Reasons to get NO medical exam life insurance

Did you know that you can secure a life insurance policy with no medical exam? Is that option better and why? What are the things that you need to look out for and what are the advantages? In this guide, we will answer these questions. We will list the reasons why and when no medical exam life insurance may be a better option for you.

If you want us to take a look at your personal situation and see if no exam life insurance is a good fit for you, just reach to out us. You can do so, by filling out the quote form on the page, send us a message or simply give us a call.

Before we dive into the reasons why you should consider a no medical exam life insurance, we felt it is important to explain what exactly it is.

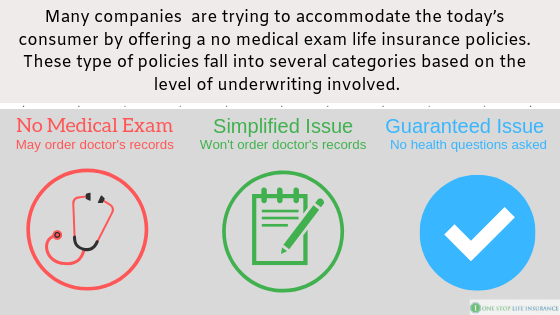

Many companies are realizing that and are trying to accommodate today’s consumer by offering a no medical exam life insurance policies. These types of policies fall into several categories based on the level of underwriting involved. We’ve dedicated an entire article outlining the different types of no medical exam policies, the process of obtaining. and the advantages of each one.

Regardless of the option, please remember you ALWAYS need to be honest and upfront with carriers. Companies have the option to contest a death claim if it occurs within the first 2 years of the policy. In other words, if they discover that you omitted information during the application process, they will have the right to deny the claim. This could expose your family to many financial challenges.

There are 3 main types of no medical exam life insurance:

- No medical exam

- Simplified issue

- Guaranteed issue policies

No medical exam policies

The application process is fairly simple. You will need to complete a phone application. Afterward, your agent will finalize the application, ensure that it is in good order and send it to you for review and electronic signatures. Your application then will be submitted to the carrier and they will start the underwriting process.

You might like to know,

That we work with many carriers that will allow you to self-complete your application. This means that you won’t even have to spend 15-20 minutes on the phone with our agents, but answer all of the questions at your own time.

Once an underwriter reviews initially your application, he or she may request a copy of your medical records. Simply put, our processing team will be in touch with your doctor’s office and ask them to provide your records. We handle this for you.

Unfortunately, this step may add extra time to the application process. We stay on top of any request. However, the turnaround time is beyond our control. If medical records need to be ordered, you may see 1-3 weeks before the company makes a decision.

Simplified issue life insurance

This is a type of no medical exam life insurance, where the company will NEVER request your medical records. In other words, we could get a decision within 24-48 hours!!! In some instances, you would know if you’ve been approved right after you complete your application.

Please keep in mind,

A simplified issue policy is a great option for someone needing insurance FAST (in the events of a divorce, SBA loans and etc). However, due to the underwriting process, carriers are very selective and not everyone would qualify.

Guaranteed issue life insurance

This is the third type of

Guaranteed issue policies are designed to ensure that the family of the insured will have to help cover the cost of the final expenses. While this may not be the best option, for many it may be the only available option to secure a policy.

Please note, that these policies still have some requirements, such as they will not allow Power of Attorney. The insured and the owner of the policy needs to be the same person.

Feel free to give us a call to learn more about this or any of the no medical exam life insurance policies.

So, now since we covered what is life insurance without a medical exam and what are your options, it’s time to turn our attention on WHY you need to look more closely to this type of insurance.

1. Convenience

There is no doubt about it. Being able to secure life insurance bypassing a medical exam is very convenient. You don’t have to worry about scheduling a visit with a nurse, fast for 12 hours and trying to eat healthy days leading up to the exam (these are all tips you can use to ace a medical exam, should you decide to go that route).

Not to mention that many people have a

Did you know that this is a more common condition that you might think?

“ It is estimated that at least 10% of American adults have a fear of needles, and it is likely that the actual number is larger, as the most severe cases are never documented due to the tendency of the sufferer to avoid all medical treatment” James G. Hamilton (August 1995). “

Needle Phobia – A Neglected Diagnosis”. Journal of Family Practice. 41 (2): 169–175 REVIEW. PMID 7636457.

2. Speed

Life insurance policies without a medical exam, tend to have faster processing time. As we mentioned above, many policies can be issued almost instantly or within 48 hours. This is extremely important if you have to get life insurance right away. There are many instances, where people are required to secure a policy due to a loan application, work, divorce decree and etc. Securing a policy without an exam will provide the speed and coverage needed.

3. Price

Yes, price is a good reason to look into a no medical exam life insurance. In many instances, applying for life insurance without a visit with the nurse can save you money. Just think about it, how long has it been since your last physical. If it’s been a year or longer, how can you be sure that your cholesterol, blood counts or sugar levels are all in check? You can’t. If you decide to go with a medical exam policy, you might be moved to a different health category due to elevated blood pressure, for example.

Another reason, many of the no exam carriers offer similar prices as the exam carriers. Just look at the image below:

Rates for 39 year old male, non tobacco in above average health

4. Available riders

This is one of our personal

Please note:

Not every no medical exam life insurance policy has living benefits included. If living benefits are important to you, please reach out to us and we will point you in the right direction.

5. Same terms as exam policies

Typically, the life insurance policies not requiring a medical exam have the same terms as an exam option. They could be level term policies or guaranteed universal life policies. Level term means that they would provide level coverage during the policy term.

For example, 250,000 in a 20-year term, would mean that the company will offer $250,000 in death benefit where the price is locked for 20 years. The carries CANNOT make any changes to your policy and agree to offer you the coverage for a fixed price.

6.Offered by top-rated carriers

We’ve encountered many clients who were second-guessing the company’s rating and overall stability. Please rest assured that many A-rated carriers are offering no exam policies. Companies understand the shift in people’s lives and are trying to accommodate the need for fast and reliable coverage.

Please see the ratings below:

Sagicor:

| Rating: | A- (Excellent) |

| Financial Size Category: | VII ($50 Million to $100 Million) |

| Implication: | Developing |

| Action: | Under Review |

| Effective Date: | November 29, 2018 |

| Initial Rating Date: | June 30, 1962 |

A.M. Best rating

SBLI:

| Rating:Affiliation Code: | A- (Excellent)g (Group) |

| Financial Size Category: | VIII ($100 Million to $250 Million) |

| Outlook: | Stable |

| Action: | Affirmed |

| Effective Date: | May 22, 2018 |

| Initial Rating Date: | June 30, 1978 |

A.M Best rating

American National:*

| Rating: | A (Excellent) |

| Financial Size Category: | X ($500 Million to $750 Million) |

| Outlook: | Stable |

| Action: | Affirmed |

| Effective Date: | November 09, 2018 |

| Initial Rating Date: | June 30, 1981 |

A.M. Best rating

*In some instances American National may request a medical exam.

7. Can be converted into a permanent policy

You can convert a policy with no medical exam into a permanent policy WITHOUT proving insurability. In other words, if you are diagnosed with a condition that can prevent you from securing life insurance in future, you have the peace of mind that you can convert your life insurance into permanent and lock in your health.

In conclustion:

Life insurance policies without a medical exam are definitely worth looking into. In some instances, they are faster to secure, more convenient and have amazing living benefits. Life insurance with no medical exam is the modern way to secure the coverage your family needs without compromising quality.

At OneStopLifeInsurance, we work with top rated carriers and will advise you if a no medical exam life insurance is a good fit for you.