This will be a good time to also re-evaluate your life insurance needs. Talk to an advisor and go over your plans and start planning how to protect them.

Please keep in mind that there are many instances, where life insurance is a required part of the divorce decree. You can reach out to us for more information. We’ve dedicated an entire post on how to secure life insurance on your child’s other parent.

Do not forget to update your beneficiary on your existing life insurance policy or change your current policy information (for example address, name change if applicable).

Birth or adoption of a child – these are some of the happiest and unforgettable moments in one’s life. The addition to the family also means an addition to your financial responsibility. The little ones will count on you to provide for them, love them whether you expanding your family through adoption or have biological children. This is also a good time to review your life insurance policy and ensure that the coverage is sufficient. Also, you might want to consider adding coverage on your little ones. We’ve listed some of the reasons why life insurance on kids makes sense and your top 3 options to secure it.

Single parents – for all single parents out there, juggling work, kids, and life in general: you are heroes! However, you have an increased responsibility towards your child (ren). Please do not postpone it and find time and room in your budget to secure the protection your children need. Life insurance for single parents is easy and affordable. It is also a good time to review the guidelines to secure coverage on your boyfriend/girlfriend. This especially important when there are children involved.

We would like to show you an illustration of how your life insurance needs change, as you enter different stages of your life. For example, let’s take a look at Steve and how his life insurance needs:

Steve is 21 years-old and single; he rents and the only big expense he has is his car payment. For him, probably $50-100,000 in coverage will be sufficient. It will pay off the balance on his car and cover funeral expenses should something happen to him.

Steve is 41 years-old and married with 3 children. Now, he needs to protect not only his assets but his family and ensure that they will have enough life insurance coverage should he pass. Based on his savings, expenses, and goals, Steve needs $750,000 in life insurance coverage.

Steve is 61 years-old. His children are adults and no longer financially dependent on him. There is very little balance on his home and he has some savings. During this stage of his life, he may need something to cover his final expenses. Based on his situation, he needs only about $25,000 in coverage.

As you can see Steve’s needs change over time. This is why it is important to reevaluate your life insurance policy, to ensure that it is up to date.

With that being said, there is one very important factor that we also need to take into consideration. It is your insurability. In other words, will your application for life insurance be approved, based on your health and lifestyle? There is no certainty that we will be healthy tomorrow and that we will qualify for life insurance.

Types of life insurance policies

We will touch on the types of life insurance policies available. We believe that way you can make an educated decision about protecting your children and family.

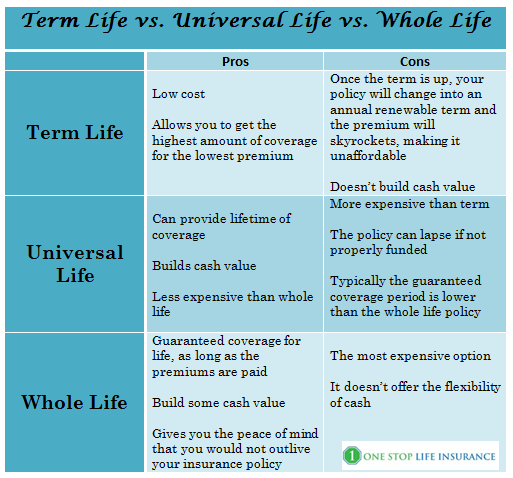

The three major types of life insurance policies are Term insurance, Whole Life, and Universal insurance. Below we will go over each one and list the pros and cons.

- Term Life insurance – provide coverage for a specific term. The most common terms are 10, 20 or 30-year term policies.

- Universal Life insurance- these types of policies fall into the permanent insurance category. They offer guaranteed life insurance benefits along with a guaranteed cash value accumulation percentage. However, you need to make sure that the policy is properly funded. Otherwise, it could cancel, leaving you without coverage.

- Whole Life insurance – it is guaranteed permanent insurance for the insured’s life or up until maturity, as long as the premiums are paid.

Why consider life insurance on your children

As parents, we understand that just the mere thought of something happening to our kids can scare us. Sadly, children pass. Avoiding the topic or not acknowledging it will not make it disappear. Brave yourself and see why it is important to buy life insurance for our children:

In case they pass – the devastation that this will cause to a family is beyond belief. Having life insurance set in place will allow the parents to bury their child, take some time off work and grieve.

Locks in their age – everybody knows that life insurance is based on your age. The younger you are, the cheaper your policy will be. Even when they are off in college (by the way see why life insurance should be tied to students loans), they will be paying the price of a toddler. So, why not lock in their age by getting life insurance today?

Locks in their health – as we discussed above, insurability is a huge factor when it comes to life insurance. There is no guarantee that they will be able to qualify for a life insurance policy when they are ready to get it on their own. They could develop conditions such as asthma or epilepsy. Even though the cases may be mild, they could still have a hard time securing coverage.

Things to consider when securing life insurance coverage on your children

Coverage on the parents – as a part of the life insurance underwriting process, the insurer wants to know how much coverage the parents have. The life insurance policy on the kids needs to be a percentage of the parent’s coverage. In some very rare instances, the child can have more life insurance than the parents do.

All the kids in the household need to have similar coverage – the underwriting department would ask you why you have $100,000 on one of your children and only $10,000 on the others, for example.

Children with special needs – unfortunately, this topic is often overlooked. The one thing that we want you to look out for is naming them as the beneficiary on your life insurance policy. The reason being is that any proceeds they will receive may jeopardize their social security benefits. Please make sure you consult with a social security attorney in your state. This might be also a good time to look into setting up a Special Needs Trust if you haven’t already.

Life insurance option for children

When it comes to life insurance on children, there are 2 major options. Each one has its positives and negatives. Which one is best for you, depends on your personal situation.

Rider on the parent’s policy

A rider is an additional feature added to a life insurance policy. Riders allow the insured to customize his or her policy to fit his or her needs and budget. This may be the only option if your child was born premature or is diagnosed with cancer, leukemia or battling addiction.

Get an individual policy

This option has many benefits, but it is a most costly approach and it is subject to underwriting. In other words, if your child has a pre-existing condition, or have been diagnosed with autism, Down syndrome, or type 1 diabetes it may be challenging to go with that option.

If you are looking for coverage on an adult with a pre-existing condition, guaranteed acceptance life insurance or an accidental policy might be the only possibility. Our agents will take the time to evaluate your situations and advise you of the available options.

This is a good time to mention that we’ve also helped adults diagnosed with Down syndrome secure coverage.

As you can see from the infographic, the rider is a cheaper option, provides coverage for all of the household children. However, it comes short when it comes to the coverage limit.

A huge determining factor when deciding on an individual policy on your children or child rider is the factor: “insurability”. If the children are healthy, but the parents have any health concerns, it may be the best option to go with an individual policy. On the other hand, if the children have been diagnosed with a certain medical condition, but the parents are in good health, the child rider may be the only option available.

Common mistakes to avoid

So, what are the most common mistakes to avoid when shopping for coverage for your children and family?

Focus only on price – this is probably the biggest mistake. Yes, the price is important, but the value is more important. Sometimes, you are looking at 2 different rates from 2 different carriers for the same type of coverage. Don’t go straight for the cheaper one. Take a moment and examine the offers. In some cases, one of the policies includes more features compared to the other for example, no medical underwriting, living benefits and etc.

In other instances, if you have or had a health or lifestyle condition like alcohol abuse or addiction, some companies would treat it more favorably than others, even though they may not be the lowest price at first glance.

No knowing your actual needs – as we covered the topic at the beginning of the page, needs are important. You need to be aware of how much life insurance coverage you need and what kind is best for you.

Please do not worry, if you do not have the answers to these questions just yet. When you contact us, we will go over your needs and help you select a product that is best suited for you.

Don’t review the policy – please don’t view the life insurance policy as purchased and done. Make sure you review it at least once every 1-2 years. You want to make sure that your address and contact information is up to date, the coverage is still adequate, review the beneficiaries and etc. This process should not take more than 10 minutes but could save you a ton of potential problems down the line.

Put off securing life insurance for your children and family – this could be a devastating financial disaster. The last thing you want for your family is to have to set up a Go Fund Me account after your passing. Please ask yourself: “should something happen to me today, will my family have enough fund to survive?” It is an unpleasant thought; we understand that, but an important one.

Thank you for taking the time and going over our life insurance guide for children and family. Should you have any questions, or would like us to review your personal situation, just reach out to us.