Life insurance after bariatric surgery

The number of bariatric (weight loss) surgery has increased dramatically over the past years. More and more people undergo a form of gastric surgery in an effort to achieve a healthy BMI. How exactly would it affect your life insurance, what companies are looking for and possible ratings are all questions we will answer in this guide of life insurance after bariatric surgery.

Table of content

How the different types of bariatric surgery affect your life application

Is it best to apply for life insurance before or after bariatric surgery

Common things companies would want to know

Things that may affect your application

What policy you can get after surgery

Possible rating after surgery (real numbers)

Before we dive into the topic, we want to advise you that you could reach out to us with any questions you might have about life insurance. We take pride in what we do and will go above and beyond to find you an option. You could simply fill out the instant quote form on the page or give us a call.

How the different types of bariatric surgery affect your life application

There are 4 different types of bariatric surgeries. Each one posses different risk and it is viewed differently by the underwriters.

- Roux-en-Y gastric bypass – this is the most common type of bariatric surgery today. “This is a type of gastric bypass surgery and is the most common method of gastric bypass. This surgery is typically not reversible. It works by decreasing the amount of food you can eat at one sitting and reducing the absorption of nutrients.” Based on the carrier you need to wait approximately 6 months after surgery before you are able to apply for coverage

- Gastric banding – use decreasing This type of surgery is not permanent and a surgeon inputs a band around the stomach to reduce its size. Even though it’s considered fairly safe, it’s popularity is decreasing. There are carriers willing to consider coverage as early as 3 months post gastric banding surgery.

- Sleeve gastrectomy – More and more people are opting for this type of surgery. During the procedure, doctors will remove a part of the stomach to reduce its size and make it smaller. Some companies will consider 6-12 months after surgery.

- Biliopancreatic diversion – This is a less common procedure out of the 4 types of bariatric surgeries. It poses more complications and it is used mainly to help people with Body Mass Index (BMI) ≥ 50. Companies would consider 6-12 months after surgery.

Is it best to apply for life insurance before or after bariatric surgery

Since we covered what is bariatric surgery, let’s answer a common question we get? When is the best time to apply for life insurance: before or after the surgery.

Well, the answer depends. If your surgery is already scheduled and you have gone through the tests, you would need to wait after the surgery before you can apply for life insurance. This stands true for any kind of surgery you might be planning.

In fact, a common question on just about any life insurance application is have you been scheduled or recommended to have surgery? You need to be honest and upfront and answer yes. As we all know, any kind of surgery poses a risk, even if it’s less than 1%. This is a reason why underwrites would want you to postpone your application until after the surgery is completed. Typically you need to wait 6-12 months after surgery prior to applying. This would ensure that there are no complications and everything is stable.

However, if bariatric surgery is something that you are just considering and you haven’t made any definitive plans, our advice is to apply before the surgery. You could always revisit your policy sometime after the surgery and see if there is a better option for you.

Common things companies would want to know

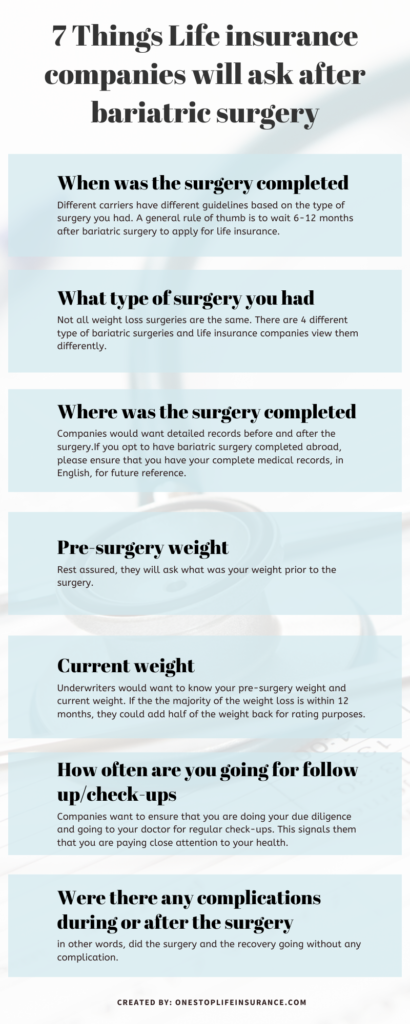

If you’ve had to apply for any kind of insurance, you are probably aware that underwrites wants to have as much information in front of them, prior to them approving or declining your policy. Life insurance underwriters are no exception to this rule. Here are some of the most common questions life insurance companies would want to know when reviewing your application for life insurance after bariatric surgery.

When was the surgery completed?

This is probably the very first thing you can expect us to ask you when you mention that you had weight loss surgery. Different carriers have different guidelines based on the type of surgery you had. A general rule of thumb is to wait 6-12 months after bariatric surgery to apply for life insurance. This would allow plenty of time for you to recover from the surgery and to ensure that there are no complications

What type of surgery you had?

As we mentioned above, not all weight loss surgeries are the same. Some procedures are more invasive than others, require more recovery time and pose higher mortality risk.

Where was the surgery completed?

Let’s be honest here, bariatric surgeries could be very pricey. Unfortunately, not all health insurance companies would cover them. Therefore, people are left with paying ten of thousands of dollars to get the procedure completed. It is not a surprise that more and more people are opting for having their surgeries done abroad to cut costs. Well, how does this matter to life insurance?

Everything matters, remember? Companies would want detailed records before and after the surgery. They would want to review your medical records to ensure that there were no complications and your overall health is improving.

If you opt to have bariatric surgery completed abroad, please ensure that you have your complete medical records, in English, for future reference.

Pre-surgery weight:

The underwriter would want to know how much you weight prior to getting the surgery completed.

Current weight:

This also something very important when applying for life insurance.

How often are going for follow up/check-ups?

Companies want to ensure that you are doing your due diligence and going to your doctor for regular check-ups. This signals them that you are paying close attention to your health.

Are there any complications during or after the surgery?

In other words, did the surgery and recovery are going without any complication.

Things that may affect your application

This is an important part. Not every bariatric surgery is the same and you can’t expect the same outcome. Here are 2 major aspects that could affect the rating of your life insurance policy

Have you had any complications before or after the surgery?

In other words, have you been treated for illnesses such as high blood pressure, cholesterol, diabetes, heart disease, and etc? The companies will look at the entire picture, not just your weight. They want to see if the extra pounds had affected your overall health.

Another aspect is the post-surgery underwriting. Are you experiencing any complications after the surgery? Are your lab results within normal ranges? How are you recovering from the surgery and how is your body adapting?

Things like that could have a positive or negative effect on your application.

The second thing that life insurance companies would do is focus on your weight.

Here is something that you won’t like to hear. Life insurance companies will add half of the weight you lost in the past 12 months. Yikes!

Let’s give you an example:

Suppose, your pre-surgery weight was 300. After the surgery and a healthy diet and exercise, you lost 100lbs in 10 months. Companies would give you credit for only half of the weight you lost and view you as 250lbs.

We understand how this may seem, and we wanted to share this “insider information” with you. This rule stands true regardless of how you lost weight, whether its through diet, such as Keto diet or weight loss surgery

However, don’t let this discourage you. Just keep in mind that your family needs some coverage today. You could always turn around and see if you qualify for a better rate down the line.

What policy you can get after surgery

Now, since you have a better idea of what to expect during the underwriting process, we felt it was important to touch on what policies are available after bariatric surgery. We will divide them into 2 major groups:

- Day 1 coverage

- Modified/graded option

Let’s go over each option and give you a better understanding of each one of the options.

Day 1 coverage

As the name suggests, these policies would offer coverage from day 1. You would not have to satisfy a waiting period before the coverage is in force. Under this category, you would have the traditional term policy (with or without living benefits), a permanent policy and accidental death coverage. Below we would touch on very briefly on each category. We’ve dedicated an entire topic on the basis of life insurance.

Term insurance – term insurance is a form of temporary insurance that you could get without even completing a medical exam. Typically it has a lower cost and allows for higher coverage amount. However, it does not build cash value and has an expiration point. In other words, should you outlive your policy, you may be left with no insurance or expensive annual renewable policy. A term is a great option for temporary needs.

Permanent policy – permanent policies, on the other hand, could last you a lifetime. We say could, because there are various types of permanent policy and they may be set up differently to address your needs. Permanent policies are Universal life and whole life.

Accidental policy – we included them in this category because they offer day 1 coverage, even if they limit the cause of death to result from an accident. We believe that despite the exclusion of death from natural causes or illnesses, these policies have their place in the market today. They are very affordable and could provide substantial death benefits to your family.

Modified / Graded benefit policy

These policies do not offer day 1 coverage for natural causes and illnesses. Typically, there are 2 years waiting period involved before the full benefits are available.

Possible rating after surgery (real numbers)

The rating you would receive on your application would be based on the factors we outlined above

- Current weight

- Past weight

- When and type of surgery

- Any other health conditions or complications

Below are some examples:

Meet jane. She is 35 years old and is 5’3 / 265 lbs and otherwise healthy. Currently, Jane qualifies for a rated life insurance policy. Rated means that companies would view her as a higher than average risk due to her weight.

Now: 500,000 – 20 years term – $74.85 per month

Janes have bariatric surgery, waits 9 months after the surgery. There are no complications and Jane successfully loses 50 lbs. Now, remember, it’s been less than 12 months, so companies would add back half of the weight.

9 months later:500,000 – 20 years term – $53.80 per month

Janes loses another 10lbs. For a total of 60 lbs in 13 months. Her new rate would be as follows:

13 months later 500,000 – 20 years term – $40.69 per month

Keep in mind that 13 months later, Jane is a year older and the cost has increased slightly. There are so many moving targets in life insurance ratings that it may not serve you well to wait. Our recommendation is to secure the coverage you can today and consider re-applying for a better rating down the line. Life is unpredictable. You want to ensure that you will have coverage in place for when the unexpected happens.

In conclusion,

Life insurance after bariatric surgery is possible. Companies would want to wait several months post-surgery to consider your application. They would also take into account your weight loss and for what time frame.

For accurate rates, solutions and no pressure advice, reach out to our agents.

Thank you