Life insurance and renouncing your US citizenship

The number of people who would like to give up their US citizenship is rising. People have different reasons to do so, however, a common question emerges: what happens to your life insurance after you renounce US citizenship? In this article, we are planning to cover what expatriating US citizenship is, why people consider it, and what life insurance has to do with it.

If you would like us to take a look at your personal situation or answer any questions, simply reach out to us. We specialize in life insurance for global citizens and would take the time to examine your situation prior to making a recommendation.

Table of content

What is expedite and why do people consider it

“I wish I never became a citizen” – those were the exact words of a high net-worth client we were working with. The family had over $65 million worth of property in Switzerland. They knew that due to their dual citizenship, they would be facing some pretty hefty estate taxes in the US.

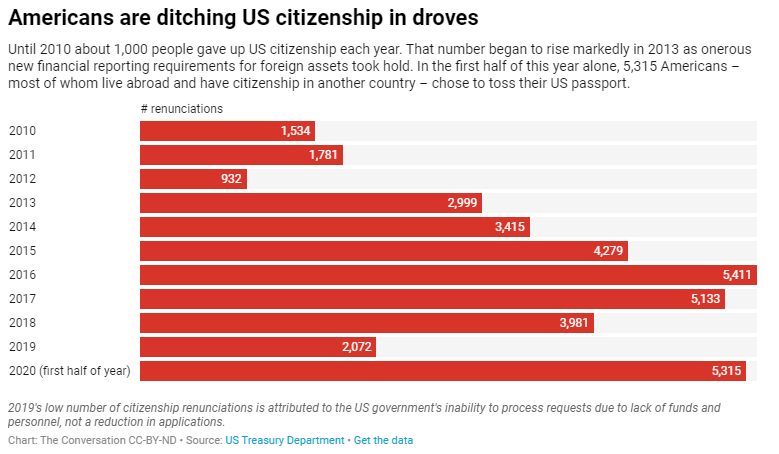

Now, we understand that not many are in a similar position; however, the numbers do not lie. More and more people are ready to give up their US citizenship and put an end to their American dream.

In fact, according to the US Treasury Department, the number is close to 10,000 per year. Look at the chart by The Conversation, outlining the increased number of applications throughout the years.

Now, as to why that is… there could be different reasons. The main one is due to financial obligations and the US tax code. Taxes are beyond the scope of our expertise, so we would not be able to provide you with any advice as to whether renouncing your US citizenship is the best path for you.

So, what happens to your US life insurance policy if you renounce your US citizenship?

The quick answer is: nothing changes. As long as you continue making the payments, renouncing your US citizenship would not have any impact on your policy. Here is a big note to consider:

If you are planning to expatriate your citizenship or move abroad at the time of application, you NEED to disclose that. You would need to advise the company if you are planning to travel or reside abroad in the next 2 years. Make sure that the information you provide on your application is true and accurate. If your plans change after a policy is in force, you do not need to update your policy.

Why you may still want to keep your US life insurance

Since we covered that you could still keep your life insurance policy, let’s touch on why it may be in your best interest to keep your life insurance even if renouncing US citizenship.

- A life insurance policy provides a death benefit payable to your beneficiaries upon your death. The key is that in most scenarios, this benefit is completely tax-free to the beneficiary when it comes to US taxes. In other words, if you move to Europe, for example, there would be no taxes on the US side. However, the beneficiary may be taxed in the country he or she resides in. Therefore, life insurance is often used as an estate planning tool.

In many cases, even if the beneficiary has to pay taxes in the country of residence, it still may make financial sense to keep the policy.

- In addition, the beneficiary may be living in the US. It is not uncommon for families to move back to their country of origin, while their adult kids remain in the US.

- Another reason to keep in mind is that the benefits are paid in US dollars. The dollar is considered one of the stable worldwide currencies. This provides an additional piece of mind that the policy benefit would not lose value.

- Let’s not forget that in the new country of residence, there could be political and economic unrest. This could make the new country of residence a bit unstable when it comes to financial planning.

- Lastly, life insurance provides privacy of assets. Many clients secure a cash value growth policy due to the fact that they may not be required to disclose the amount built into the policy.

There are several companies that can consider coverage for US citizens, even if they currently do not live in the US. If giving up your citizenship is something you may want to pursue in the future, it is beneficial to secure a policy NOW. Again, if you have started the process, make sure you disclose it on your application.

So, how can you keep your life insurance if renouncing US citizenship?

You need to make sure that you keep up with the payments. If you would like, you can set up an automatic payment out of a US bank account or send in an annual payment. Typically, our clients would have a trusted individual who can help them stay on top of their payments. For example, receive the annual notice and mail in a payment, if needed.

Please note, due to strict life insurance regulations, your life insurance agent cannot do this for you.

In conclusion,

A US life insurance policy offers a number of advantages. Even if you believe that renouncing your US citizenship is in your best interest, we would strongly urge you to factor in life insurance in your long-term financial plans. Please note that if you already have a policy in place, you can still keep it, regardless of citizenship.

We hope you find this information helpful. Should you have any additional questions, simply reach out to us.

Thank you.