Guaranteed Acceptance Life Insurance

There are instances when for one reason or another you can not get life insurance. Then what do you do? What are your options to secure a policy? We’ve had countless families reach out to use with these very questions, so we felt the need to put together this guide. We would outline what is guaranteed acceptance life insurance, how to secure it and would it help you. We consider these products as a great option for people needing life insurance, but could not secure a traditional policy.

Here is what we will cover

- What is a guaranteed acceptance life insurance

- What are the available coverage amount

- Eligibility ages

- What type of policies

- How is the policy structured

- What other products may be available

- The additional information you need to consider

Ok, let’s get started…

If you have a specific question we are not covering in the guide or would like us to take a look at your personal situation, just reach out to us. You can do so by filling out the quote form on the page, leave a comment or simply give us a call.

What is a guaranteed acceptance life insurance

We felt it’s important to outline what is guaranteed issue (acceptance) policies and who are they designed for. These are types of life insurance policies, where the companies have little to no underwriting involved. The application consists of asking several basic identifying questions and carriers are able to issue the policy. In most instances, you can complete the entire application is less than 10 minutes! That is correct, it is that fast. Here is an example of the information you need to provide on your application:

- Name

- Address

- Date of birth

- Phone and email

- Social Security Number, if you have one

- Citizenship information, based on the company

- Desired coverage amount

- Beneficiary

- Payment information

- When do you want to have the policy effective.

These policies are very easy to secure and they are a great option for many families. However, they also do have several limitations we want you to keep in mind. We will cover them later in the article.

What are the available coverage amount

Depending on the company, you could secure a guaranteed acceptance life insurance from $5,000 to $50,000 in coverage. The price will be based on the type of plan, coverage amount and the insured’s age.

Eligibility ages

Most companies offering guaranteed issue life insurance would offer the products for clients over the age of 50. Many families have reached out trying to secure coverage for their adult children, diagnosed with a preexisting condition. Therefore, we’ve contracted with 2 carriers that are able to offer coverage for adults as young as 18 years of age.

Depending on the company and the option you select, the highest issue age for these products is 75 or 85 years old.

What type of policies

There are 2 types of policies:

Whole life

As the name suggests, this is a type of policy locked in for life. The price and coverage amount would remain the same up to age 121. This policy is very attractive due to its stability and knowing that regardless of when the time comes, there will be a policy in force. These policies also build cash value.

The downsides of these policies are the price and cash value growth. We understand that we just listed the cash value growth as attractive and as a negative side of the product. Here is why: in some instances having cash value in life insurance is viewed as an asset and it could interfere with any government benefits the insured receives. In some instances, the parents or the children of the insured can be the owners of the policy and therefore minimizing this issue.

However, we want to let you know that we are not tax specialists and we advise you to consult your advisor to ensure that a cash value policy is a good option for you and your family.

Term insurance

This is the other type of guaranteed acceptance policy. Unlike the whole life, this product does not build cash value and you don’t have to worry about interfering with government benefits. This product will renew every 5 years and the price will adjust based on your age at the time of renewal.

Here are some of the things to look out on this plan:

- It is not available in every state. As of today, here is a list of the states where it is available:

AL, AR, AZ, CA, DC, DE, FL, GA, IA, ID, IL, IN, KS, KY, LA, MI, MO, MS, NC, ND, NE, NJ, NM, NV, OH, PA, TN, TX, WV, WY

- There is a $25 application fee payable at submitting the application

- You would be issued a certificate of insurance. The death benefit will be paid out to the beneficiary named in the enrollment form.

How is the policy structured

This is the part we want you to take a look at. We mentioned that these policies do have some limitations and it is the way the policies are structured for the first 2 years. The guaranteed acceptance life insurance product often has what is called a graded or modified benefit. In other words, should the insured pass away during the first 2 years of the policy, for any reason other than an accident, the beneficiary will NOT receive the full benefit.

It is important to mention that should the insured pass away due to an accident at any point, the full benefit will apply.

This is a way for the life insurance companies to continue offering the products without any underwriting.

Here is an example of a benefit structure:

If a death occurs in the first 2 policy years for any reason other than an accident, the beneficiary will receive all of the premiums paid with an interest no less than 4.5%. In other words, he or she will receive the money-back plus interest.

While having a grated benefit may not be an ideal situation, it provides peace of mind that should the insured outlive the 2 years, the full benefit will be paid out. In addition, you have the reassurance that the money paid into the policy will be returned plus interest.

What other products may be available

Many of our customers have advised us that $25,000 or $50,000 of coverage is not enough to truly protect their family’s needs. If a client is not able to qualify for a traditional policy and secure larger death benefit, here are the 2 options they have:

Secure a guaranteed issue policy with more than one company

This will increase the total coverage amount and should he or she pass away, the beneficiary could file a claim with both companies.

Consider an accidental policy

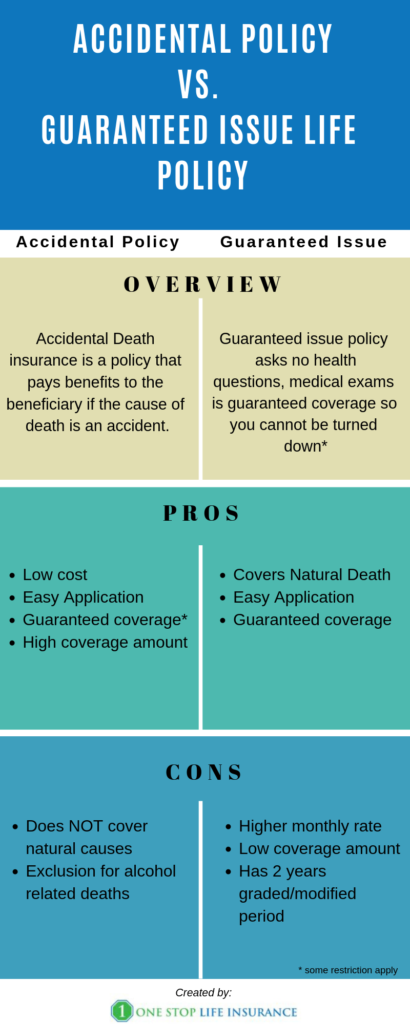

We want to take a second and touch on this type of product. First off, an accidental policy is often compared to guaranteed issue policy in essence that there is no underwriting involved. Companies want to ensure that you are not replacing a traditional policy with an accidental only policy, as this most likely is not in your best interest. An accidental policy is a good option for someone battling addiction.

The accidental policy allows you to secure a higher coverage amount while keeping the monthly premiums at a reasonable rate. With accidents, being one of the leading causes of death amongst people age 40 and under, it makes sense to take a closer look at this product. According to an article, an American dies from an accident every 40 seconds.

For better protection, some of our clients have opted to secure an accidental policy and a guaranteed issue policy.

Here is an infographic outlining some of the key differences between accidental policies and guaranteed acceptance life insurance.

The additional information you need to consider

- If you are securing the policy for someone else you need a guardianship or power of attorney – for example, a parent looking to purchase the policy to an adult child with a pre-existing condition such as Down Syndrome or epilepsy. Companies will see if the paperwork was issued within the past 3 years. If you’ve obtained the forms longer than 3 years, some will require a notarized statement that the condition still persists and you are still the insured’s guardian.

In addition to guardianship, you need to have a clear insurable interest in the life of the insured. In other words, you would suffer a financial loss should he or she pass away.

- Companies process payment electronically – typically, they will need a credit or debit card to process an automatic monthly payment. In some instances, they may ask for your account and routing number instead.

On a side note, regardless of what type of life insurance you have, having your payments processed automatically is a good option. it ensures that your payment will be processed on time and you will not have your policy canceled over a misunderstanding such as a lost check in the mail.

- You will need an email address. The applications are completed electronically. Carriers will send you the confirmation of your application or the forms you need to sign electronically.

- Some carriers will require an application fee. Based on the carrier, the fee ranges from $18 to $25.

- Some plans offer additional member benefits, such as discounts on prescriptions and wellness services. Make sure you review your policy booklets and take advantage of the savings.

In conclusion,

Guaranteed acceptance life insurance is a great solution for many families. While the policy has some limitations, it provides peace of mind that there is insurance in place, should you pass away prematurely. The product is affordable and easy to secure. And, should your situation changes, we can always revisit your options and see if you qualify a different policy.

We hope you find this helpful. If you have any questions, do not hesitate to reach out to us.

Thank you!

1 Comment

Cheri Maples

I need life insurance for my drug addicted son.