5 Reasons why NOT to buy life insurance as a college savings plan

Many agencies market life insurance on children as a way to pay for college. Are you wondering if this is a good idea? Can you really use life insurance as a college savings plan? We’ve heard this question over and over again, and we wanted to give the numbers and let you decide for yourself.

Before we go any further into the topic, we wanted to let you know that if you have any specific questions or would like us to take a look at your situation, simply reach out to us. You can contact us by filling out the instant quote form on this page, give us a call at 1-855-795-LIFE (5344) or send us a message at info@onestoplifeinsurance.com.

Is buying life insurance as a college savings plan a good idea?

Well, there are different opinions on the subject. Agencies and life insurance companies often market life insurance as a way to pay for higher education. However, we believe that this is just plain marketing and you should never buy life insurance on your children as a way to pay for college.

Now,

We want to designate that we are strictly discussing buying a permanent policy on your children and using the cash value accumulation benefit as a way to pay for college. We are not talking about the death benefit being used for paying for higher education. Many parents and grandparents buy life insurance in hopes that should they pass away, their children will have the opportunity to obtain higher education. And this is different.

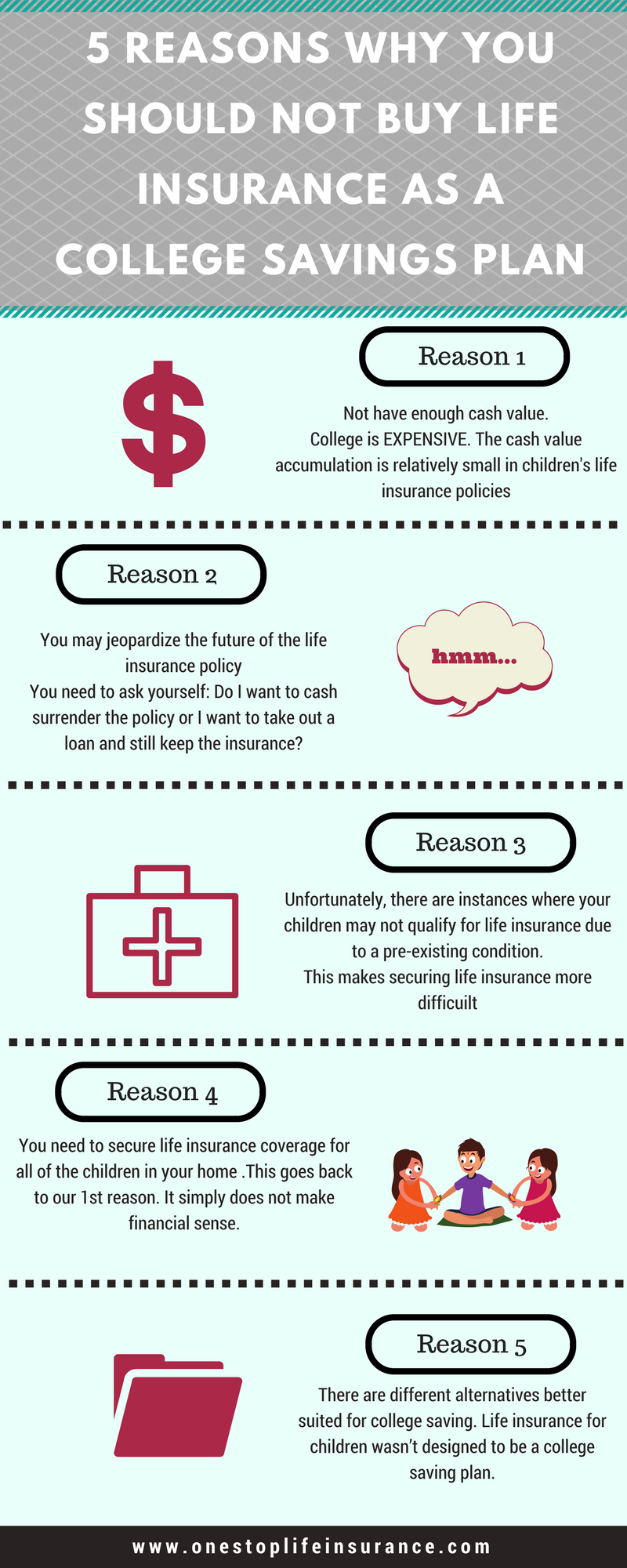

5 reasons why buying life insurance as a college savings plan is a bad idea

1. Will not have enough cash value to pay the college tuition

This is the biggest reason. Everybody knows that higher education is EXPENSIVE. There is no question about it. And unfortunately, the numbers keep on rising. According to the College Board, for the 2016-2017 academic year, the average cost for an in-state public college was over $24,000. Multiply this number by 4 and you get close to $100,000 for college for 1 child. Furthermore, there is absolutely no way of knowing what the actual figures will look like when your son or daughter is ready for college.

On the other hand, life insurance policies on children just don’t build that much cash value. This is due to the fact that the premiums of life insurance on children are relatively small. (On a side note, this is a good reason why should look into it and lock these rates now)

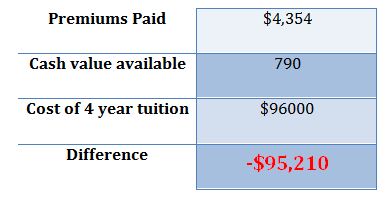

For example, if you decide to purchase a $100,000 life insurance on policy on Alex who is now 4, you are looking at around $25 per month. In 14 years, when he is ready to go to college you would’ve paid $4,354 into the policy and the cash value will be just about $790.

As you can see, the numbers simply don’t add up. Yes, there will be some money available. However, they are far from what Alex will need for college.

2. You may jeopardize the future of the life insurance policy

What we mean by that is that every time you pull all of the cash value out of a life insurance policy, you need to make a decision. Do you want to cash surrender the policy or you want to take out a loan? It is important to understand the consequences of pulling that cash value and make sure that you are making the best decision for you and your family.

Cash surrender a life policy – in other words, you are cashing out the life insurance policy. You are taking all of the cash value that has been accumulated and you are canceling the policy. If your son or daughter wants to have a life insurance policy, he or she will need to reapply. The downside is that they will be subject to underwriting and the premiums of the new policy will be based on their current age.

Taking a loan against the cash value – this is the second option to pull funds out of the life insurance policy. Not many people are aware that yes, you can take the cash value out, but that withdrawal is considered a loan against the policy. This loan accrues interest that is added to future cash value growth. Based on the amount you pull out, you might be required to increase your monthly premium to ensure that the policy is still properly funded or repay the loan.

Bottom line:

Yes, there will be cash value available to cover some of the expenses when it comes to college. However, are you ready to forgo your children’s life insurance policy?

3. Unfortunately, there are instances where your children may not qualify for life insurance due to a pre-existing condition

This is reason breaks our hearts. The mere thought of a child who is ill is dreadful, but it is a reality for many families. In order to buy individual life insurance on your child, he or she will be subject to underwriting. In other words, companies will look at his or her medical history and current health condition. It is possible for carriers to deny coverage for your child.

4. You need to secure life insurance coverage for all of the children in your home

Life insurance companies want you to have coverage on all of the children in the household. In fact, this will be a question on the application. While this is understandable and every parent will want to have coverage on all of his or her children, it makes it a pricey option. This goes back to our 1st reason. It simply does not make sense.

Please do not take us the wrong way; we are strong advocates for life insurance on children. However, we believe that you should consider it for reasons other than saving for college.

5. There are different alternatives better suited as a college savings plan.

Life insurance is an asset and a necessity. It offers a tremendous amount of benefits. The biggest one is the help to your loved ones during the most difficult times in their lives. However, life insurance for children wasn’t designed to be a college saving plan.

Yes, it builds cash value.

Yes, you can use it however you deem fit.

But, there are better ways to plan for this phase of your children’s life.

Our advice is to consider the bigger picture and make sure you have all of the pieces of the puzzle. It is important to secure coverage for your children. There are several options to do this. You can do this by either purchasing an individual policy or adding them as a rider to your policy. Each option has its positives and negatives. We’ve dedicated a separate post on the subject.

The second step is to look at different alternatives.

So,

What are the different ways to prepare for college?

We are not financial planners and we’ll advise you to consult one to guide you and help you find the right plan for you. However, below are just some of the ways you can financially prepare for sending your children off to college.

529 Plan – it is a very popular way for people to save for college. It offers many tax breaks. However, in order to take full advantage of all the benefits, your child or grandchild must attend qualifying higher education universities.

Roth IRA – It is designed for retiring and offers full benefits for people who are over 59 and a half. The key is that withdrawing investment earnings is consider qualifying reason and allows you to avoid any penalties.

Research prepaid tuition programs – typically these programs will allow you to purchase tomorrow’s college tuition at today’s rates.

In conclusion,

When it comes to saving for college, you have options. It is important to review and select the one that best suits your needs and budget. Even though, we advise you not to count solely on life insurance as a college savings plan, without a doubt it is definitely protection you should consider.

Please keep in mind that we are here for you. If you have any questions or would like more information, just contact us. We are an independent agency and have access to the top-rated provides. Your information will be kept confidential and NEVER sold to a third party.

Thank you