Life insurance for Canadian citizens

Are you a Canadian citizen who has questions about life insurance in the United States? Great, because we have the answers for you. In this post, we will go over the basic requirements to obtain coverage and all the guidelines that must be followed.

So let’s dive right into it:

We’ve created 2 major categories for you based on where you live. You can click on the one that fits your personal situation the best.

- Life insurance for Canadian citizens living in the United States

- Life insurance for Canadian citizens living in Canada

If you would like us to take a look at your personal situation, please do not hesitate to reach out to us. You can also fill out the instant quote form and get instant prices from top-rated carriers.

Life insurance for Canadian citizens living in the United States

Living in the US is a great start. It is the first indicator to the life insurance company that you have ties to the country. With that being said, we need to point out that any life insurance carrier would need to know your residency status. In other words: are you a permanent resident or visa holder?

Permanent residents (green card holders):

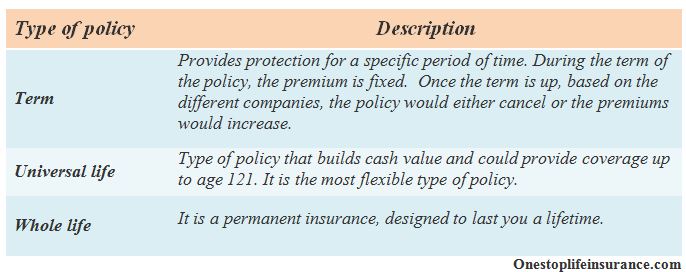

You would be treated as a US citizen and given the best possible rating. You would be able to choose from any life insurance product available: Term, Universal, or Whole Life Insurance. For more information on each one, take a look at the table below:

Visa holders:

You could still have access to all products and be offered the best rating. However, there would be a few additional points that companies will be looking at:

- Type of visa and length – the carriers would like to know what type of visa you currently have and what is its length. They will also require a copy of it. Therefore, we will ask you to submit a copy of it to us during the application. This will speed up the underwriting process. We’ve created a separate guide on life insurance with a TN visa.

For the most helpful tips, you can check out our guide for life insurance for foreign nationals.

- Financial ties to the US – companies want to know why you are looking into securing life insurance in the US and why it makes financial sense to you. They are looking for substantial contact or financial ties to the county. Below are some examples of what constitutes financial ties. Please keep in mind that you don’t have to meet all of them:

- Own a real estate property in the US

- Have a systematic ongoing business, requiring visits to the country

- Are married to a US citizen

- Work for a US company in the country and etc.

The bottom line:

If you are a Canadian citizen living in the US, chances are you meet the substantial contact requirement and can purchase life insurance. A US life insurance policy is a great tool to help you preserve your wealth or meet immediate family obligations should you pass away.

Life insurance for Canadian citizens living in Canada

Yes, it is possible for Canadian citizens living in Canada to purchase life insurance policies in the US However, there will be some requirements that need to be met in order for an application to be approved:

Be in the United States for the entire process of applying for coverage:

One of the key requirements for purchasing life insurance is that you need to be in the US to start the application. Typically, it takes approximately 4-6 weeks for a company to approve an application and issue a policy. There are 4 major steps when applying for life insurance coverage:

Quote – during this step, we will go over your residency, financial ties to the US, health, lifestyle, needs, and budget. We don’t take this process lightly, as we would like to tailor the coverage based on your needs. This will ensure that we will find the company that looks most favorably at your particular situation and offers you the best value.

Application – once you select the coverage and are ready to move forward, we will proceed with the application. To ensure the fastest processing time, we will submit an electronic application to the carrier and schedule a medical exam, if needed.

Medical exam – it is not uncommon for carriers to require the applicants to complete a medical exam, as a part of the underwriting process. Typically, a nurse will come to your home or workplace and take vitals. Please keep in mind that there are carriers that may not require a medical exam. In these instances, the company may issue the policy in several days.

Delivery – the final step of the application process. Once the carrier approves your application, we will get in touch with you and finalize the policy. We will go over the information to ensure that there are no changes and schedule a payment.

Please keep in mind that all payments must be in U.S. dollars. Typically, life insurance carriers require automatic premiums deductions from a U.S.-based bank account.

Have substantial contact with the US

You can prove substantial contact by fulfilling some of the following:

- You are married to a U.S. citizen;

- Have an immediate family member, living in U.S. and travel regularly to visit them. Examples of immediate family members include spouse, children, brother or sister;

- Have a bank account in the U.S.;

- Own real property in the U.S.;

- Be an employee of a U.S.-based company;

- Maintain an investment interest in the U.S. which may include investment account ownership in the U.S.;

- Have significant, systematic ongoing business activities in the U.S. and etc.

In Conclusion:

Canada is an “A” country when it comes to life insurance purposes. If you are looking for life insurance for Canadian citizens, rest assured that you could qualify for the best rating class. For more information and what other things you should consider, you can review what every foreign national should know about life insurance.

Please reach out to us if you have any questions or would like us to take a closer look at your personal situation.

Thank you!