What is Accidental Life Insurance?

There is a group of policies on the market today called accidental death life insurance policies. Many of our clients have called us inquiring about the product and its advantages and limitations. We felt the need to put together this guide and outline what is accidental life insurance and is it really worth it.

We will cover the following topics

- What is accidental life insurance

- What does accidental policy cover

- Who might benefit from this policy

- Are there any exclusions

- Frequently asked questions and sample rates

- What if you need more than $500,000 in an accidental life insurance policy or you have special circumstances

Ok, let’s dive in…..

What is accidental life insurance

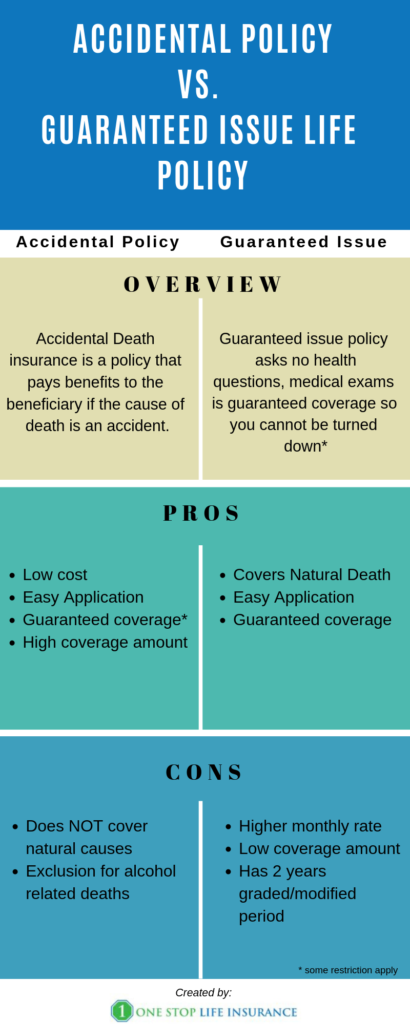

This is a type of policy that would provide coverage, in case the insured dies due to a covered accident. This group of policies is very affordable and easy to secure. It is often viewed as a piece in the overall protection plan for your family and children. Accidental coverage can be added to a traditional life insurance policy as a rider to secured as a stay alone product. There is little no none underwriting and it is offered compared to guaranteed acceptance life insurance. Accidental life insurance does not require a medical exam and it could be issued in days vs. weeks or months.

Most companies will offer coverage from $50,000 to $500,000 and you need to be between age 18-70 to qualify. If you need more coverage, jump over to the last section of the guide.

We want to mention that if there is a topic we didn’t cover in this guide, or have any questions when it comes to life insurance, simply reach out to us. We will take the time to review your options and present you with a solution. You can do so by filling out the instant quote form on this page or simply give us a call.

What does accidental policy cover

Accidental life insurance could be a great addition in one’s financial portfolio and provides a peace of mind that you are protected in case of an accident. Did you know that according to the National Safety Council, an American dies every 3 minutes by a drug overdose, a motor vehicle crash, a fall, a drowning, a choking incident or another preventable occurrence?

In 2018, was the highest number in accident deaths. There are 466 lives lost PER DAY due to an accident.

The need is there and this product fills the gap.

Here are some of the most common causes of accidental death covered by accidental life insurance

- Fatal vehicle accidents

- Work or non-work related accident

- Pedestrian accident

- Unintentional poisoning

Who might benefit from this policy

We view accidental life insurance as a great option for someone who:

- Wants to supplement his or her existing plan with a low-cost alternative or needs affordable coverage.

This plan is also a great fit for anyone who can not qualify for a tradition policy due to any of the following:

- Health condition or history (cancer, hearth condition, addiction and etc)

- Driving history (Did you know that many companies would postpone your application for traditional life insurance due to your driving record, especially if you had a DUI in the past 3 years)

- Felony record – life insurance companies review lifestyle as a part of their underwriting guidelines. In some instances, having a recent felony conviction on your record could disqualify you for life insurance

- Occupational restrictions – some professions can be viewed as a higher risk than others. Rest assured that this production does not have any occupational restrictions.

Are there any exclusions

Yes, this product has several exclusions that we want to cover. While accidental life insurance could be a great fit for many, it is not complete protection. It does offer many advantages, but you need to view it as supplemental rather than proper coverage, if possible.

- Natural causes, illness or age

- Death resulting from war (whether declared or not), this also includes death while serving in the armed forces

- Suicide or attempted suicide, while sane or insane

- Death while under the influence of any controlled substance (drug overdose would fall into this category)

- While the insured is intoxicated and operating a motor vehicle or while the insured is engaging in any contest of speed, organized or not

- Death while the insured is committing or attempting to commit a felony and etc.

Every company has it’s own list of exclusions that will apply. Our advice is to pay close attention to the exclusion page and familiarize yourself with the reasons why coverage will not apply. You want to make sure you understand the product and the coverage.

Frequently asked questions

Q: Can everyone secure an accidental life insurance policy?

A: Based on the company, the products are available for US citizens or permanent residents (who have lived here for more than 12 months) and are between the ages 18-70.

Q: Can I replace my existing policy with an accidental?

A: No, you can not. You can add to your existing policy, but typically a replacement is not in your best interest.

Q: Do I get my money back?

A: Some options include the Return of Premium feature. (not available in every state)

Q: Who can be my beneficiary?

A: Anyone with an insurable interest ( Spouse; Parent; Child; Sibling; Domestic Partner; Spouse Grandchild; Trust; Grandparent; Business Owned by Insured; Business Partner)

Q: Can you have more than 1 accidental life insurance policy?

A: You may have more than 1 policy (not with the same company) and up to the financial underwriting limit.

Q: Are there any additional features of the policy?

A: Some carriers allow for an additional benefit should pass away in common carrier accidents or as a pedestrian.

Below are some sample rates from one of the carriers we work with. Take a second to review them. Please note, that there are NO health questions, lifestyle questions, tobacco use and etc.

| Gender | Age | Coverage | Monthly premium |

| Male | 25 | $200,000 | $24.15 |

| Female | 25 | $200,000 | $14.88 |

| Male | 35 | $500,000 | $53.81 |

| Female | 35 | $500,000 | $30.63 |

What if you need more than $500,000 in an accidental life insurance policy

There are instances when you might need more than $500,000 in coverage or you have special circumstances. Please know we’ve partnered with a carrier designed to offer coverage up to $100,000,000 and consider the hard to place cases.

In other words, feel free to reach out to us and let us find the best option for you. We will take the time to listen and match you with the right carrier.

In Conclusion,

Accidental life insurance is limited protection. However, it is a great option for people who are not able to qualify for a traditional policy or need to supplement their existing coverage.

We hope you find this guide helpful. Please feel free to reach out to us if you have any additional questions or would like us to review your options.

Thank you!