Life insurance as an estate planning tool for foreign nationals

Are you are a foreign national considering the ways to maximize your estate? Are you aware of the consequences if you do not plan accordingly or what your family could expect should you pass away? In this post, we want to go over the importance of estate planning and why you should act now. We would outline why you should consider life insurance as an estate planning tool for foreign nationals.

Prior to diving into the topic, we want to stress that our main objective is to raise the question and show you solutions. By all means, we are not giving you tax advice, we specialize in life insurance, not financial services.

Here are the topics we would cover.

Feel free to go through the entire post (should take you 3-4 minutes) or review the ones that are most relevant to you.

- What is estate planning

- Why foreign nationals need to consider estate planning in the US

- Life insurance as an estate planning tool for foreign nationals

- How to start the process of estate planning

- What are the key things that you need to be aware of

We strive to keep this guide straight to the point and provide you with accurate and up-to-date information. Please keep in mind, if you would like us to take a look at your personal situation and advise you on the options you have, simply reach out to us.

Ok, let’s dive in….

What is estate planning

We wanted to take a short minute to discuss what exactly means estate planning and it’s benefits. Simply put, estate planning means creating a plan and deciding who will inherit your assets when you pass away. The most common objectives of estate planning are to minimize the potential tax exposure and also name a guardian of minor children. There are various ways to do that, however, most people employ an estate planning attorney to help them.

Why foreign nationals need to consider estate planning in the US

Since we touched on the basics of estate planning, let’s dive into why it’s important for a foreign national to consider estate planning if he or she owns assets in the US. We’ve divided the subject into several key points. Please note that should you renounce your US citizenship, you would be considered a foreign national.

Exposed to significant US estate tax and reduce the value of your assets.

If you are not a US citizen or permanent resident and would like to transfer assets to your loved ones when you pass away, they may be exposed to significant U.S. federal estate and gift taxes. Unfortunately, they could significantly reduce the value of your estate.

Under the current tax law, foreign nationals who have assets in the US and do not reside permanently in the US are exempt from taking advantage of certain tax provisions.

We can’t stress enough the importance of estate planning in an effort to preserve your assets and estate.

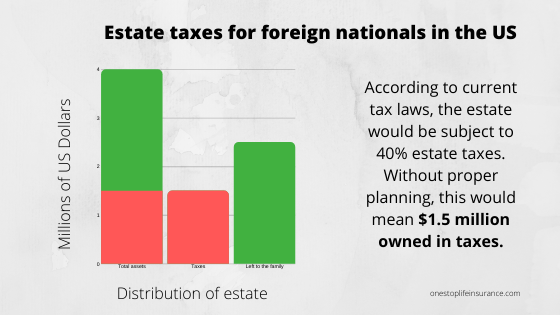

Let’s give you a quick example:

Meet Martin, he is a foreign national and lives abroad. He holds approximately $4million in investment assets and real estate in the US. If Martin does zero estate planning in combination with his residency status, his family would have to pay more than a third in taxes. According to current tax law brackets, the top tax rate is 40%. This means that the net estate tax due on his $4 million would be approximately $1,5 million. In other words, his family would inherit only $2,5 million.

US non-resident aliens could shelter only $60,000 in US assets from US federal estate law.

We would outline below how to determine if you are considered a non-resident or resident alien.

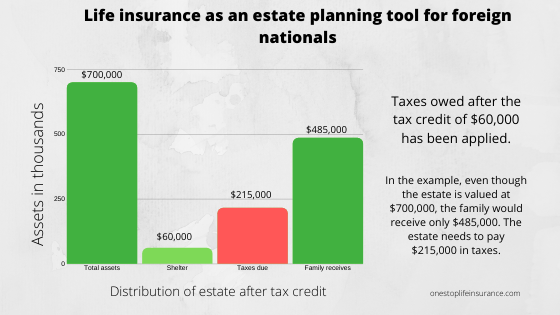

Let’s explain what this exactly means. Currently, if you own assets in the US worth more than $60,000, they would be subject to federal taxes.

Here is a quick example:

Adam owns $700,000 in US assets. Upon his death, the taxes due would be based on $640,000. Assuming he falls into the 40 percentile, his family would owe over $215,000. Unfortunately, that tax may be due up to nine months after his death. In other words, if his family does not have $215K to pay IRS, they will have to sell the assets. This is simply adding insult to injury.

Why life insurance as an estate planning tool for foreign nationals?

The answer lies within the tax treatment of life insurance proceeds. According to the US tax code, life insurance proceeds receive a favorable tax treatment. In most instances, life insurance benefits are tax-free. This could be a tremendous help and an extremely powerful tool to plan and preserve your estate.

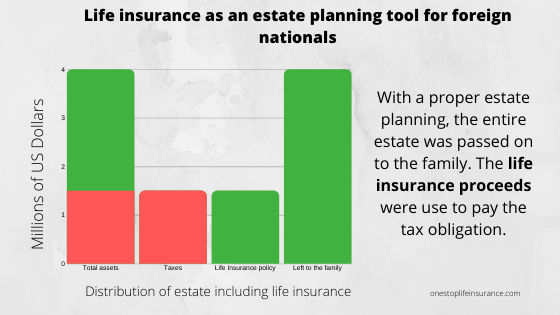

Let’s look at Martin’s case again. However, this time Martin did some estate planning and purchased a $2,5 million in life insurance coverage. This number is not random. Martin met with his tax accountant and was able to estimate the approximate tax obligation should he pass away.

An account would be able to guide you through a proper coverage amount you need and our job as agents is to find you the best company that could offer you this coverage for the least cost possible.

This is a great example of how to use life insurance as an estate planning tool for foreign nationals. It is more than essential to plan ahead and minimize the financial impact to your family should you pass away.

Here is the other benefit of life insurance:

Tax-deferred growth of the cash value account

Let’s elaborate on this for a minute. There are policies, such as universal life or whole life, that not only provide your family with a death benefit but also are building cash value. The cash value grows on a tax-deferred basis and could be used for living needs.

Think about it… Life insurance could not only provide your family with funds to cover any potential tax obligation, but it could give you access to cash, while still alive.

How to start the process of estate planning?

There are several steps that you need to take to ensure proper estate planning.

Are you a non-resident alien or resident alien and why does it matter?

Your family could be impacted differently by the US federal estate and gift taxes, based on your residence.

Take a look at the table below. In which category you have more answers? This would help you predict your classification.

Here why it matters:

- If you are a non-resident foreign national, your estate would be subject to US transfer tax ONLY to the extent of assets located in the US. Also, your family would be able to shelter up to $60,000 in US-based assets.

- If you are a resident foreign national, your estate would be subject to US transfer tax to the extent of ALL assets, regardless if they are located in the US or worldwide.

Consult with an international tax and estate planning attorney

The key here is to work with someone is an expert in international tax planning. You want to ensure that you are maximizing the value of your estate worldwide. This would be a good time to mention that you have a foreign national spouse, you may want to consider a Qualified Domestic Trust (QDOT). Review our guide on life insurance for a foreign spouse.

Set up a life insurance policy to protect your estate

Once you know exactly what you need and the ways to protect your estate, reach out to us. We would help you navigate through the world of various life insurance carriers and match you with the best option. Our objective is to take the time to understand your needs upfront and provide you with a solution. We have access to several carriers that specialize in life insurance for foreign nationals and have guidelines designed to suit the life insurance needs of foreign nationals.

Consider setting up your policy in a way to maximize the cash value growth (if this is what you need). That way you could not only have the death protection but take advantage of the tax-deferred growth within your cash-value account.

What are the key things that you need to be aware of

There is a special set of rules that companies would follow when reviewing life insurance for foreign nationals. We’ve dedicated an extensive guide to the subject. Below we would point out some of the basic requirements companies have:

Be in the US for the entire process

There is no exception to this rule. Every company requires you to be in the US for the solicitation, application, underwriting, and policy delivery. The only exception is that they may allow a limited power of attorney for the policy delivery. Therefore, we would ask you to plan accordingly and allow enough for your policy to be processed. Even if you are purchasing a policy to cover only your final expense, you still need to be in the US.

Have financial ties to the US

In other words, there must be a reason why policy in the US makes sense. Unfortunately, we’ve worked with clients interested in life insurance in the US only because they could not find a good option in their own country. This would not fall under financial ties to the US and there are no grounds for a policy to be issued. In other words, you can’t come to the US for the sole purpose of getting life insurance.

The premium needs to be paid out of a US bank account

Some companies require the account to be established for more than 6 months prior to the application.

You still need to qualify based on your health and lifestyle

Be prepared to answer health and lifestyle questions to determine eligibility. In addition, the companies may require a copy of your medical records, translated in English.

Financial underwriting

Based on the circumstances, carriers may ask for a 3rd party financial data to ensure that all of the financial ties are met and policy limits are adequate.

In Conclusion

You need to plan ahead. Life insurance is a crucial estate planning tool for foreign nationals. It helps preserve your estate and ensure your family is financially protected. The benefits of life insurance by far out weight the cost of insurance and are an essential part of one’s financial portfolio.

Feel free to reach out to us if you would like us to provide you with a personalized solution plan that meets your individual needs.