How to get affordable life insurance for single parents

Life is very busy. There is no question about that. The life of a single parent is beyond busy, it is often crazy. In a 24 hour span, you need to find time for kids, school activities, play dates, work, housework, sleep and the occasional “me time”.

Single parents, you are heroes, and you are irreplaceable. That’s why life insurance for single parents is essential. You need protection for your family. We understand people put off getting life insurance for various reasons. One of the main reasons is that they think it is unaffordable. In this post, we would like to show 5 simple steps to ensure that you get the best rate for you when searching for coverage.

You can see your rate in less than 60 seconds, by completing the instant quote form on the page. If you have any questions you can always reach out to us via the comments section below, e-mail or by phone.

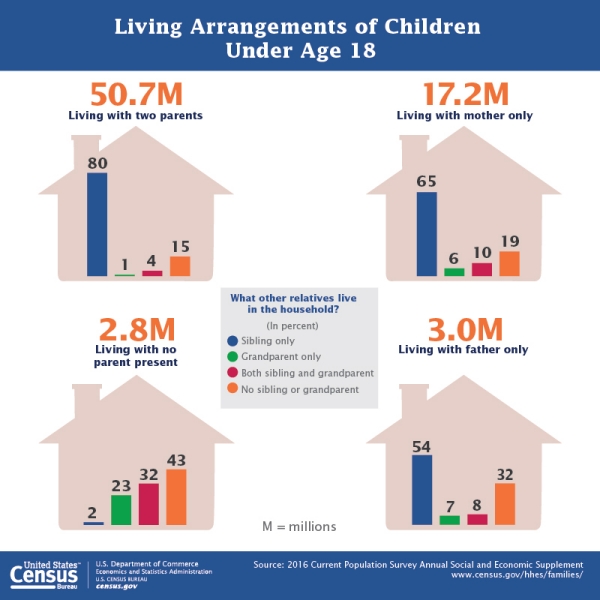

According to the U.S Census Bureau, the number of single-parent households is on the rise. For one reason or another, more and more children are living with only one of their parents.

“During the 1960-2016 period, the percentage of children living with only their mother nearly tripled from 8 to 23 percent and the percentage of children living with only their father increased from 1 to 4 percent…. Between 1960 and 2016, the percentage of children living in families with two parents decreased from 88 to 69.”

When reviewing these numbers, we felt the need to put together a guide to help single parents find reasonably priced life insurance.

1. Know your needs

This is extremely important when shopping for life insurance. What does know your needs mean? Simply put, you need to estimate how much of life insurance you need and for how long you need it. Our individual needs change as we enter the different stages in our lives. When the little ones are still living with us, we need to make sure that in case we pass away, they will be somewhat financially stable.

However, when they are adults and living on their own, you no longer need that much coverage. That’s why it is important to estimate how much life insurance you need. An experienced agent will walk you through the process and help you select the right coverage amount for you.

Life insurance for single parents: how much do you need

There are various life insurance needs calculators out there to help you figure out what amount of coverage is sufficient. The LIFE formula below will give you a basic idea and it is a good starting point.

L – living expenses (car loan, credit card balance, mortgage and etc.)

I – income replacement (usually 10x the annual income)

F – final expense (the average funeral in the United States vary between $5,000-$10,000)

E – education (college fund for the kids)

Please keep in mind that this is not a “one size fits all” formula. For example, if you are a parent of a child who is on the spectrum or with epilepsy, you would need to figure in additional coverage for continued care.

Life insurance for single parents: for how do long you need it

Another thing to consider is the duration of coverage. If you want to have protection for only when the kids are little and until the house is paid off, you might want to consider a shorter duration of the policy.

For example, Emily is a healthy, non-smoking 35 years-old single mother. She needs $500,000 in life insurance. Below are the average monthly rates, based on the duration of coverage.

As you can see, going from 30 down to a 20-year term, she is looking at $2,800 savings for the life of the policy. Also, going from 30-year term to a 10-year term policy, the monthly premium is cut in half.

2. Get a term life insurance

If you would like to stay on budget when shopping for life insurance, a term policy is your only option. The basic idea behind a term policy is to cover you for a specified period of time. If you pass away during the term of the policy, your beneficiary will receive the death benefit.

However, once the term is up, the price of the policy skyrockets and the majority of the policies are canceled. A term policy is a very good tool for financial planning. It allows single parents to purchase a large death benefit for a relatively small monthly premium. This makes it the most budget-friendly option when it comes to life insurance.

This will be a good time to mention that it is a good idea to consider coverage on the other parent, regardless if you are still together or not. In many instances, there may be child support involved and other financial ties.

Also, here are some additional tips for sig

3. Get coverage NOW

Don’t put off getting life insurance coverage. It will simply get more expensive as you get older. Life insurance rates are calculated based on life expectancy and age. Younger you are, the cheaper your rate is. Sometimes, even waiting one month can put you in a different age group.

We understand that people often put off applying for coverage because they hope to get healthier, quit smoking or lose a few pounds. Our advice is: don’t wait to buy coverage. You simply don’t know what the future holds. As a single parent, your kids count on you to provide for them and protect them. The worst possible thing for your family is to need life insurance coverage, but you didn’t get it because you waited.

What we can suggest is to make sure you secure some form of life insurance for your family. Once you quit smoking or get healthier, you can call your agent and reevaluate your policy. Which brings us to our next step of the guide…..

4. Make sure you review your life insurance policy regularly

This means talk to your agent to ensure that your policy is still adequate and all of the information is up to date. Share with us if there were any changes in the past year or two. For example, you might’ve moved and we need to update your address and contact information. This may simple, but it is important. Imagine you moved and never got your life insurance bill. With no way for the carrier or us to get ahold of you, your policy could lapse. This can put you in a very difficult spot, as you have to reapply for new coverage based on your current age and health. This is just one example of why you need to review your life insurance policy.

5. Consider who will be the beneficiary

A beneficiary is a person who will receive the death benefit should you pass away. You can select more than one person to be a beneficiary. In fact, we will advise you to do so. If you chose to name your children as beneficiary, you need to take into account their ages. Life insurance proceeds will not be paid out to a minor. In other words, they will not have access to the money, until a certain age. However, you are able to select a person to act as a guardian on behalf of your children. This person would be able to claim the proceeds of life insurance. You can also create and list a trust as a beneficiary.

Bonus tip:

Having a support network and taking care of your self is essential when being a single parent. Here are 12 tips to ensure your family’s well-being .

Life as single parents can be challenging and rewarding at the same time. You see how your little ones grow and become the best they could be. As parents, it is our responsibility to provide, care and love them. Don’t make the mistake of waiting. Get your instant quote and let us help you find the best coverage for you and your family.