Cost of Life Insurance with ITIN: What You Need to Know

One of the biggest concerns clients have is the cost of life insurance with ITIN. Many wonder if applying without a Social Security number means they’ll pay more for coverage.

The truth is, life insurance companies look at more than just your immigration status, they consider your health, age, financial ties to the US, and available documentation.

In this article, we break down how pricing works, share real-life examples, and explain what you need to qualify – so you can make an informed decision and secure the right protection for your family.

What We’ll Cover:

- Can you get life insurance with an ITIN?

- Which companies will approve your application?

- What are the requirements?

- Sample prices and how product availability affects cost

Quick Summary: What is the Cost of Life Insurance with ITIN? Life insurance with an ITIN is not inherently more expensive. However, applicants may face limited carrier options and product availability, which can affect pricing and flexibility. In this article, we explain the requirements to qualify, provide sample rates, and offer guidance for securing the best life insurance coverage as an ITIN holder.

If you have specific questions, feel free to reach out directly. Our goal is to make life insurance for foreign nationals not only possible but also easy to secure.

Can You Get Life Insurance with an ITIN?

Yes, you can qualify for life insurance with an ITIN (Individual Taxpayer Identification Number). That said, there are some important limitations you should be aware of.

Not every life insurance company accepts applications with an ITIN. Many still require a valid visa or other immigration documents to proceed with underwriting. This can be a challenge for clients who are undocumented or whose visas have expired.

The reality is, many companies still underwrite based on immigration status – not just your health or financial profile.

That’s why working with an agency that specializes in life insurance for foreign nationals is critical. We know which carriers are flexible and how to position your application for success.

Unfortunately, many companies still underwrite a client’s immigration status, not his or her health and lifestyle.

We’ve covered in depth what the requirements and process are to secure life insurance coverage without an SSN in this life insurance with ITIN. What we want you to take away is that when trying to find life insurance with an ITIN, it is possible if you apply with the right company.

Will Every Life Insurance Company Approve ITIN Applicants?

Unfortunately, no. Some carriers are more flexible than others. While a few will accept ITINs with no visa, many will want to see proof of lawful presence or strong ties to the US, such as a home, a job, or family.

Let’s walk through a real-life example.

Sample Pricing: Cost of Life Insurance with ITIN

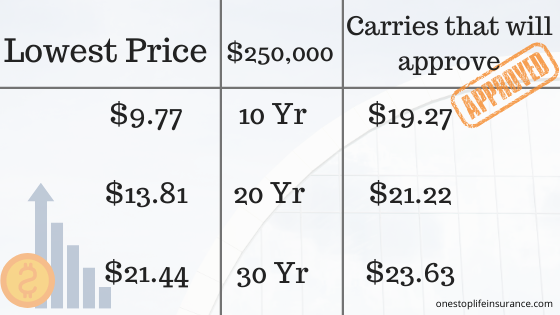

Meet Anthony. He’s 35 years old, a foreign national living in the U.S. for several years. He has an ITIN, pays taxes, rents a home, and is in excellent health. He doesn’t have a valid visa but plans to stay in the U.S. permanently.

Anthony wants a $250,000 term life insurance policy to protect his wife and growing family. He might pay more for traditional term insurance, not because he has ITIN, but because there are limited carriers that will approve coverage.

Let us elaborate: you would not pay a surcharge or additional fee just because you do not have a social security number. However, you could be limited in the selection of carriers and/or products available to you. In other words, you might not be able to apply with the lowest carrier on the market when it comes to life insurance.

Below we will look at an example to demonstrate what we mean.

Here’s the key: Some companies will approve him based on his financial ties and strong health. Others will decline the application because of his expired visa.

This is why working with the right agency matters—we’ll help you find the carrier that fits your situation.

Note: If you hold a visa such as H1B, L1, O-1, K visa, or other visa types and also have an ITIN, you may qualify with more companies – including those offering lower-cost options and living benefits.

Does Life Insurance Cost More with an ITIN?

No, having an ITIN doesn’t automatically increase your premium. There’s no extra charge just because you don’t have a Social Security number.

However, fewer product choices can sometimes mean slightly higher rates. For example, if the lowest-cost company on the market doesn’t accept ITINs, you may have to choose from a smaller pool of carriers.

In some cases, only permanent life insurance options, like Guaranteed Universal Life (GUL), may be available. These provide lifelong coverage and build cash value, but they’re more expensive than term life.

So while ITIN life insurance isn’t priced higher by default, your available options may impact your final cost.

Final Thoughts

If you’re applying for life insurance with an ITIN, know that it’s absolutely possible to get coverage—often at competitive rates. The key is knowing which companies to apply with and how to qualify.

Not every company will be the right fit. That’s where we come in.

We specialize in life insurance for foreign nationals, visa holders, and ITIN applicants. We’ll take the time to understand your situation and recommend the best solution for your needs and budget.

Have questions? Reach out today and let’s find the right policy for you.