Life Insurance for Visa Holders: FAQs and Helpful Tips

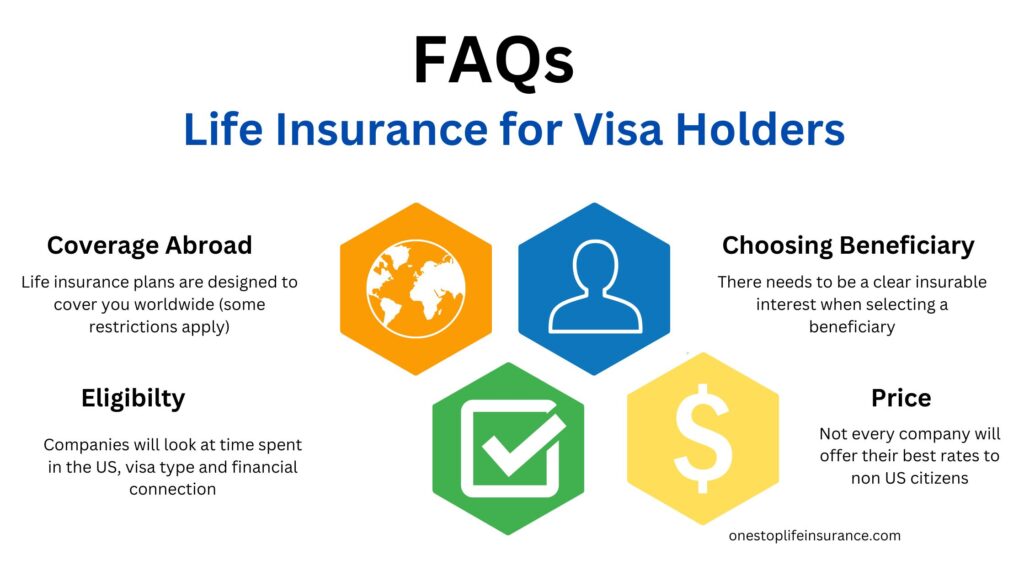

If you are a foreign national or visa holder trying to buy life insurance, you probably have questions. In this post, we will share just the facts and answer 12 of the most common questions we have received over the years when it comes to life insurance for visa holders. The goal is to give you short and clear answers.

Should you have any questions not answered below or want us to review your options, simply reach out to us.

Q: Will this plan be canceled if I move back to my country of origin?

A: This is probably the first thing many visa holders ask us when setting up life insurance in the US. We understand; life happens, and sometimes you may be at the “mercy” of USCIS. Note that life insurance plans are designed to cover you worldwide. However, the policy premiums must be paid from a US bank account, and you need to have a US address.

Q: Will life insurance cover me if I die abroad?

A: This question follows the previous one. As mentioned, life insurance plans cover you worldwide. However, if you die abroad, processing the death claim will take longer. The company will require a translated and certified copy of the death certificate and may need to wait for authorities to complete any investigations into the cause of death. For detailed information, we have outlined the process of filing a life insurance claim if you die abroad.

P.S. Your beneficiary can expect additional delays if you die within the contestability period (the first 2 policy years). If the insured dies during the first 2 years, the company has the right to contest the claim and closely examine your application and the circumstances surrounding your death.

Q: How will my beneficiary claim the benefit if they live outside the US?

A: First off, you can name a beneficiary who does not live in the US, as long as there is a clear insurable interest. The beneficiary will need to communicate with the company and go through the process of filing the claim. This can be challenging if they do not speak English or cannot come to the US if needed.

Therefore, we advise our clients to choose their beneficiaries carefully or set up a trust if necessary. We have created a separate article on naming a foreign national as a beneficiary.

Q: Will the company decline me due to my visa status?

A: Yes, it is possible. Not every company will approve every visa. This is why it is crucial to work with an agency that specializes in life insurance for visa holders. We will apply to companies for which we know you have a chance of approval. For example, we will not submit your application to Banner Life if you are here on an F-1 visa.

Q: Will my price change if I become a US citizen?

A: Once the price is set, the company will not adjust your rate due to your immigration status. However, we highly recommend reaching out to your agent to see if there is a better option available. In some cases, companies can offer you a better rating, no-exam life insurance, and more options to choose from. It will depend on your visa type, length of stay in the US, etc.

Q: Can I still get life insurance if I do not have an SSN?

A: Yes, you can buy life insurance without an SSN. Some companies will require you to have an ITIN instead, while others can approve you without either number. The key is to have a financial connection (Nexus) to the US.

Tip: When it comes to life insurance for visa holders, the key is to apply with the right company! Before processing his application, we reached out to the carriers to confirm eligibility. It took them an extra day to respond, but by doing this, we knew our chances before even applying.

Q: Do I need to disclose my travel plans to the company or if I plan to move abroad?

A: Yes. The companies will ask on the application whether you plan to travel or live outside the US. You need to disclose this information so they can properly assess the risk and decide whether to approve, modify, or postpone your application.

If you do not disclose this information, you could risk the payout of the policy if you pass away during the contestability period.

For example, we worked with a client who was taking a motorcycle tour across Europe, Africa, and Asia. Some of the countries where he and his group of friends planned to ride were considered by most companies to be high-risk. We took detailed notes of the travel dates, destinations, and accommodations and presented them to the companies. We secured coverage for him with a top-rated company at the best rating.

Q: What if I have been declined before by another company?

A: Having a prior denial by a different company due to your citizenship is common. About 10% of our clients have been declined by another company simply because of their visa type or immigration status. Do not be concerned with this. We simply need to disclose the denial on your current application and provide a short explanation of the reason.

A past denial does not equal a future denial.

Not every company will underwrite your visa before your health. This is why it is important to work with an agency that specializes in life insurance for foreign nationals.

Q: What if I do not have a doctor in the US?

A: It is common for visa holders not to have established medical care when first arriving in the US. Depending on your age, companies may be okay with you not having a doctor in the US. The company may order a medical exam and/or request a copy of your medical records from your country of origin.

We have worked with countless non-permanent residents and have been able to help them, even if they do not have a doctor in the US yet.

Q: Do I need to have my medical records from my country of origin?

A: Possibly, yes. You may need to provide a copy of your medical records. The underwriting team may require a copy of your foreign medical records based on your age, if you have or had a medical condition that required continuous care, or depending on the amount of insurance you are applying for.

You will typically need to obtain the records, and we can submit them to the company. Some carriers may accept them if the records are in Spanish without needing translation, while others may require authorized translation.

Securing medical history records can be the longest delay in life insurance underwriting. We will walk you through every step and try to make the process as easy as possible.

Q: Is life insurance for foreign nationals convertible?

A: Yes, most life insurance plans are convertible. Some companies have better conversion options compared to others.

To convert a life insurance policy means to “exchange” or convert your term insurance to a permanent life insurance plan with no health questions. In other words, you can replace your term life insurance with a permanent insurance plan with the same company and not answer a single underwriting question. Here is a bit more information of the benefits of lifelong coverage for visa holders.

Q: Why would a visa holder want to convert their policy?

A: If you develop a health or lifestyle condition that prevents you from buying new life insurance, you still need coverage to protect your family. Having the option to convert your life insurance provides peace of mind that your coverage period may be extended (at a new rate based on the product and your age at the time of conversion). Having a lifelong coverage can be a part of a cross-border financial plan.

In addition, permanent life insurance is used by many global citizens as a way to preserve their wealth.

If you want to know more about converting your life insurance policy, simply fill out the form below or give us a call.

Q: Will applying for life insurance affect my status in the US?

A: As far as we know, it will not. We have worked with hundreds of clients whose visas have expired or who have never had a visa at all. They were able to secure coverage to protect their families.

Q: Do I have to wait until my policy is in effect as a visa holder?

A: Most plans we offer provide immediate coverage. In other words, once the policy is officially in force, the coverage will start from day one. In some cases, mainly due to health or lifestyle, a client may not qualify for immediate coverage, and the only option may be guaranteed issue plans. If this is the case, there will be a waiting period for the full benefit to take effect, typically 2 years.

Q: Would it cover me worldwide?

A: Yes, most individual US life insurance plans are designed to cover you worldwide. However, every company will ask about your intention of traveling or relocating abroad in the next 2 years. If you are planning on traveling or moving, you must disclose this on the application.

Q: Will I pay more for life insurance as a non-US citizen?

A: No, you will not, if you apply with the right company. Carriers do not have different “price sheets” for US citizens and visa holders. However, some companies may not offer you the best health class you qualify for due to your citizenship. This could mean you pay more than what you actually qualify for.

For example:

* One carrier will not offer you the best class available if you have not been in the US for over 3 years.

* Another company will not offer you the best class available if you are not a permanent resident or a US citizen.

What can you do? Work with an agency that specializes in life insurance for visa holders and global citizens. We have done the research, so you can rest assured you are getting the best price you qualify for, not being “penalized” for your visa status.

Tip: Check with your agency to see if you qualify for life insurance with living benefits.

There you have it, some of the most common questions we have received over the years regarding life insurance for visa holders and non-US citizens. If you have a question that we did not cover or would like us to review your options, simply reach out to us.

There you have it, some of the most common questions we have received over the years regarding life insurance for visa holders and non-US citizens. If you have a question that we did not cover or would like us to review your options, simply reach out to us.

We hope you found this helpful, and we look forward to working with you!