Can you buy life insurance if you live outside of the US

Regardless of what part of the world you live, life insurance is an essential tool in creating financing strategy. US life insurance is attractive for various reasons, so it is no surprise that people from all over the world are interested in securing coverage. In this guide, we will outline how to buy life insurance if you live outside of the US. We would review the different scenarios and the actual process to apply.

What we will cover

- Are you are US citizen/permanent resident living outside

- Are you a non-permanent residents living outside of the US

- The process of securing coverage

- Would a policy payout if you pass away abroad

- What if your beneficiary lives outside of the US

Prior to jumping in, we wanted to point out that if you have any questions or would like us to take a look at your personal situation, just reach out to us. You can do so by filling out the instant quote form on the page, leave a comment or simply give us a call.

Are you are US citizen/permanent resident living outside

This is a very common scenario we run into. We have countless people reaching out to secure coverage while they are living abroad. Chances are you either moved there permanently or on a temporary basis. We’ve created separate complete guides outlining the difference:

Life insurance for Americans working abroad.

Regardless of which category you fall, the biggest things companies are looking for:

Current country of residence – this is an important piece of the puzzle. Life insurance companies would need to know in what country you live in. The country of residence matters due to:

- Possible higher health and safety concerns in that country.

- Legal restrictions to sell life insurance policies to the residences of a particular country.

Does the policy make financial sense – this is called financial underwriting. Life insurance underwrites would ask questions such as your annual income, the current amount of coverage, and the financial ties between you and your beneficiary. In other words, they want to ensure that you are not over-insured and that the policy is addressing financial needs.

Health and lifestyle – this stands true regardless if you live in the US or abroad. Every company would ask about any health condition or past medical history.

The biggest challenge might lie in getting your complete medical history if your primary doctor is abroad. In many instances, this is a big delay in time and could be costly as the records may not be in English.

Some companies will reimburse you up to $250 for the translation of your medical history if your records are not in English.

Please note: If you are considering renouncing your US citizenship, please advise the life insurance carrier.

Are you a non-permanent residents living outside of the US

If you are a foreign national and you are living outside of the US, you would need to establish what companies are calling financial ties to the US.

In other words, you can NOT come to the US for the sole purpose of buying life insurance. Companies would want to ensure that policy in the US makes financial sense. Therefore, they’ve put together some guidelines outlining what is considered financial ties.

- Owning a real estate in the US

- Own a business in the US

- Married to a US citizen

- Have an established US bank account

- Have US tax presence and etc

The best way to see if you qualify for coverage under the financial ties is simply reached out to us. We will take the time to understand your situation and to match you with the right option for YOU.

Products available

This is another key point you need to consider. Not every company will offer coverage to non-permanent residents living outside of the US. This limits the number of available options and products. What do we mean by that? In some instances, only permanent life insurance products might be available to you.

What are permanent products?

If you are new to insurance, here is a basic outline of what is a permanent product vs. term life insurance.

Term Life – typically a level policy. The coverage and the price remain level for the duration, the term, of the policy. Most often, these types of policies are locked in for 10, 20 or 30 years. These types of policies are affordable, but do not build any cash value and have an expiration date.

Permanent Life– there are several different types of permanent policies, based on your objectives. They are more flexible and some build cash value. They could be set to last you a lifelong or up to a certain point. They offer many different advantages over a term policy but are priced higher. Many clients use permanent policies as a way to preserve their wealth and as an estate planning tool.

Here are some other factors, companies would look into when reviewing your application:

- Country of residence and international travel

- Length of time spent in the US annually

- Occupation

- Health and lifestyle (which country has your most complete medical history and in what language, if not English)

Now, since you have a basic understanding of what companies will be looking for in order to approve your application, it is time to turn our attention to the process of securing a policy.

The process of securing coverage

The very first step to secure a policy is: to be in the US.

There is zero exclusion to this. You need to be physically in the US to apply for coverage, this stands true even if you are e-signing the application.

Application – this is the first step in the process. During the application step, we would complete the application and obtain any additional forms that the companies may request, such as W-8 forms, a copy of your visa, passport, etc.

During this step, we would schedule the medical exam, if one is required.

Underwriting – during this step the company is reviewing your application and results from the medical exam. In addition, during this step, they might request your medical records.

Keep in mind that typically, obtaining your medical records is the lengthiest step in the process. In some instances, it could take weeks or even months to secure the records. This is especially true when it comes to medical records from abroad.

In some instances, the companies would allow you to obtain the records yourself and submit your medical history to them.

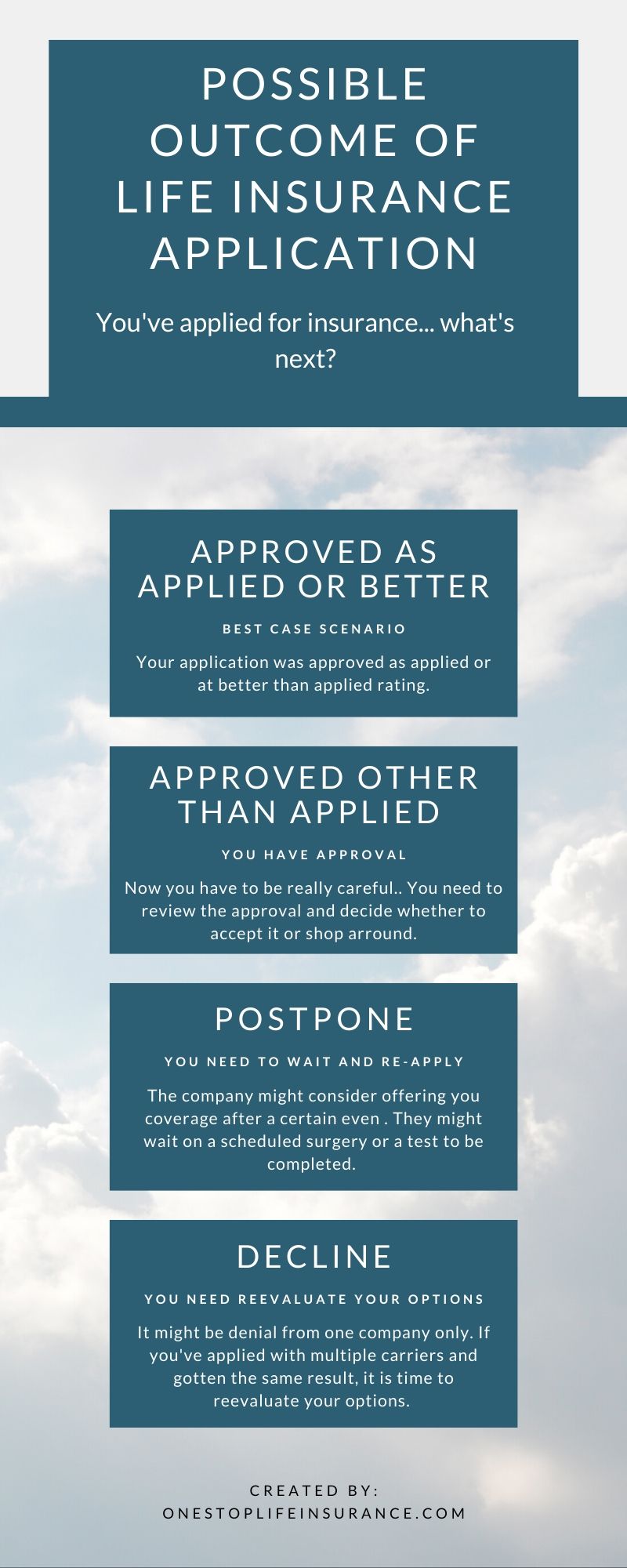

Decision – after the carrier reviewed your application, they will issue a decision:

- Approved as applied or better – this simply means that the numbers we provided you at the beginning have been re-confirmed by the company and they will approve your application as applied or you qualified for a better rating (and price) than originally estimated.

- Approved other than applied (AOTA) – this simply means that the policy is approved at a rate higher than originally quoted.

- Postpone – there are instances, when the company might offer you coverage, however after a certain event. For example, you have a planned surgery. They would postpone your application after the surgery or any other event is completed.

- Decline – this means that at this time, this particular carrier could not offer you coverage.

Our advice:

Please don’t get a denial to discourage you. Just because you’ve been declined by one carrier does not mean that you are uninsurable. If we believe we could find you another option, we would submit it to another carrier.

Placing in force and policy delivery – this is the last step of the application process. The company will require you to make a payment and sign any additional forms to finalize and accept the policy. You need to be in the US to sign any policy acceptance forms.

Exclusion:

Some companies would allow you to appoint someone to accept the policy via a limited power of attorney. The key is to have this address during the application.

Last note:

The policy needs to be paid in US dollars out of a US bank account. Some companies would require an annual payment to place in force.

Would a policy payout if you pass away abroad

We’ve dedicated an entire post (view it here), outlining life insurance payout if you die abroad. In short, almost every company will cover you anywhere in the world.

What if your beneficiary lives outside of the US

This is a very common question we get. Yes, you can name a beneficiary who lives abroad. Here are the guides and additional things you need to consider.

In conclusion,

Securing a policy while living outside of the US is possible. There are additional steps and forms you might need to complete, but by working with the right agency, you can speed up the process and ensure you are getting the most up-to-date and accurate information.

We hope you find this guide helpful. Feel free to reach out to us if you have any questions or would like us to take a look at your personal situation.

Thank you!