Steps to get life insurance with alcohol abuse

Have you ever tried to secure life insurance with alcohol abuse? Did you think it would be this challenging? Do you have a family member who’s battling an addiction? Companies are really taking alcohol abuse seriously and have strict guideless. In this article, we would outline the steps to secure life insurance and list all of your options.

We would like to divide this post into 2 major categories based on use:

Before we dive into the topic, you can always reach out to us and let us provide personalized advice. Every case is different, that’s why we take the time to understand your circumstances and find the best option for you. We are small enough to provide you with a personal touch and large enough to have the resources to find you the best policy!

Why alcohol consumption matters on your life insurance application:

1. HEALTH COMPLICATION

The excessive use of alcohol could lead to a series of health complications. According to the CDC:

“Over time, excessive alcohol use can lead to the development of chronic diseases and other serious problems including High blood pressure, heart disease, stroke, liver disease, and digestive problems. Cancer of the breast, mouth, throat, esophagus, liver, and colon.”

2. INVOLVED IN MORE DANGEROUS ACTIVITIES

As we all know, alcohol clouds our judgment and we could do things that normally we wouldn’t: become more aggressive, more adventures and ect…. (you get the gist).

3. INVOLVED IN A DUI

Unfortunately, DUI is a serious offense. Countless lives are ruined due to avoidable mistakes. How this exactly affect your life insurance? Companies are looking into your MVR (Motor Vehicle Record) when reviewing your application. They would deny an application if the violation is recent. For them, this is a sign of reckless behavior that could lead to your premature death.

Current use of alcohol

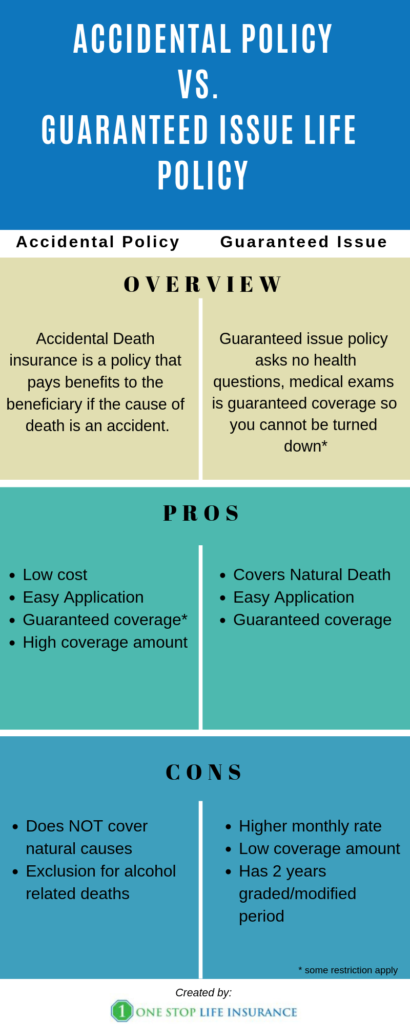

If you have a history of alcohol abuse and you are still currently drinking, you would have only these 2 options of securing a policy:

- Accidental death only

- Guaranteed issue policy

We’ve created the infographic below outlining what these products are, the pros and cons of each one of them.

ACCIDENTAL LIFE INSURANCE POLICY

Accidental Death Insurance is a policy that pays benefits to the beneficiary if the cause of death is an accident.

Pros:

- Low cost

- Easy Application

- High coverage amount

- Guaranteed coverage*

Cons:

- Does NOT cover natural causes

- Exclusion for alcohol-related deaths

GUARANTEED ISSUE POLICY

Guaranteed issue policy asks no health questions or medical exams. It is guaranteed coverage so you cannot be turned down*

Pros:

- Covers Natural Death

- Easy Application

- Guaranteed coverage

Cons:

- Higher monthly rate

- Low coverage amount

- It Has 2 years graded/modified period

We were able to obtain contracting with a carrier offering Immediate Guaranteed Issue Coverage. In other words, you do not have to wait 2 or more years for the full benefit to be payable. Please reach out to us directly for more information. Many of our customers were able to qualify and protect their loved ones. *

* We wanted to point out that even though these policies do not ask any health questions, there are still some restrictions. For example, many carriers would not issue a policy with a Power of Attorney

Past use of alcohol

If you currently are not drinking and you’ve stopped for a while, there would be more companies willing to offer you insurance. We’ve broken it down into different categories:

0-2 years since you are sober – unfortunately, this may not be enough time for companies to determine a pattern, stability, and control. Your options would still be very limited

2-5 years since you are sober – more companies would consider your application. Chances are you could still be issued a rated policy.

Pro-Tip:

Secure what you can today! You can also submit for reconsideration with the carrier or even apply with a new one if a better rate is available. Don’t gamble with your family protection. It is possible to develop health complications down the line, making you uninsurable.

5+ years since last drink- you could choose from a wide range of companies. Depending on your personal circumstances, some could still offer you a mildly rated policy, while other: standard to even preferred rates.

Let’s look at the exam below. In the table, we’ve demonstrated how much would a policy for a $35 years old male will cost, based on what health class he qualifies for. As you see, we have also included the rates for an option that requires NO medical exam.

[table id=3 /]

The process of securing life insurance with alcohol abuse

The process itself when securing life insurance would depend if you are considering an option with or without a medical exam. However, they would follow somewhat of similar steps:

Step 1

We would complete an

Why?

Because we really want to take the time and ask all of the right questions. We know what companies would need to know when making the decision about approving an application. We want to ensure we would have everything upfront and find the best solutions for you.

Below are some of the things we would ask you. Please understand that we know that this sensitive information and we would protect your privacy at 100%.

- History of Condition:

- • When did the condition begin?

- • Time since stopped drinking?

- • Relapses? Date of last drink?

- • Reason for stopping?

- • Traffic violations or legal problems caused by alcohol?

- • Stable job and home life?

- Treatment/Therapy:

- • Hospitalization required?

- • In/out-patient therapy?

- • Member of AA or support group?

- • Any use of Antabuse?

- Current Condition and related issues

- • Normal blood studies? (i.e. Liver) Function tests: SGOT, GPT, GGTP

- • Was the c

lient treated for adrug problem? - • Court-appointed treatment?

Step 2

Based on the answers we may submit a soft application to different carries. This is an additional step that not many agencies are willing to take. It requires us sending inquiries to several companies and

Step 3

After we receive the answers from the life carriers, we would review them and present your options.

Typically you can choose between a company with no medical exam and a company with a medical exam (see the sample rates above)

Securing life insurance with alcohol abuse without a medical exam? –Yes, it is very possible to get approved for coverage, without the hassle of a medical exam. We would ask you to pre-fill an additional questionnaire and attach it to your application for faster processing.

Site note:

- Securing life insurance with alcohol abuse without a medical exam -Companies offering NO medical exam policies would still review your records. Some may request your medical records. Based on how fast your doctor provide your records, it could take 3-4 weeks before they make their decision

- Securing life insurance with alcohol abuse with a medical exam – typically, we ask you for a convenient date and time and schedule the exam for you. You can request a nurse to come to your place of work/home or to go to a lab location.

Tips on acing your medical exam:

- Fast for 6 to 8 hours prior to the exam

- Limit salt and high-cholesterol foods 24 hours prior to the exam

- Refrain from consuming alcohol 24 hours prior to exam (can increase

fat in blood and liver functions) - Limit caffeine and nicotine 24 hours prior to the exam (can increase

blood pressure and cholesterol levels) - Smokers should not smoke 30 minutes prior to exam (tends to constrict

artery walls and elevate blood pressure) - Drink a glass of water one hour prior to the exam

- Get a good nights sleep prior to the exam

So there you have it! Life insurance with alcohol abuse is possible. Your options would depend on whether you are currently drinking or how long it’s been since your last drink. Please reach out to us with any questions or if you would like us to review your personal situation. There is no cost for our services and the information shared will remain confidential

Thank you!