Life insurance for Japanese citizens

It is no secret that people cross country borders and decide where to work, live and create families. We’ve encountered many of our clients who are no longer confined to the native countries but decide to spend a big portion of their time in the US. Naturally, they have many questions about securing the best policies. Therefore, we’ve created this guide on how to secure life insurance for Japanese citizens. We’ve outlined the advantages of US life insurance, the qualifications and the process of obtaining a policy.

Topics we would cover

- Why looking for US life insurance for Japanese citizens

- Do you qualify

- Process of obtaining a policy

- What are the available life insurance products for Japanese citizens

- Things to consider

Prior to diving into the topic, we wanted to take a second to advise you that you can always reach out to us if you have any additional questions or would like us to take look at your personal situation. You can give us a call, send us a message, or fill out the quote form on this page. We specialize in life insurance for Foreign Nationals and will take the time to understand your needs and match you with the right option for you.

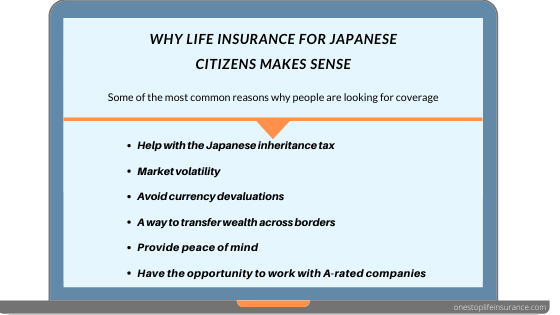

Why looking for US life insurance for Japanese citizens

There are countless different reasons why someone might look into securing life insurance coverage. Below, we’ve listed some of the most common reasons why our clients have secured a policy.

Help with the Japanese inheritance tax

Now, we are not tax professionals, international at that. However, the rates of Japanese inheritance tax has been a hot topic in the nation’s foreign community for a while now. It could reach up to wapping 55%!!

Therefore it is no surprise that many families are trying to preserve their estate by securing life insurance and taking advantage of the benefits it has to offer.

Market volatility

Life insurance offers the security, backed up by the regulations of this industry. Many policies are offering a cash value growth guarantee of zero, even in a market downturn. This is a huge advantage over traditional products that are more volatile when the market changes. Life insurance could be a great diversification tool when you don’t want all of your money in the same product.

Avoid currency devaluations

Life insurance proceeds will ALWAYS be paid out in US dollars. This is a huge advantage in an unstable world economy. Historically, the US dollar has been a more stable alternative than other currencies across the Globe. This, in addition to the other benefits, makes US life insurance for Japanese citizens a very attractive opportunity.

A way to transfer wealth across borders

Many young Japanese citizens decide to pursue higher education in the US or even call it a permanent home. Their parents are aware of the international transfer gift limits and view life insurance as a legal, efficient and secure way to transfer a larger portion of their wealth across the borders. Through life insurance, they are not able to comply with the regulations, but also to provide a legacy to their children.

Provide peace of mind

Life insurance provides peace of mind that when we are gone, our loved ones will be financially taken care of. It allows for young families to ensure that they will provide for their children even if they pass away prematurely.

Have the opportunity to work with A-rated companies

This is another piece of the puzzle, providing additional security in the company and the product you select.

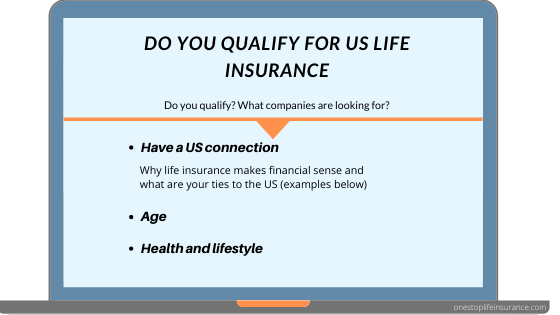

Do you qualify for US life insurance

Since we covered some of the reasons why someone might consider US life insurance, it is time to turn our attention to the qualification process. We would touch on some of the basic requirements companies have when underwriting applications for life insurance for Japanese citizens.

Have US connection

This is the first thing that companies would need to establish. What is your Nexus, or what is your financial tie to the country? You can not come to the US for the sole purpose of purchasing life insurance, you need to have a tie to the country. You can meet this requirement in several ways. Below are some of the basic examples of US connection:

- Married to a US citizen – this is one of the ways to meet the requirements for a US connection. Please keep in mind that if you haven’t applied for permanent residency or have no other connection to the country, you and your US spouse might need to apply for coverage together in order for you to qualify.

Here is an example,

We are working with a couple. The wife is a US citizen and the husband is a foreign national. They are currently living and working abroad. The husband is able to qualify for coverage if he and his wife secure coverage together with the same carrier.

- Have assets in the US – companies want to ensure that you have a financial footprint in the country. You can qualify if you have real estate or business in the US.

- Have a US bank account – the account needs to be open for more than 90 days and have a balance of over $100,000.

These are some of the examples of US financial connections that could qualify you for coverage in the US. If you are not sure if you meet any of the requirements, please reach out to us. We will take the time to understand your circumstances and try to match you with the right option for coverage.

Age

Many companies have a limit of age when they are underwriting foreign nationals. Typically, the maximum age they will consider for coverage is 70.

Pro Tip:

Please still reach out to us, even if you are over 70 years old. Guidelines change on a regular basis and even though we try to ensure the guide is up to date, there might be new information available.

Health and lifestyle

Keep in mind that in addition to foreign national underwriting, you also need to meet the companies’ guides when it comes to health and lifestyle. They will ask you questions such as:

- Tobacco use

- Height and weight

- Any medications and or health conditions

- Family history

- Lifestyle and hobbies such as skydiving, car racing and etc;

Process of obtaining a policy

Here are the steps to secure a life insurance policy in the US:

Be in the US for the entire process – while this is not actually a part of the application, it is a requirement that every company has. You need to be in the country in order for us to start the application and get you the coverage you need.

Please plan accordingly, as you need to be here to complete a medical exam and any additional requirements that the company might have.

Initial conversation

During this step, we would like to uncover your needs and reasons for securing the coverage. We are strong believers in tailoring the coverage to meet your needs and your priorities. We are able to do that by asking you the right questions.

Also, during this step, we would advise you of the forms that the company would need in order to approve your application.

Application and medical exam

We would get your signatures on all of the forms and schedule the medical exam. Typically, the medical exam is non-invasive and you can have it completed in approximately 20 minutes. If we know your schedule, we can coordinate with the facility and get everything scheduled at a convenient time.

Underwriting

This is the longest part of the process. Companies would be looking at your medical history, results from the medical exam, financials, and ties to the country. It is not uncommon, for them to reach out to us for additional information.

Policy approval and delivery

This is the final step. You need to be in the US to accept the policy and sign any delivery forms.

However, some companies would allow a Limited Power of Attorney. In other words, you can appoint a trusted individual to accept the policy.

Please note, we need to know your schedule ahead of time and get the Limited Power of Attorney signed and submitted during the application.

What are the available products for life insurance for Japanese citizens

If you are a Japanese citizen, living abroad and are NOT a US citizen or permanent residence, chances are only permanent insurance will available to you.

Permanent policies offer lifelong protection and peace of mind that you would not out-live your life insurance. They could also be very flexible and build cash value.

We’ve divided the permanent policies into 2 major categories:

Lifelong protection only – this is typically a though a policy called Guaranteed Universal Life (GUL). GUL offers guaranteed coverage up to age 100 or beyond. Its main focus is to ensure that whenever you pass away, your beneficiaries would be able to collect the death benefit.

Protection plus cash value growth – These types of policies are unique and they could be customized to meet your specific needs and lifelong goals. They not only provide you with peace of mind but with a cash value growth. Cash value is money you can use, while still alive to supplement your retirement or to help you financially in any other way.

Pro advice:

Ensure that that the policy is properly set up and you have current illustrations demonstrating the cash-value account.

Things to consider

Here are a couple of important tips you need to consider when looking into life insurance for Japanese citizens.

- Policy needs to be paid on an annual basis. Most companies would allow only annual payment mode when underwriting policies for foreign nationals. This has several advantages, one is that you would ensure that your policy would not lapse due to not received invoice or payment. In addition, companies often times offer a discount if payment is paid annually vs. monthly.

- Premium financing – this is a unique concept. There are companies that will allow for foreign nationals to use premium financing to cover the cost of insurance. In a nutshell, premium financing involves taking out a third-party loan specifically to pay for a policy’s premiums. High net worth individuals use this strategy so they can avoid paying for life insurance using liquid assets.

While premium financing could make sense, we encourage you to seek guidance from your financial advisors, to ensure it’s the best financial decision for you.

- Naming a foreign national as a beneficiary – it is very common to want to name a foreign national as a beneficiary on your life insurance policy. Companies allow that as long as they can see a clear insurable interest. Another thing to consider is any possible foreign tax consequences your beneficiary could have.

In Conclusion,

Life insurance for Japanese citizens is possible. The companies would take a closer look at your ties to the US and ensure that you have a financial connection. In order to get the process started, you need to be in the US and complete a medical exam. There might be additional requirements you might need to satisfy, however, we would be here to guide you and answer any questions you have.

We hope you find this guide helpful and we are looking forward to working with you.

Thank you!