How To Get Life Insurance For DACA Recipients

We would like to address a very common question we are receiving: Can you secure life insurance if you are a DACA recipient? In this post, we will not only answer this question, but we will also cover what companies are looking for and what is the actual process of securing coverage for your family.

Please review the topics we will be covering, if you would like us to take a look at your personal situation, or if you have any additional questions, simply reach out to us. You can do so by completing the instant quote form on the page or giving us a call. We specialize in life insurance for foreign nationals and would take the time to understand your circumstances and provide you with solutions.

What we would cover:

Is life insurance with DACA possible

What companies are looking for

What is the actual process to apply

Is it more expensive to secure a policy while under DACA status

OK, let’s dive in….

Is life insurance for DACA recipients possible?

Yes, you can qualify for life insurance if you are a DACA recipient. Unfortunately, not every company would approve or even consider your application if you are a DACA recipient. The key is to apply with a company that would underwrite you vs. your immigration status.

What are life insurance companies looking for

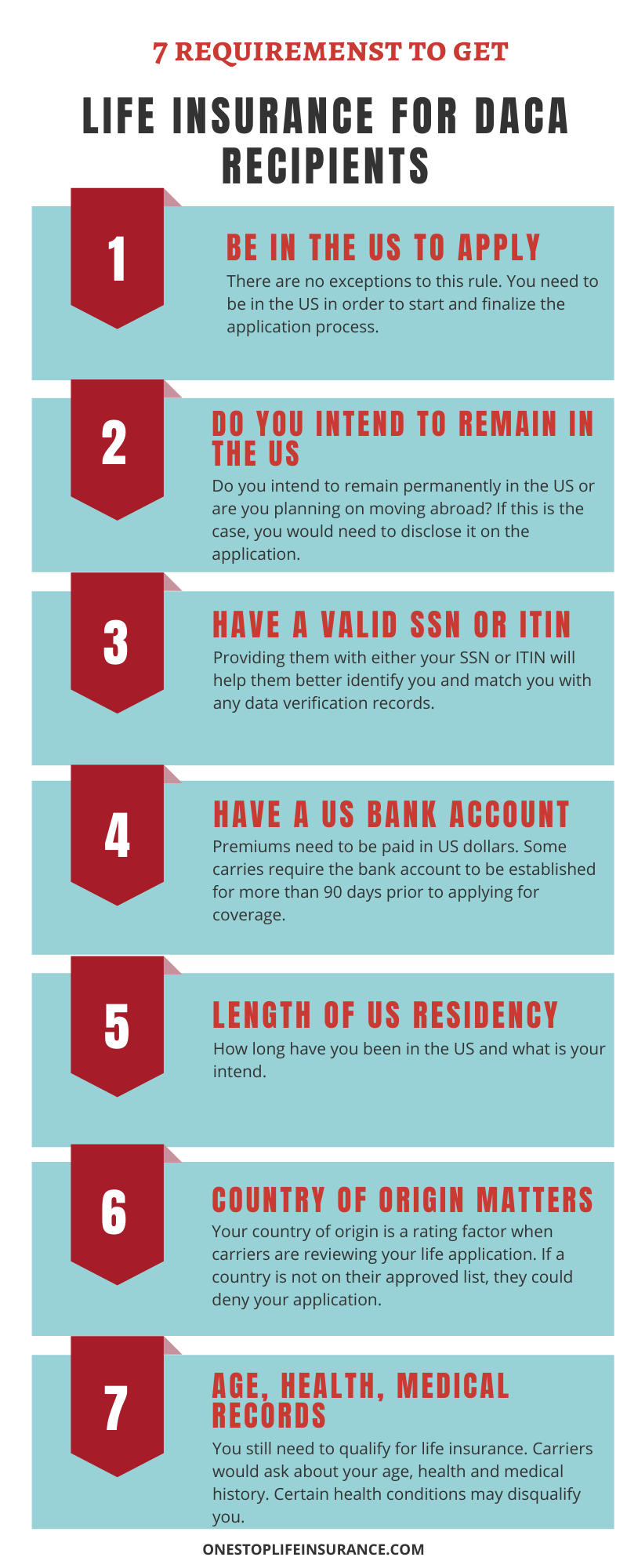

Again, the key to getting your life insurance application approved is to apply with the right life insurance company. So, what are the qualifications? In other words, what are carriers looking for when underwriting your application:

Time spent in the US

Companies want to know how long you have been in the US. Some companies have advised us that you need to be in the US for no less than 6 months in order for them to review your application, while others require you to be in the US for a minimum of 5 years.

What is your intention?

Do you intend to remain permanently in the US or are you planning on moving abroad? If this is the case, you would need to disclose it on the application and to us. Many of our clients have expressed a concern that their applications may not be approved if they disclose future travel plans.

However, here is the thing: if you know that you will be traveling/residing abroad in the next 2 years, you need to tell the life insurance company. Here is why: should you pass away in the first 2 policy years, you give the company grounds to void your policy and not pay out for misrepresenting information on your application.

In addition, many companies are OK with foreign residency, as long as the country you would be living in is considered safe and having coverage makes sense.

If you are unsure if this applies to you, simply reach out to us. We would go over your personal situation and advise you of your options.

Do you have an SSN/ITIN

Some companies would ask for either an SSN or an ITIN.

Do you have a US bank account?

If approved, the insurance premiums need to be paid out of a US bank account in US dollars.

Health/Lifestyle

You would need to qualify medically for life insurance. In other words, companies would ask you about your height/weight, tobacco use, and whether you have been diagnosed or treated with a number of medical conditions. Many companies would also require you to complete a medical exam. We would cover the process of securing life insurance next.

What are the steps to secure life insurance if a DACA recipient

Quote:

The first step is to work with an agency specializing in helping global citizens find coverage. Once, we go over your health, lifestyle, and needs, we will present you with your options. During this step, we would ask you what is important to you and why you are considering coverage. This would allow us to customize your insurance policy and offer you a solution tailored to your needs and budget.

Application:

Once we go over the options and you are ready to move forward, we will complete the application. Some carriers allow you to self-complete your application, while others would need it to be completed via a phone call. There is a company that would require us to schedule a quick introductory video call. Every company is different and we would be guiding you through their process.

Medical exam:

Based on the company’s guidelines, you may be required to complete a one-time medical exam. There is no cost for the appointment and we will help you schedule. You can have the examiner meet you at your home, place of work, or go to a location. The appointments typically take 15-20 mins and the results are sent directly to the insurance company. You would be able to download a copy of your exam as well.

Decision:

Once the company issues a decision, we will reach out to you. At this point, you could accept, decline, or modify your application. For example, you can decide to take advantage of insurance stacking (combining term with permanent insurance for overall protection, or secure 2 individual policies with different durations).

Placing in Force:

After we discuss the carrier’s approval and you are ready to accept the policy, we will let the company know. They will send out the acceptance forms. Typically, these forms can be signed electronically and you will provide the company with your payment information if you haven’t already. When they process the initial payment, they place the policy in force.

Is it more expensive to secure a policy while under DACA status?

This is a question we have been receiving a lot, whether it is for DACA recipients or undocumented immigrants.

No, you would not be paying any additional premium because of your immigration status. The fact that you are a DACA recipient would only limit the available companies that can offer you coverage. However, they would not be adding any additional cost to your application.

On a side note,

If you receive your permanent residency card or become a US citizen, you will have a larger number of companies to choose from. This would create competition for your business and you might be able to get a better rate with another carrier.

Things to consider

Over the years, we’ve worked with a number of foreign nationals and wanted to share some of the most common things we want you to be mindful of:

Take the time to discuss your options – make sure you understand the different insurance products, so you can better understand which one is right for you. Do not be afraid to ask questions. This helps you and a good advisor would always be available to answer any questions you might have.

Be upfront on the application – do not misrepresent or hide any information. This not only can be considered insurance fraud, but you could give the carriers a reason to void your contract and not pay should you pass away during the contestability period.

Select your beneficiaries – it is very common for foreign nationals to name beneficiaries living abroad. Life insurance companies are OK with that. There are a few tips when naming a foreign national as a beneficiary. We’ve written a detailed post on the topic, however here are some key points:

- There needs to be a clear insurable interest – in other words, what financial loss would the beneficiary experience, should you pass away.

- Make sure you provide your beneficiary with the policy information and if possible a copy of the policy.

- Also, ensure that the company has the correct beneficiary name (in case it was changed due to marriage) and relationship.

These simple steps would ensure that your family would know what to do, should you pass away, and also the carrier could easily verify their identity.

In conclusion,

Life insurance for DACA recipients is possible and easy to secure, as long as you are working with the right carrier. It is imperative to provide the agent with all the information upfront, so he or she can better assist you in selecting the right coverage for you and your family.

If you have any additional questions or would like us to provide you with a personalized solution, simply reach out to us.

Thank you!