How to get the best No exam life insurance for non-us citizens

We live busy lives and want things delivered to us yesterday. So, it is no surprise that we have more and more clients asking us for no exam life insurance for non-citizens. Companies are catching up on this and are utilizing technology to offer clients a lab-free experience when securing life insurance to protect their families.

In this post, we would cover what exactly no exam life issuance means; if non-us citizens qualify and what are the available options. We have divided the guide into several key points, feel free to jump to the ones that you are mainly interested in.

What we would cover

- What does no exam life insurance mean

- Why exam free is a better option

- Qualification for a no exam life insurance as a non-us citizen

- Available coverage limits

- Process of applying

Prior to jumping into the topic, we would like to point out that we specialize in finding life insurance for foreign nationals. We are life insurance brokers and have access to over 20 different carriers. We will take the time to ask the right questions and match you with the best option for you.

What does no exam life insurance mean?

Life insurance is an important part of protecting your family’s financial future. If you are considering permanently living in the US, you understand the importance of having proper life insurance and death benefit.

We felt it is important to start here and explain what exactly a no-exam life insurance policy means. Yes, it means a policy without a medical exam, however, you still need to medically qualify for the insurance.

Here is what we mean by that. We worked with a number of customers who were under the impression that a no medical exam life insurance policy also means no medical underwriting. In other words, the company will be asking zero health questions.

This is not the case.

The company will still medically underwrite you. They will still ask health/lifestyle questions. Afterward, they will request a third-party data report on you. Here are some of the examples of reports life insurance companies often times request during the underwriting phase:

- Prescription report

- MIB report – Medical Informational Bureau

- MVR – Motor Vehicle Report

- Public Records

The key takeaway is that no medical exam life insurance means no labs. However, as an application, you would still need to medically qualify for coverage.

Why exam free is a better option for non-citizens

There are 2 big reasons why a no medical exam life insurance may be better for non-us citizens:

Convenience:

There is no doubt that being able to get life insurance without having to schedule an appointment with a nurse is much more convenient than having to complete a medical exam.

Cost:

Yes, this is correct. Many companies are utilizing technology during underwriting. This allows them to cut down on the cost and pass it on to you.

Let me explain. If they order a medical exam, they need to pay for the lab service and in addition, an underwriter needs to review the results. This adds to the average cost to issue an insurance policy.

Many companies are updating their guidelines. They are striving to approve more policies without the need for a medical exam making the process of getting affordable life insurance even easier.

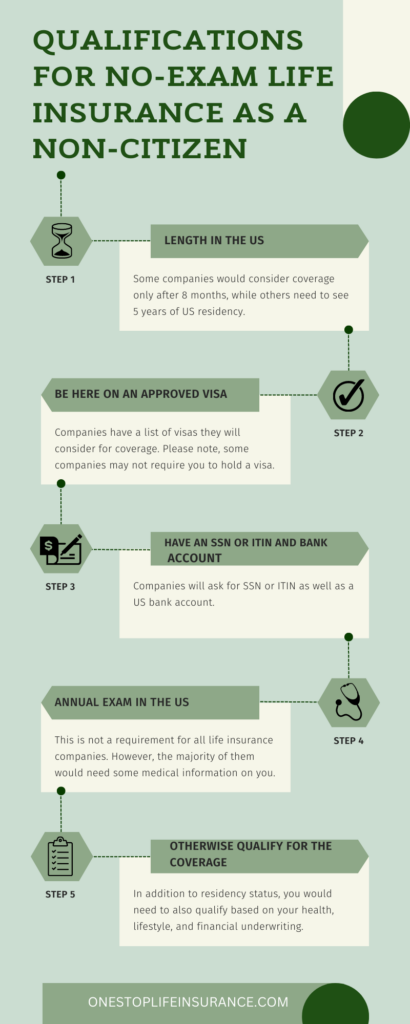

Qualification for no-exam life insurance as a non-citizen

Now it is time to turn our attention to what are the qualifications or requirements to get no-exam life insurance as a non-citizen.

We’ve divided them into several categories:

- Length in the US

- Be here on an approved visa (with some carriers this may not be a requirement)

- Have an SSN or ITIN

- Have a US bank account

- Seen a doctor in the US for an annual exam (not all companies)

- Otherwise qualify for the coverage (based on health, lifestyle, and financial underwriting)

Length in the US

Companies look at how have you been in the US prior to approving coverage. Some companies would consider coverage only after 8 months, while others need to see 5 years of US residency. This to them would demonstrate a substantial presence in the US.

Be in the US as a non-citizen on an approved visa (with some carriers this may not be a requirement)

When it comes to applying for life insurance, many companies would still underwrite your visa rather than your health. In other words, they would ask what type of visa you have in order to confirm your eligibility to get life insurance.

Here are some articles we have created on options for coverage if you hold the following visas. Please note more companies would ask for some sort of valid visa documentation to verify your residence in the US

- Life Insurance with H1B visa

- Life Insurance with a TN visa

- Life Insurance with an O-1 visa

- Life Insurance with a student visa (F-1)

Please note that if you are a permanent resident or a green card holder, the life insurance companies would offer the same options as a US citizen for coverage. With some companies, you would need to satisfy the length of residency in the United States.

In addition, if you are undocumented or your visa had expired, we have created a separate guide for this as well:

- Life insurance for undocumented immigrants

- Life insurance for a non-resident

- Life insurance without a social security

- Life insurance with EAD

Have an SSN or ITIN

Life insurance companies would ask if you have a social security number or Individual Taxpayer Identification Number (ITIN) to offer insurance in the United States. Please keep in mind that not having either does not automatically mean that you will be denied life insurance coverage. However, we did speak with an underwriter on this topic and they mentioned that their main concern would be: if you do not have SSN or ITIN, how are you paying taxes?

Have a US bank account

Life insurance companies would ask for a US bank account when underwriting your policy for 2 main reasons:

- As a form of identity verification – opening a US bank account gives the company additional assurance that you have met the bank requirements to open an account.

- The second reason is that all premiums must be paid in US dollars. The account owner could be the policy owner, the payor, and/or the insured.

Please note that if you are paying for your life insurance on a monthly basis, it needs to be via an automated payment plan

Seen a doctor in the US for an annual exam (not all companies)

Now, this is not a requirement for all life insurance companies. However, the majority of them would need some medical information on you prior to approving term life insurance with no medical exam. Please note, this is also true for citizens and permanent residents.

Some companies would look at age and overall health to determine if you qualify for lab-free life insurance, regardless of citizenship. Other carriers would consider when was the last time you had an annual exam or blood work done with your doctor.

Let us give you an example:

A company had come out and advised us that they would be able to consider up to $2,000,000 of term life insurance with no medical exam if the client had an annual check-up within the past 18 months. They are even taking a step further and advised us that if a client had completed a full blood panel, they would be able to take the results and use them in the underwriting.

Here are some of the results they would be looking at when approving your policy.

• Glucose

• Calcium

• Electrolytes: sodium, potassium, carbon dioxide, and chloride.

• Albumin (liver protein)

• Total protein, which measures the total amount of protein in the blood

• Liver enzymes:

• ALP (alkaline phosphatase)

• ALT (alanine transaminase)

• AST (aspartate aminotransferase)

• Bilirubin

• Kidney waste: BUN (blood urea nitrogen) and creatinine Complete Lipid Panel

• Total cholesterol • Triglyceride • HDL cholesterol • LDL cholesterol

Otherwise qualify for the coverage (based on health, lifestyle, and financial underwriting)

We felt it important to specify that life insurance companies are not only looking at your residency status in the United States, but you would need to qualify also based on your health, lifestyle, and financial underwriting.

Health/ medical history

The medical portion of the application. In this section, they would be asking questions about medical history, prescriptions, and any treatment recommendations.

Lifestyle

Life insurance companies take your lifestyle into consideration when approving your application. They look at things such as international travel, do you have plans to live abroad, and whether you have any public records against you, such as a criminal background.

Financial underwriting

Is another component of the life insurance puzzle. Companies want to ensure that the policy makes financial sense. They would ask questions about your annual income and use it as a qualifier to calculate how much insurance coverage you qualify for.

Driving record

You would need to provide your US driver’s license information (if you do not have a license, we need to explain why). It is a good time to mention that your driver record is closely reviewed. Things like multiple speeding tickets could negatively impact your insurance application.

Please note that companies would ask for your license, even if you are a citizen of the United States.

Employment

Companies would ask for the name of your employer and how long you have been in this line of work. Preferably they are looking for long-term employment, as it signals more stability.

How much no exam life insurance can non-citizens get

Since now you have a better understanding what are the requirements to obtain coverage, it is time to turn our attention to the available coverage limits.

Different companies have different guidelines when it comes to approving life insurance without a medical exam. However, here are some approximate guidelines. Also, please note that these could change at any time.

Age 20 – 60 – up to $2,000,000 of coverage without a medical exam.

We also contacted a carrier that can potentially approve clients under age 60 for up to $3,000,000 without an exam. Once we submit the application, they will send you a link to complete the medical portion of the application (answering a number of Yes/No questions).

Steps to buying no exam life insurance as a non-us citizen

In this part of the guide, we will outline the steps to secure life insurance with no medical exam as a non-citizen.

The first step after obtaining a quote and selecting the proper coverage amount and type of plan is to apply

The application process is very streamlined and most companies will not take a long time. The insurance industry understands that clients want convenient and speedy processes.

In fact, many companies are allowing clients to self-complete the application by answering several basic questions (name, address, date of birth, beneficiary names). Afterward, you will be completing the medical portion by checking off yes or no in a list of medical questions.

This is the preferred method for many of our clients for several reasons:

- Spead

- Ability to complete the application on their own time (after hours, on weekends, etc.).

Please take care to read each question carefully and answer truthfully, disclosing any relevant medical conditions. Omitting information or failing to provide full answers could result in your application being declined. In addition, if you do not disclose all information you could be giving the company reasons to not pay out if you die.

After your application is submitted, the company will immediately start the underwriting process.

Depending on the company, there are several outcomes:

- Approve your application

- They may need additional clarification and reach out to you with some questions

- Some companies may ask for a copy of your medical records and review the results from any recent physical you have taken.

- Decline your application. It is possible for life insurance to decline your application. There are several different ways you can process a denial. Please note that our agents would communicate with you and advise you of your options if your application is denied.

In conclusion,

The good news is that no exam life insurance is possible for non-citizens. The key is to find the right carrier that would offer you the best rates and the easiest approval process. Things like length of your stay in the US, overall health, and age are some of the factors that would play a role in the decision whether you qualify for life insurance lab free, or you would need to schedule a medical exam.

We hope you find this information helpful. Please reach out to us if you have any questions.

Thank you!