Life Insurance and Adoption

There many reasons one might choose adoption, but the end result is the same: fulfill families’ lives. It is an exciting, emotional and sometimes even challenging process. The adoption itself can be a lengthy affair, involving many steps and procedures that need to be followed. In this post, we would like to discuss life insurance and adoption.

There are 2 main things we will touch on: Life insurance on parents as a requirement during the adoption process and getting life insurance on recently adopted children.

Every family is unique and every situation is different. Please reach out to us if you have a specific question and would like us to protect our growing family. You can fill out the instant quote form, leave a comment or give us a call.

When discussing the life insurance and adoption, we would first turn our attention towards the little ones. It is as equally important and beneficial to secure a life insurance policy on an adopted child, as it is on a biological child. There are several reasons why life insurance on kids makes sense.

It is important to mention that you would need to wait until the adoption process is finalized before you can purchase a life insurance policy on your child. The life insurance companies would wait until you are the legal guardian prior to approving and issuing a policy on a minor.

There are several ways you can go about purchasing a life insurance policy on your adoptive child. It all comes to his or her health and the family’s needs.

Option A

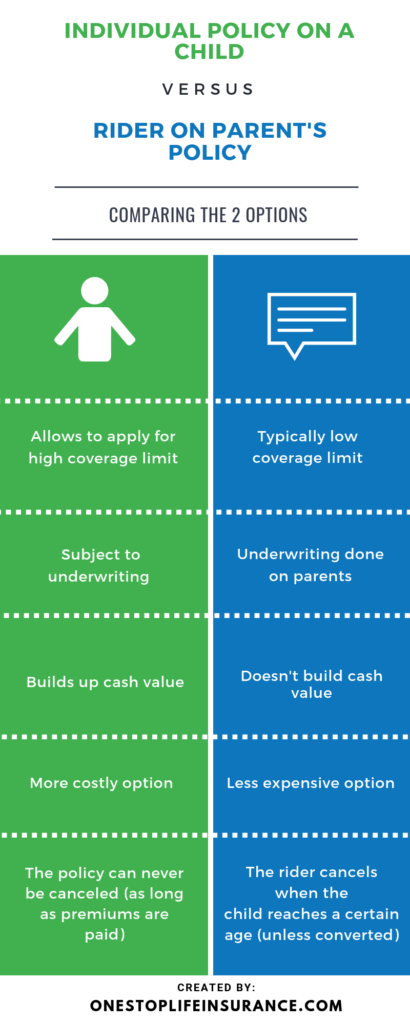

You can purchase an individual policy on them. Please keep in mind that since the underwriters might not have the complete medical and/or family history, it might take a little longer.

In addition, if the child is diagnosed with a pre-existing condition, such as asthma or epilepsy, securing this option may be more challenging.

Option B

Your other option is to purchase a new policy on you and add your child/children as a rider to your policy.

Each option has its positives and negatives. It is important to familiarize yourself with each one and see which one is a better fit for your family’s needs.

∗A rider is a feature of a life insurance policy that will allow the owner to add additional benefits

Life Insurance and Adoption as a requirement in the adoption process

Life insurance is a necessity for every individual. This is even more applicable when one is considering starting a family. Whether you have biological children or you decide to adopt, you will have a financial responsibility towards your kids.

In the event of your premature death, the beneficiary can use the proceeds from the life insurance policy to ensure a stable future for your loved once. Adoption agencies want to make sure that you are taking all of the necessary steps to provide for the child/children you are about to adopt.

Therefore, having life insurance on the parents is one of the requirements when adopting.

Based on your age, health, and budget, there are several types of insurance policies you can select from. The most common options available are term and permanent policy. There are also features, variations within the categories, or even a combination of the two.

Advantages and Drawbacks of each option

A term policy will provide a large death benefit for a lower monthly cost. It is referred to as the best “bang for your buck”. There are several term options available: 10, 15, 20, 30-year term. During the term, the policy will stay in force (as long as the premiums are paid). After the term is up, the policy typically changes into an annual renewable term and the premium skyrockets.

For example, if you are a 25-year-old healthy non-smoking male, you can purchase a $250,000 policy for about $13 per month. This rate will be guaranteed for the next 20 years.

The disadvantage of a term policy is that when the term is up, it becomes unaffordable for many and they cancel the policy. Another drawback is that it does not build cash value.

A permanent policy provides the peace of mind that you would not “outlive” your policy. You are able to “lock” a monthly premium and not having to worry about protecting your family. Another HUGE benefit is building cash value.

The biggest negative on a permanent policy is the price. Today, a permanent policy cost more than a term policy. However, in the long-term, it could be a better value product.

It is important to consult with a licensed professional who can help you decide which product is right for you. At One Stop Life Insurance, we have more than 11 years of experience in helping people protect their loved ones.

Keep In Mind:

You would need to pay special attention to how you are listing the beneficiaries on your life policy. To avoid any complications and confusions, list the full names of the beneficiaries. This way there will be no additional questions or things you would need to clarify.

For example, if you intend to list your children as beneficiaries, you will need to clear up if you plan to include adopted children or children by a former spouse.

If you have a specific question or you would like us to provide you with a personalized insurance plan, you can reach us via e-mail, by phone or simply leaving a comment below.

Thank you!