Life insurance with living benefits if undocumented made easy

Many of the clients we help are happy to know that they finally have found an insurance company that will underwrite their health and lifestyle, not their visas. In addition, they are really ecstatic to learn that they can secure life insurance with living benefits as undocumented immigrants.

In this article, we will outline what are living benefits in life insurance, why you should consider a policy with living benefits if undocumented, and what are the qualifications. We’ve divided the post into several categories.

Topics we would cover

What are living benefits in life insurance?

Why you should consider living benefits if undocumented

Overview of the application process

Is this expensive and other Frequently Asked Questions

If you have additional questions or would like us to take a look at your personal situation, simply reach out to us. You can complete the instant quote form, send us a message, or just give us a call.

Ok, let’s dive right in….

What are the living benefits in life insurance?

We felt this is an appropriate place to start. Many clients are not even aware that there are policies that offer this feature and the ones who are aware, believe we are talking about cash value growth. This is not the case.

We’d like to think of living benefits in life insurance as a modern take on life insurance. The Accelerated Benefit Riders, as often referred to within a policy booklet, allow the owner of a life insurance policy to use the policy while still alive. In order to do so, the insured needs to be diagnosed with a qualifying medical condition. The conditions are often referred to as triggers and they vary amongst the different life insurance carriers.

In a nutshell, living benefits in life insurance would pay out a lump sum, should you suffer a qualifying illness. The money is not considered a loan, you would not have to pay it back and it is sent directly to you, not your doctor or insurance company.

You can use the funds how you see fit: pay your medical bills, pay your rent, or be able to put food on the table.

Often times foreign nationals who are undocumented may not have other sources of income or savings they can use, such as disability insurance from work or 401K.

Below is a basic breakdown of the triggers or qualifying conditions that make it possible for a policy to pay out while you are still alive.

Critical illness

Under this group of triggers, you would be able to accelerate the benefit, if you are diagnosed with any of the following conditions:

- Heart Attack

- Stroke

- Invasive cancer

- End-Stage Renal Failure

- Major Organ Transplant

- System Tumors

- Major Multi-System Trauma

- AIDS

- Severe Disease of Any Organ

- Severe Central Nervous System and etc.

Chronic illness

The client is able to accelerate if he’s been unable to perform 2 out of the 6 activities of daily living for more than 90 days. The 6 activities of daily living are:

Bathing, Continence, Dressing, Eating, Toileting, Transferring

Terminal illness

This is a common rider on many policies. It allows you to accelerate the policy if you are diagnosed with a terminal condition that is expected to result in death within 12 or 24 months (based on the company guides).

Please note these are just sample living benefits. Not every company allows acceleration under these conditions. It is essential to see what the company covers and review the policy. Some carriers offer more comprehensive benefits than others.

Why you should consider life insurance with living benefits if undocumented

We touched on this briefly above but wanted to expand a bit more. Oftentimes people are not able to work or are forced to work with reduced hours due to an illness. This could put tremendous financial stress on a family.

- In addition, people who are undocumented may not have access to either health insurance, disability insurance, or any other financial assistance in the event of serious illness. Not having access to care could be the difference between surviving the condition or passing away.

- It is not uncommon for foreign nationals to not have extended family here. You might need to fly a family member to help you with the care of the kids or take care of yourself.

On a personal note,

As a foreign national myself, I often hear stories of people planning to return to their country of origin to seek medical care due to cost. Unfortunately, this may not always be possible. You might have a condition preventing you from flying or otherwise leaving the US; you might have kids who are enrolled in school. Unfortunately, it is not always easy to pack up and leave.

There are many reasons why a foreign national may need coverage. The important thing is to consider your needs and make sure you secure a policy tailored to these needs. Did you know you can secure a policy on your parents, if they are undocumented, to help protect any final expenses?

Having access to resources during a tough time means you can breathe a bit easier. It allows you to focus on getting better vs. paying to live.

Qualifications

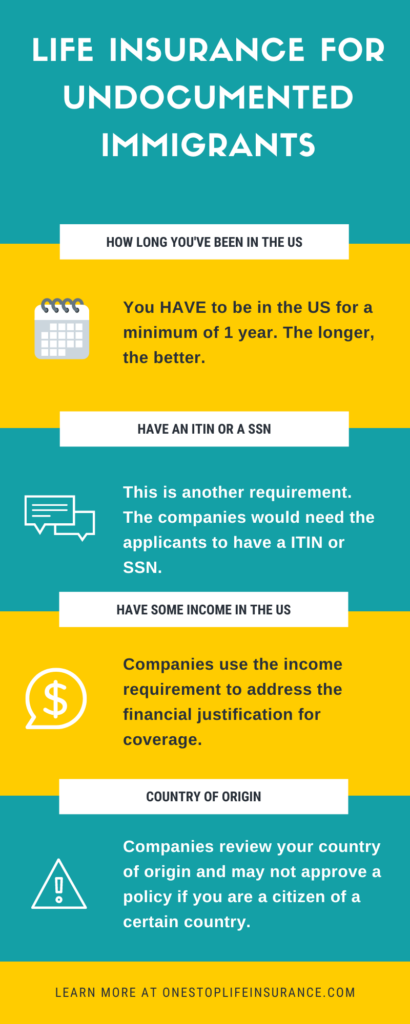

Here is a list of the main things carriers would consider when underwriting life insurance with living benefits if undocumented:

- Country of origin

- Length of stay in the US

- Do you have an income

- Do you have an SSN or ITIN

We’ve dedicated a separate article on the topic of qualifying for life insurance if undocumented. For a more comprehensive list of qualifications and explanations of the qualifications, please review it here.

Overview of the application process

We’ve talked to many clients concerned about confirming their immigration status. In some instances, some fear that this could impact their stay in the country.

Therefore, we felt it is important to give you an overview of the application process, so you would know what to expect. Being better prepared, will not only make it an easier process, but it will also give you peace of mind.

Here are the steps to apply for coverage:

Qualifications and Quote

During our initial call, we would pre-qualify you for coverage. We would ask questions as to why you are looking for insurance, how long you have been in the US, and your intention to remain in the country.

Please note, that the life insurance industry is constantly evolving and therefore changing insurance guidelines, especially when it comes to life insurance for foreign nationals. In some instances, we would reach out to several carriers to determine eligibility. We call it a possible outcome question. The goal is to get a clear answer before putting you through an application.

Submit an application

We’ve tried to streamline the process as much as possible. We work with carriers that accept applications over the phone and e-signatures. When it comes to life insurance with living benefits if undocumented, we would complete the entire application over the phone. Realistically, the process would take 20-30 min, as we would need to ask you each medical question verbatim.

In addition, during the application step, we would ask for personal information, such as SSN/ITIN; your driver’s license (if you have a US Driver’s license); the name of your doctor, and any medications you are or have been prescribed.

In most instances, we would ask you to send us a copy of your passport or any other documents you might have demonstrating your identity and need for coverage.

Process of underwriting

During this stage, we would schedule a medical exam (if one is required) and request a copy of your medical records (if the carrier advises us if they are needed). In some instances, the application could qualify for acceleration. Meaning, that the carrier would be able to obtain all of the information they need, simply by requesting various reports.

If an exam is needed, we will schedule that with you. An examiner can meet you at your home or you can go to a lab near you. There is no charge for you for the exam.

Is this expensive other Frequently Asked Questions

We’ve gathered a list of the most common questions we’ve been asked about life insurance with living benefits.

Q: Is life insurance with living benefits expensive?

A: No, a life insurance policy with living benefits is not expensive. This feature is offered in term and permanent products. In other words, you would have a selection of products you can choose from.

Q: Will every company offering life insurance with living benefits consider me if I am undocumented?

A: Unfortunately, no. There are still many companies that will underwrite your visa or immigration status in the US rather than your health or lifestyle.

We were able to find only one carrier that would offer life insurance with living benefits to undocumented immigrants.

Q: Would I receive the payment and is it a lump sum?

A: Yes and yes! The policy owner will receive the payments directly and oftentimes in a lump sum.

Q: Do I have to pay back the money?

A: No, you do not. Companies do not consider it a loan, you are accelerating your death benefit (using it in advance).

Q: Do I have to accelerate the entire policy or just a portion?

A: It is up to you. You can file for a partial acceleration or the full amount. The only thing you need to keep in mind if partly accelerating is the remaining death benefit may not fall below the minimum requirement for the type of policy you have.

Q: What is the process of submitting a claim?

A: If you are diagnosed with a qualifying medical condition (all conditions would be listed in the policy), you would reach out to the carrier and file a claim for acceleration. The company would request your complete medical records and have them reviewed. They would try to determine how this condition affects your life expectancy.

Q: What if I change my mind and do not want to accelerate after filing a claim?

A: You have the option to close out your claim. Make sure you do so before accepting any offer of payment.

In Conclusion,

You could still qualify for life insurance with living benefits if undocumented. Not every company would offer this coverage to you. Therefore, it is essential to work with an agency specializing in life insurance for foreign nationals. Please reach out to us to learn your options and see how this policy can help you and your family not only when you pass away, but while still alive.

We hope you find this helpful. Please do not hesitate to contact us if you need additional information.

Thank you!