How to get life insurance on your child’s father or mother

We get this question A LOT: can I get life insurance on my child’s father (or mother)? What options are available and who will be paying for it? We felt the need to answer all of these questions, so we put together this guide. We will outline if it’s possible, touch on insurable interest and list ALL of the things you should look out for.

Please keep in mind that this guide is dedicated to finding coverage for your child’s other parent. The same terms and conditions will apply whether it’s their mother or father.

What we will cover:

As always, if you want a personalized consultation with us, or you wonder how much does it cost, simply reach out to us. You can do so, by filling out the quote form on the page, send us an e-mail or give us a call. The conversation will be private.

Is it possible to buy life insurance on your child’s father (or mother)?

The answer to that question is: YES. There are several things that carriers will consider when reviewing the application. The biggest thing allowing you to secure a policy is the fact that you have an insurable interest.

What is insurable interest?

Simply put, insurable interest means that you would suffer a financial loss if a person passes away. In the case of parents, whether they are together or not, the financial care for the child creates an insurable interest. This gives you a reason to own a policy on your child’s other parent. Essentially, life insurance will replace the child support, should something happen to your child’s father or mother.

HOWEVER,

The other parent needs to know about the policy and be on board with. In some cases, the need for insurance is court-appointed and part of a divorce decree. Even then, the other parent needs to know and cooperate.

Nowadays, many carries would simplify the process by offering a no exam life insurance policies. They are great policies and fairly easy to secure (if the insured qualifies based on health and lifestyle). However, many people may be tempted to complete the application for someone else. Please don’t do that.

Do not commit insurance fraud, risk the policy be void and/or be prosecuted.

Available life insurance options

Based on the need and the budget, there are several options available to secure life insurance on your child’s father:

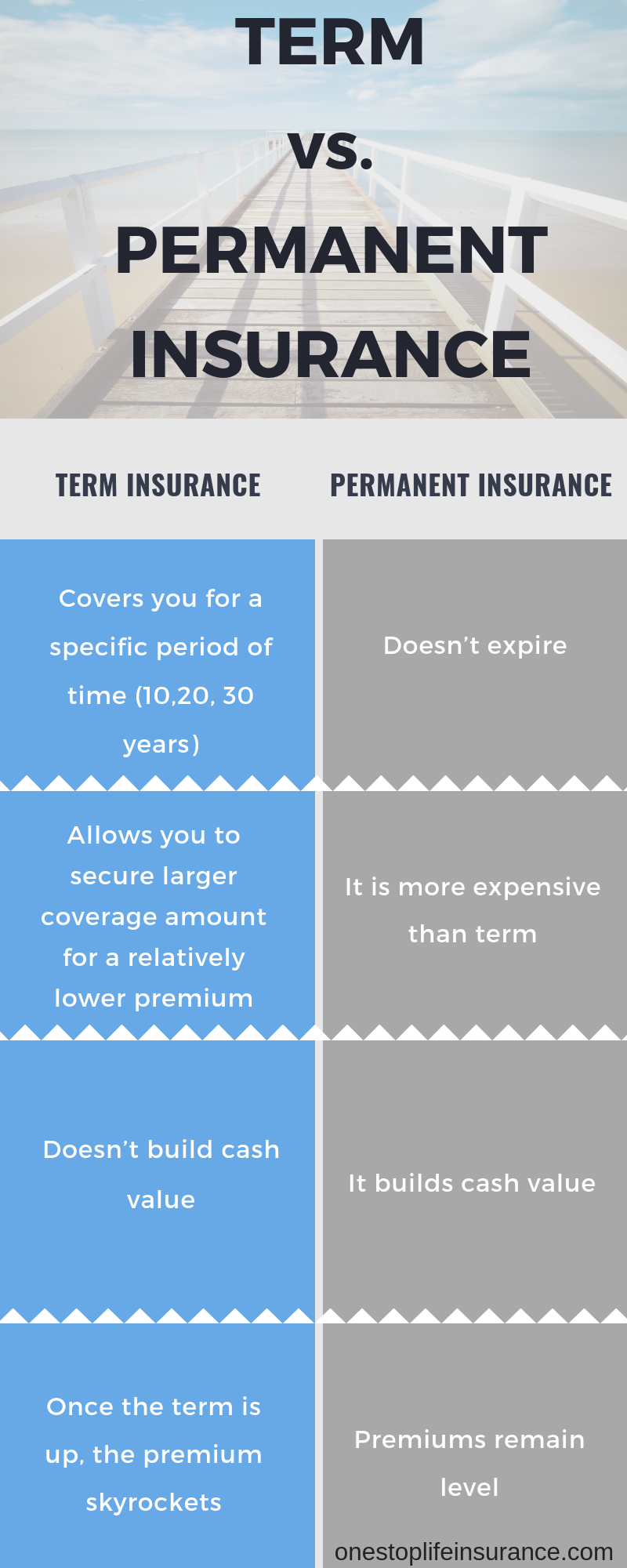

** Term policy – this is a very straight forward policy. It provides coverage for a certain period of time, as long as the monthly premiums are paid. The term of the policy could be 10,15, 20 or even 30 years. It is a fairly low price and it does not build cash value

** Permanent policy – this type of policy provides lifelong coverage. It does not have an expiration date, like the term option. It builds cash value, that the owner can borrow against. However, the price is higher when compared to term insurance.

** No Exam policy – many companies will offer no exam life insurance policies. These policies can be a term or permanent. We felt that they are unique and wanted to list them as a choice. What makes them a go-to insurance product for many parents is the convenience. Typically, the only thing that the insured needs to do is complete a phone application and electronically sign. The entire process can take about 15 – 20 minutes. Again, in a situation when you need coverage on your child’s other parents you might want to consider a no exam policy.

It is also worth mentioning, that in many instances no-exam policies are very competitively priced. This along with the speed and convenience factors makes them a great option.

Things to look out when shopping for life insurance on your child’s father or mother

His or her health and lifestyle

The insurance underwriting will be done on the insured. It will not matter who is the owner. The life insurance companies will want to know about the person’s health, medical history, list of medications, tobacco use, build, felony convictions, driving record and etc. All and all there are over 60 factors companies are looking for.

Our agents will ask you this information at the beginning of the call. We do this to ensure that we would provide you with actual rates vs. just a quote. We are strong believers in setting up realistic expectations and provide you with accurate numbers. Please be prepared to answer these questions.

His or her annual income

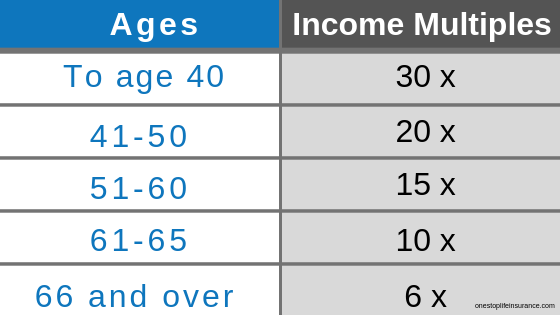

Yes, it does not matter who will be paying for the insurance, carriers will ask about the insured’s income. They want to make sure that life insurance makes financial sense. Carriers would not allow for a person to be over-insured.

Below is a sample table of a person’s age and the amount of coverage he or she can secure based on annual income:

His or her current insurance in force (outside of work)

Companies will need to know that as a part of their financial underwriting. Circling back to the fact that they need to make sure that he or she will not have too much life insurance.

Let’s look at an example:

Mary is looking to secure a policy on Sam. They have a 10-year-old son together. Sam is 42 years old and his annual income is $30,000. Sam has already a policy in force for $300,000. He wants to keep the policy. Based on his age and current policy in force, the maximum coverage available is $300,000.

Who will be the owner of the policy

The owner of the policy is the person in charge. The owner can make policy changes and the biggest thing is that the owner has the right to name the beneficiary. If possible, you would always want to be the owner of the policy. This will ensure that your ex-partner would not just take you off the policy down the line.

Who will be the payor of the policy

There are 3 different roles in 1 life insurance policy:

- Insured – person whose life the policy is based on

- Owner – the person who can make policy changes

- Payor – the person who will be making the payments

In most instances, 1 person is all these roles. For example, you own the policy on yourself and you are responsible for the payments. However, in certain circumstances is best to have another person take on a specific role.

Our advice is for you to be the owner and the payor of the policy. This will ensure that the policy is paid on time and you could also be the beneficiary.

Your annual income

If you will be the owner and/or the payor of the policy, the carriers will ask about your income and occupation. They want to ensure that the policy is affordable for you. There are upfront expenses, related to the issuance of a life insurance policy. The carriers want to ensure that the payor will have the financial means to keep the policy in force.

This is a good time to mention that it will be a wise decision to review your own policy and ensure that everything is up to date: beneficiary, coverage amount and etc. For these and other tips, you can review our guide on life insurance for single parents.

Sample rates:

There are many variables that can come into play when carriers are reviewing a life insurance application. We put together the sample numbers below to give you an idea of the approximate cost of life insurance.

| Age | Coverage | Class | Gender | Price |

| 20 | $250,000.00 | Non-tobacco | Female | $18.29 |

| 30 | $250,000.00 | Non-tobacco | Female | $19.36 |

| 40 | $250,000.00 | Non-tobacco | Female | $29.11 |

| 50 | $250,000.00 | Non-tobacco | Female | $57.71 |

| 60 | $250,000.00 | Non-tobacco | Female | $141.65 |

| 70 | $250,000.00 | Non-tobacco | Female | $308.26 |

| Age | Coverage | Class | Gender | Price |

| 20 | $250,000.00 | Tobacco | Female | $42.00 |

| 30 | $250,000.00 | Tobacco | Female | $47.00 |

| 40 | $250,000.00 | Tobacco | Female | $83.00 |

| 50 | $250,000.00 | Tobacco | Female | $180.00 |

| 60 | $250,000.00 | Tobacco | Female | $451.00 |

| 70 | $250,000.00 | Tobacco | Female | $635.00 |

| Age | Coverage | Class | Gender | Price |

| 20 | $250,000.00 | Non-tobacco | Male | $22.66 |

| 30 | $250,000.00 | Non-tobacco | Male | $22.96 |

| 40 | $250,000.00 | Non-tobacco | Male | $35.64 |

| 50 | $250,000.00 | Non-tobacco | Male | $78.94 |

| 60 | $250,000.00 | Non-tobacco | Male | $208.99 |

| 70 | $250,000.00 | Non-tobacco | Male | $482.00 |

| Age | Coverage | Class | Gender | Price |

| 20 | $250,000.00 | Tobacco | Male | $54.29 |

| 30 | $250,000.00 | Tobacco | Male | $59.64 |

| 40 | $250,000.00 | Tobacco | Male | $101.10 |

| 50 | $250,000.00 | Tobacco | Male | $249.23 |

| 60 | $250,000.00 | Tobacco | Male | $537.58 |

| 70 | $250,000.00 | Tobacco | Male | $947.00 |

Please keep in mind that the numbers represent average health. For simplicity, we’ve used the rates for only one company. In many instances, there might be a carrier who will look at the insured more favorably and offer a better rating. This is why it is essential to work with the right broker. He or she needs to have access to a wide range of companies and select the best option for a particular situation.

1 Comment

Joanna Paneccasio

Life Insurance on my children’s father