Life insurance with Keto Diet

Keto is taking the world by a storm. It is a way of life, where people are swapping carbs for healthy fats. There are many benefits of Keto, but did you know it keto can also save you money on your life insurance? Yes, that is true Keto affects your life insurance. In this post, we will outline how life insurance views your new way of life and what you need to know prior to applying for life or health insurance.

What we will cover

Prior to diving in, we want you to know that you can reach out to us if you have any specific questions or would like us to take a look at your personal situation. You can reach us, by filling out the quote form on the page or give us a call.

Ok, Let’s begin….

How Keto and life insurance are connected?

Life insurance is looking at over 60 factors when determining one’s rate and Keto could affect a number of these factors. In other words, your life insurance rate is determined by your health. It’s Life Insurance 101. If your health is better, you can expect to have a lower rate on your life insurance. Some of the positive effects, people have on Keto are weight loss and improved overall health. Below are 2 examples where Keto saved life insurance premium dollars.

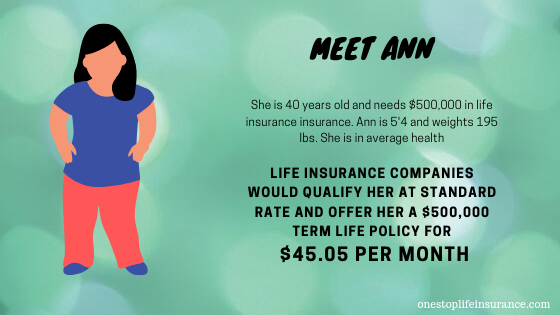

Ann is 40 years old. She is 5’5 and weighs approximately 195lbs. Life insurance companies would qualify her into a standard rate class. This means that Ann can expect to pay approximately $45.05 per month in life insurance for $500,000 in coverage.

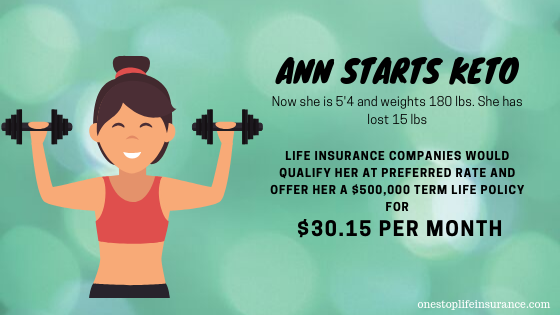

Following the ketogenic diet, Ann loses 15 lbs. These 15lbs weight loss and qualify Ann into a better health class. Companies could offer her a preferred rate for her and her new rate is $30.15 for the same coverage.

Think about her, she saves approximately 34% from her life insurance premium every month or over $3,500 for the life of the policy.

Now, let’s look at our second example….

We recently worked with a gentleman, let’s call him Michael. Michael was considered a pre-diabetic and his doctor had put him on a medicine to control his blood sugar level. Michael was overweight and also was having a blood pressure reading higher than normal. These conditions have put him in a rated life insurance policy.

Michael followed Keto principles and adjusted his eating habits. He lost weight and his blood sugar level was normalized. The doctor monitored Michael’s progress and had taken him off completely of diabetes medicine and blood pressure medicine. At the time we are creating this article, we are working with a carrier to offer Michael a standard rating. The savings would be really significant.

This story and many more has inspired us to create this post. We want to spread the word out and to encourage people to have a second look at their existing policies or to shop for some options today.

Things that matter when applying for Life insurance after Keto

This is a topic you need to review. There are a couple of things to consider when you are applying for life insurance after weight loss.

1. How much weight have you lost and in what time frame

Companies want to see stability. Therefore, if your weight loss is recent 3-5 months, they may add back half of the weight for rating purposes. This stands true regardless of how exactly you lost the weight, whether is through diet or weight loss surgery.

Here’s what we mean.

Just to make the math easier, suppose a person weighs 300 lbs. He loses 80 in a period of just 5 months (impressive, right?). Now the when life insurance companies are reviewing his application, they would add 40 lbs (80 / 2) back to his current weight. They would rate him as 260 lb weight vs. his actual weight of 220 lbs. Unfortunately, these 40lbs could very well put him in a more unfavorable rating.

Here’s the solution:

There are some companies that will not add the lost weight back. Some would look back at only the past 6 months and some will look back 12 months.

Let us review your personal situation and match you with the carrier that would offer you the most favorable rating, based on your personal situation.

2. Has keto affected your cholesterol or other vitals

This is a common concern that people starting off on Keto have. It is very common to have a spike in your cholesterol reading due to the increase in fatty foods. Over time and with proper diet, the readings should go back to normal or even below normal limits.

Here are the solutions:

- Monitor your cholesterol through regular check-ups – that way you would know you are in healthy limits prior to applying

- Make sure you follow the plan and avoid foods that can cause a spike of your cholesterol reading

- Apply with a company that will not require a medical exam – the main thing to keep in mind is that you still have to be 100% truthful and honest on your application. Please answer the questions and disclose any information relative to your life insurance policy. Why? Because the last thing you and your family would want to have happened is the company to deny a claim due to misinformation during the application process. Not to mention that lying to an insurance company could be considered fraud.

3. Are your medical records up to date

In many instances, companies would request a copy of your medical history. The last thing you want is for them to have your previous weight on the charts.

Also, please know that companies would need some time to pass before they are able to offer a better rating based on your improved health. For example, if your doctor has just advised you that you no longer need blood sugar controlling medicine, companies would want to wait a bit. They want to ensure that the improvement will persist and in the long run. Think of life insurance companies as conservatives, who like stability and predictability.

Tips to get the best rate on your life insurance when on Keto

Here are some tips to help you save on your life insurance after Keto

Know your numbers

This would give us a better idea of your current situation and could guide which carrier would offer you the best rate, also recommend an option with or without a medical exam.

If you have a medical exam:

- Eat healthy the days leading up to the exam – nothing spicy, greasy, eat avocado

- Drink plenty of water

- Get good night sleep

- Fast through the night and complete the exam the first thing in the morning on an empty stomach (just water)

- Reduce stress and laugh more – it has been proved that laughter lowers your blood pressure.

Last note: Companies view your weight and use it as a rating factor. Did you know that if you are underweight, carriers might view you as a higher risk?

In conclusion,

Keto could have a positive effect not only on your waistline but also on your wallet. There are many instances when Keto has helped clients get a better health rating on their life insurance policies.