Why life insurance and student loans should go hand in hand?

Why should you consider getting life insurance when applying for a student loan? What happens to the debt should something happen to the borrower? These are just some of the questions that might be going to one’s mind when signing or co-signing on a student loan application. In this post, we’ll cover just that. There are many things involved when it comes to life insurance and student loans, so please take the time to go over this guide.

If you would like us to take a look at your personal situation, you can always reach out to us. You can contact us via e-mail, by phone or simply by filling out the instant quote form on the page. Please keep in mind that your information is kept confidential and we take your privacy seriously!

What we’ll cover

- Types of student loans; pros and cons

- What happens to the loan should the borrower pass away

- What can you do?

- Different options and cost

OK, Let’s get started…

Types of student loans; pros and cons

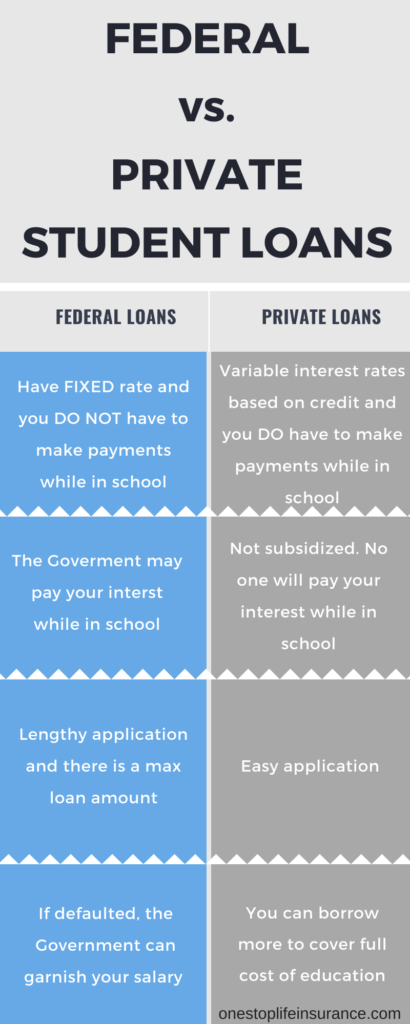

First off, we felt it is appropriate to touch on the different types of student loans and what are the pros and cons of each one. We are sure that there might be some other combinations and/or features not included here, but at least you would have a good overall understanding.

Federal loans

Federal loans have many advantages and they are typically the starting point for someone looking for financial help when paying for school. They have many advantages such as fixed-interest and the loan repayment does not have to start until you leave school or your status change to less than half-time student. Typically, students start off by filling out the Free Application for Federal Student Aid, also known as FASFA. After your application is submitted and reviewed, you will be able to see what help you qualify for.

Federal student loans could fall into one of the following categories:

- Direct Subsidized Loans –the biggest advantage of direct subsidized loans is that the Government pays the interest while the student is still enrolled in school.

- Direct Unsubsidized Loans – with direct unsubsidized loans, the interest starts accruing immediately when the loan is taken out.

- Federal Perkins Loans – these are types of loans, where the school is the lender. The interest is relatively small. Federal Perkins loans are available for both graduate and undergraduate students.

- Direct PLUS Loans – these loans are for graduate and professional students or parents of a dependent student. These types of loans help pay for any expenses up to the cost of attendance minus all other financial assistance.

Private loans

This is the other classification for loans. These are types of loans made by an institution such as a bank, credit union, school and etc. Typically you will need to start repayments while still in school and the interest rate is higher than federal loans.

As a summary, we’ve created this comparison table. You are able to see the pros and cons of federal and private student loans.

What happens to the loan should the borrower pass away

The answer to this question depends on the type of student loan you have.

If you have a federal student loan:

According to the U.S. Department of Education, if you have a federal student loan and the borrower dies, the loan will be canceled. The Government will discharge the debt.

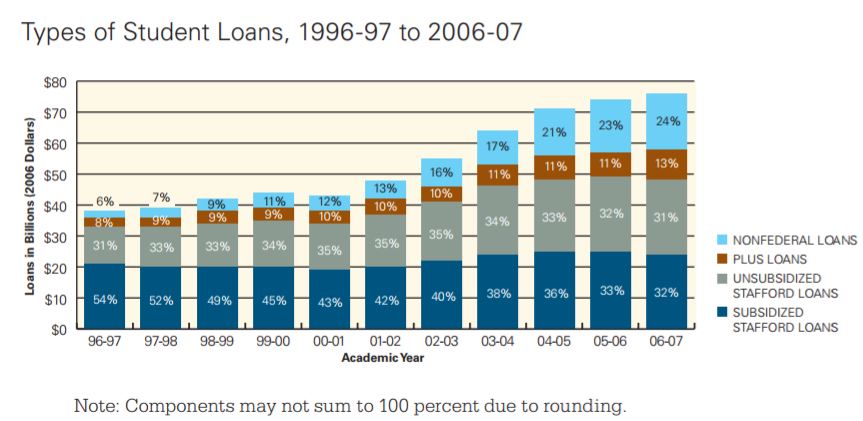

While this is a great benefit of federal student loans, the percentage of private loans is gradually increasing.

If you have a private student loan:

The above trend is troubling because if the borrower of a private student loan dies, the loan is NOT automatically canceled. In fact, for the majority of private student loans, the lender will attempt to collect the amount borrowed. They will first try to collect from the borrower’s estate and/ or from a co-signer if one exists.

What can you do?

You should consider applying for life insurance and student loans at the same time. This will ensure that should something happen to the borrower, his or her family will not be left covering the bill. It is a valid concern and an issue that needs to be addressed. The last thing that student’s loved ones need to worry about is how to cover the remaining balance of the student loan. This could be a big chunk of change, considering that the average loan balance is over $37,172.

Also, did you know…

… that the student loan is a type of loan that is very difficult to be discharged in bankruptcy. In fact, many attorneys may even say it is impossible.

Below are some guidelines, as to what you can do:

If you are a parent of a student or a co-signer of a student loan:

- You can purchase life insurance on the student

He or she will be considered the insured. The price and the available types of insurance policies will be based on his or her health and lifestyle.

- Be the owner of the policy

The owner of the policy has rights of the policy, as well as responsibilities. For example, the owner can make changes to the life insurance policy, such as beneficiaries, address, payment mode and etc. Typically, the owner is the person paying for the policy. In order to be an owner of someone’s life insurance, you need to establish what is called an insurable interest. You need to demonstrate to the company that you will suffer some form of a financial loss, should the insured pass away

- You can be the beneficiary

The beneficiary is the individual or individuals who will collect the death benefit, should something happen to the insured.

- Make sure that you will have the option to transfer the policy to the insured

This means that when times come, you could transfer ownership to the policy to your son or daughter. From that moment on, he or she will be able to select a beneficiary, make changes and will be responsible for the premium payment.

- What to do if your child’s health doesn’t qualify him or her for life insurance

Unfortunately, this is a reality for many families. For one reason or another, their son or daughter may be insurable. In these instances, you need to consider other options.

If you are the primary borrower of the loan

Make sure you have some life insurance on you – there are many policies offering coverage as little as $50,000.

Name your family as beneficiary – parents or spouse.

Make sure you inform them that there is a policy in place – you would be surprised how many people are not aware that there was a life insurance policy set in place. In order for the beneficiary to collect from a policy, he or she would need to know the following information:

- Name of the company

- Policy number

- Contact information

Different options and cost

When it comes to life insurance and student loans, you have different options to choose from:

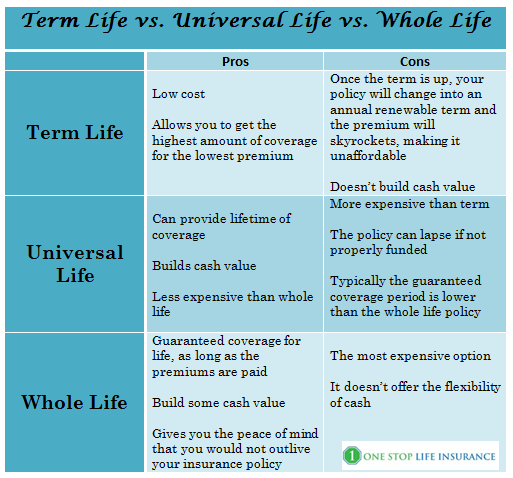

Term or permanent coverage – this will be the first decision that you would need to make. Each type of coverage has its positives and negatives. Below is a quick summary of the two to help you make the selection.

Coverage amount – this will be the second thing that you would need to consider. An experienced life insurance agent will guide you through what is called life insurance needs calculator. It is simply taking into account your liabilities, such as student loan balance, credit/vehicle loan, mortgage, funeral expenses and subtracting them from your assets such as savings, 401 K, IRAs and etc. The difference will be what you need in life insurance coverage.

Cost – this is the real question. How much does life insurance cost?

Did you know

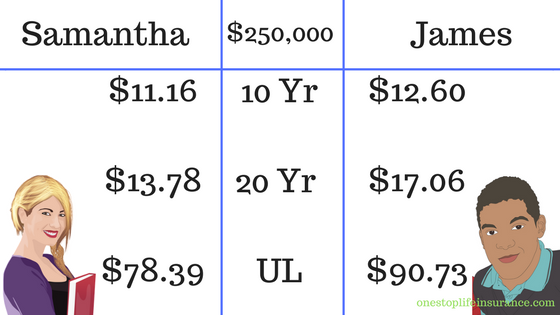

That the majority of people think that life insurance is expensive and overestimate its cost. In reality, there are policies as little as $10-15 per month for $250,000 in coverage.

Let’s look at an example:

Meet Samantha, 25 and James also 25. They are above-average health and don’t smoke. Below are examples of what life insurance would cost for $250,000 in coverage, based on the type of policy and the length of term they select.

*UL – Universal Life Insurance

Now, we do understand that $250,000 is probably way more than you have as a balance on the student loan. However, this will give an idea of what life insurance actually costs.

We hope that this guide gave you a better understanding of the different types of loans and answered the question: “why life insurance and student loans should go hand in hand?” If you have any specific questions or would like us to give you more information, you can fill out the instant quote form on this page or give us a call.

Thank you!