Life insurance with O-1 Visa

O-1 visa is a nonimmigrant type of visa. It is issued for the individual who possesses extraordinary ability in the sciences, arts, education, business, and etc. Even if here on a temporary basis, many families are still in need of life insurance coverage. In this guide we would outline how to secure life insurance O-1 Visa, what requirements, and go over the process step by step.

Table of contents

- Is life insurance with O-1 visa possible

- What are the requirements to secure life insurance

- Process of applying for life insurance with O-1 visa

- Frequently asked questions (FAQs)

If you would like us to take a closer look at your personal situation, simply reach out to us. We will take the time to ask you the right questions and match you with the best carrier for you. You can fill out the instant quote form on this page, send us a message or simply give us a call.

Ok, let’s go over some of the key information when looking for coverage as a non-permanent resident.

Is life insurance with O-1 visa possible

We purposely are starting with this question. It is one of the most common ones our clients are asking. Yes, life insurance with O-1 visa is possible, if you are applying with the right carrier. This is the key here. Not every life insurance company will approve your application if you are on a nonimmigrant visa. In fact, many companies have specific guidelines listing acceptable visa types.

Therefore, it is essential to work with a life insurance agency, specializing in life insurance for foreign nationals.

What are the requirements to secure life insurance

This is the section we would spend the majority of our time. We want to advise what life insurance companies are looking for and help you understand their requirements.

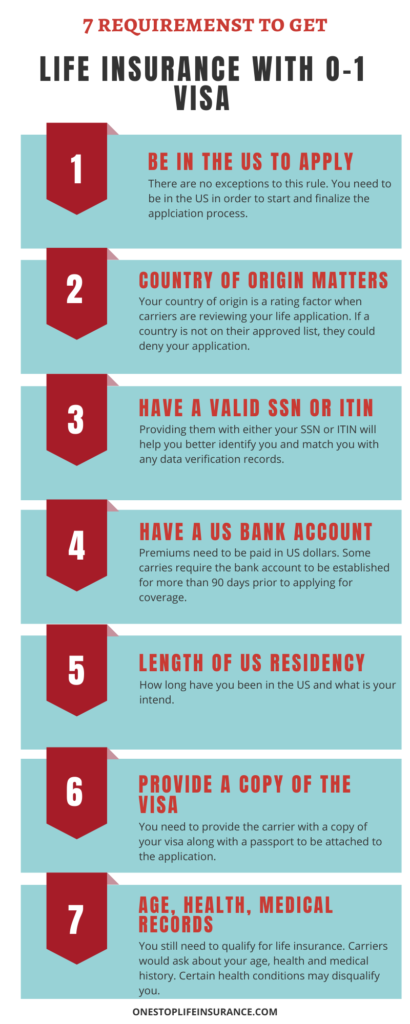

Be in the US in order to apply for coverage

There are no exceptions to this rule. Due to insurance regulations, every company requires you to be in the US in order to apply for coverage.

What is your country of origin

This is one of the very first things we would ask you during our initial consultation. There are several reasons for this. Some countries have legal restrictions on their citizens to purchase life insurance abroad. Therefore, many companies here in the US would not issue a policy if your country has these restrictions.

On the other hand, some countries are deemed to pose a higher health and safety risk. Therefore, life insurance companies would not approve life insurance applications, unless you hold a permanent recency card or are US citizens as well.

Every company has it’s own list of approved countries. Company A may approve coverage for one country, while company B will not. It is important to know that these lists could often change.

Have a valid SSN or ITIN

This is a requirement for most companies. Providing them with either your SSN or ITIN will help them better identify you and match you with any data verification records.

Please note, we have an option for insurance for anyone, who is here in the US and does not have either SSN or ITIN. Please view additional details on this type of insurance.

Have a US bank account

As a protection measure, companies require the premiums to be paid from a US bank account. Some would even require the account to be established for more than 90 days.

Length of US residency

This would be another piece of the puzzle. Some companies will require the applicants holding O-1 visa to be present in the US for more than 12 months. Not every company has these requirements, but we felt it is important for you to know.

Provide a copy of the visa

During the application you would need to provide us with a copy of the visa, so we can attach it to your application. Please note, if your visa is expiring within 60 days from the time of the application, you might be asked to submit an extension approval.

Current age

Many companies have age requirements when underwriting applications of visa holders. Typically, applicants need to be between 18-70 years old.

Health/Lifestyle and medical records

Besides your immigration and residency status, companies will review your health and lifestyle. They will ask questions about your medical history, family health history, and whether you are involved in any high-risk hobbies such as sky-diving, scuba diving and etc.

In addition, they might request a copy of your complete medical records. Now, this could be tricky, especially if your records are from your country of origin and they are not in English.

Companies will allow you to obtain the records, some could reimburse you up to a certain amount for the cost of translation. Typically, obtaining medical records is the biggest delay when it comes to securing a life insurance policy.

In a nutshell,

When a company is reviewing your application for life insurance with O-1 visa, they will be also taking into account several additional factors. Please note, this is a standard process and we strive to make it as easy as possible.

What s the process of applying for coverage

We felt it is important to outline the process of applying for life insurance with O-1 Visa. When you know what to expect and what the application process consists of, you would have a better understanding and set realistic expectations.

We’ve divided the process into 2 categories:

1. Pre-application process – we help you and guide you through every step:

Review the available choices and carriers

We will ask you several questions to determine your objectives and eligibility. Afterward, we would “match you” with the best carrier for YOU. That’s true, there is no one option that works for everyone.

Complete and e-sign the application

After we discuss your options and you feel comfortable with our recommendation, we move forward with the second step: completing and signing the application. We help you with this part. We would ask you all of the necessary questions a carrier requires and send you the application for e-signatures.

Obtain any necessary documents to attach to the application

When we are processing an application for foreign nationals, we would gather a copy of their visa, passport, and other documents to attach to the application. We try to gather all of the information upfronts. Keep in mind that it is not uncommon for a carrier to send out additional requirements after an application has been submitted.

Schedule a medical exam, if one is required

There are many instances wherein order to secure a life insurance policy in the US, you would need to get a medical exam. Basically, you meed with a lab technician and he or she processes your vitals. The appointment takes approximately 15 minutes and is free of charge to you.

Please note that not every company will require a medical exam. In fact, more companies are implementing processes allowing them to complete an accelerating underwriting and do not require vitals.

Feel free to let us know if you prefer to have your application expedited without the need of blood work.

2. Post application process – we take it from there

After we submit your application, we get to work. We are in constant contact with the case manager assigned to your application and will respond to every requirement they might have. Here is what we do:

- Follow up with the company on a regular basis

- Advise you of any requirements and try to obtain them

- Assist you in the process and provide you with periodic updates

- Help you finalize the application, the policy delivery, and acceptance

4 Frequently Asked Questions

Below are some of the most common questions we’ve received. Please go through the list and if you need some additional information, or you have a question we’ve not covered, simply reach out to us.

Q: Is there a fee to apply? Do I have to pay at the time of the application?

A: Even though, those questions are similar they differ. Here’s how: No, there is no fee to apply, and additional you do NOT have to make a payment at the time of the application.

However, if you are planning to pay monthly for the policy, once it is issued, some carries ask for your bank information upfront. In addition, some of our clients opt-in for temporary insurance. In this case, they make a payment during the application. Let us know if you would like to take advantage of temporary insurance or learn what it is and if you qualify, simply reach out to us.

Q: How long is the application process?

A: It depends on the type of policy you are applying for (with or without a medical exam) and whether the company needs to obtain a copy of your medical records.

- Without a medical exam: allow 2-5 business days

- With a medical exam: please allow 3-8 weeks for processing

Q: Will my rate increase every year?

A: No, it will not. When applying you decide on the type of policy you select. It could be a 10, 20, 30-year term policy or a permanent policy. The price and coverage amount would be fixed for the duration of the policy.

After the term ends, the price will increase substantially. Most policies are canceled at that time or converted to a permanent policy, if eligible.

Q: What if my visa expires?

A: We get this question a lot and wanted to list the possible scenarios:

- You can return to your country of origin – in that case, your policy would still cover you, as long as you continue making your payments. See our guide on if I die abroad.

- If you want, you can always cancel your policy. There are no fees or penalties during so. However, please consult with us to ensure it is in your best interest.

- You can remain in the US with a new visa or without adjusting the status. We’ve created a complete guide on life insurance for undocumented immigrants. Either way, the terms of your current policy will still apply.

In conclusion,

We hope you find this guide helpful. What we want you to take away from it is that life insurance with O-1 visa is possible. Ensure that you are applying with the right carrier and you have a policy tailored to your specific needs.

If you have any additional questions or would like a personal review of your situation, simply reach out to us. You can fill out the instant questionnaire, leave us a comment, or give us a call.

Thank you!