Life insurance for children with epilepsy

There are nearly 500,000 children in the U.S. diagnosed with epilepsy. Seeing your child having a seizure could very well be one of the most terrifying moments in a parent’s life.

Fortunately, there are many medications that can control seizures and stop them from recurring. In addition, many children may even outgrow it and not need any treatment for the rest of their life.

With this in mind, we are here to tell you that securing life insurance for children with epilepsy is possible and affordable. In this post we will go over what are your options, the pros, and cons in each one, and what will the companies look for. To skip over the topic you would like to view, just click on the title.

What we will cover

- Available options for life insurance for children with epilepsy

- What are the life insurance companies looking for

- What else to consider

Your options

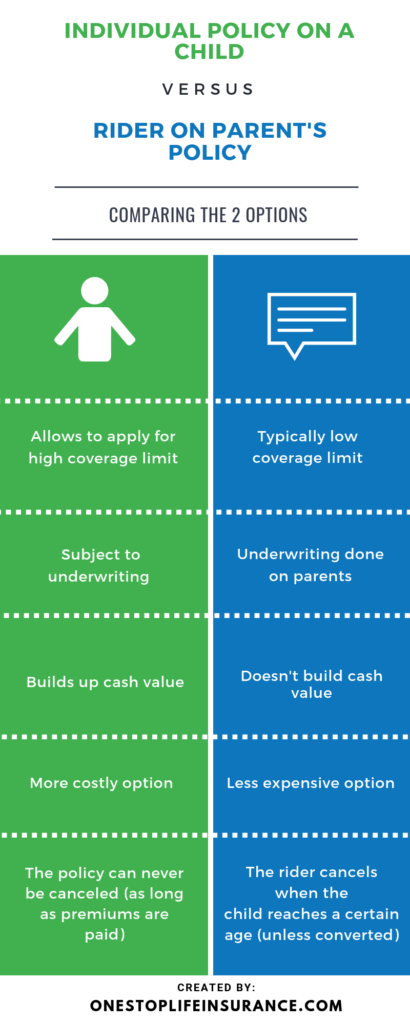

When researching life insurance for children with epilepsy, there are 2 options to consider

- Getting an individual policy

- Getting a rider on the parent’s policy

We will go over the pros and cons of both of the options. If you have any additional questions or would like us to review your child or grandchild’s circumstances, please fill out the instant quote form or give us a call at 855-795 –LIFE (5433).

Individual Policy for a child with epilepsy

Getting an individual policy may be a good option if the epilepsy is well controlled with medication. The life insurance companies will ask a series of questions to determine the severity of the case. Based on the information they will make their decision and present the available outcomes.

This is where One Stop Life Insurance is different than the other companies. We will ask you these questions ahead of time and based on the life insurance guidelines try to determine the best carrier for you and your child. This will not only save you time but could save you a lot of money in premium.

We are able to contract with several carriers who would consider and approve a life insurance policy for children with epilepsy. The application process is simple and straight forward. Please continue reading to learn some of the benefits setting up a policy for your little one today.

Pros: Getting an individual policy for your child, means that he or she is covered for the rest of their life no matter what. They don’t have to worry 15 years down the line how to secure coverage to protect their family and kids. You can review all of the benefits an individual policy offers.

- In addition, these polcies are typically whole life insurance. In other words, the premium would be locked in for life and also builds cash value.

- Many companies would also allow you to increase the coverage when the insured reaches 25 years old WITHOUT proving insurablilty. This simply means that if your child’s condition does not improve or even worsens, she or he would not be denied the additional protection.

- The last advantage many of the parenst we work with like is the option of having the policy completly paid off in 10 years. This means that you would never have to worry about the policy cancelling and when your child is an adult, you can give them a completly paid off policy, rather than a monthly bill.

Cons: Unfortunately, not every child could qualify. The life insurance companies will ask questions pertaining to the health of your child and make a decision.

Getting a rider on the parent’s policy

Adding a child’s rider to your policy – Before we dive into this option, we would like to explain the term rider on a life insurance policy

A rider is an add-on option to a life insurance policy that allows you to customize your policy based on your needs.

Pros: This is a good option to secure life insurance for children with epilepsy. There are many companies that will add the rider without asking health questions for your child/children. It is a very cost-effective option.

For example, typically a child rider costs about $5 per year per $1000 in coverage. If you would like to add $10,000 in coverage, you are looking at $5×10 or $50 per year in total cost. This is the total cost, regardless of the number of children you have in your household.

Cons: while a very affordable option, it provides a limited amount of coverage. In many cases, $10,000 or even $20,000 may not be sufficient to cover medical expenses, final expenses and allow the parents time to heal. Another thing to keep in mind is that the majority of companies allow for a coverage conversion, typically when your child turns 25.

However, not all of the life insurance companies will allow you or your child to add coverage without proving that he or she is healthy. This could be the biggest negative, especially if your child’s epilepsy and seizures are not under control.

We’ve created the following infographic to clearly outline the differences between the 2 options. For more information, you can review our complete guide on life insurance for children.

What are the life insurance companies looking for

Every company has different principles when reviewing a life insurance application for children with epilepsy. However, the majority of them would like to know the following information.

» Date of diagnosis

» Date of the last episode

» What type of epilepsy or seizures have been diagnosed

- Generalized seizures

- Partial seizures

- Simple

- Complex

» What terms have been used to describe the epileptic or seizure attacks

- Grand mal; Petit mal; Absence; Myoclonic or other

» Do you know of any cause of the symptoms

» How often are the episodes of seizers

» Did a doctor perform or recommend a surgery

» What kind of testing has been done

» Current list and history of medication prescribed

These are just some of the questions that life insurance companies may ask when considering life insurance for children with epilepsy. We understand that the amount of information may feel overwhelming. Here at One Stop Life Insurance, we will try to make the process as quick and simple as possible. Please do not hesitate to reach out to us if you need any additional information or you have any concerns.

What else to consider

There are some additional factors that you need to consider when securing life insurance for children with epilepsy:

- Every child in the household needs to have similar coverage – the life insurance companies want to see that every child has the same amount of coverage. If you want to purchase different coverage amounts for the different children, please prepare to submit the reasoning behind it.

- Less than a certain limit – in most cases, the maximum coverage amount for children is $250,000. Life insurance companies are able to make an exception to this rule. However, they will need an explanation as to why you need a higher coverage amount.

- How much do the parents have – another factor that life insurance companies are considering when reviewing a life insurance application on a child is the amount of coverage that the parents have.

In Conclustion,

Please keep in mind that we are here to answer any additional questions you may have. You can reach us via e-mail or by phone. We are looking forward to working with you in getting the peace of mind that your family is protected.