Do I need life insurance if…

Do I need life insurance? We’re sure that this is one of the first things that come to mind when one hears life insurance. The most common answer that we give to ourselves is: “probably yes, but….”. And then it begins. As people, we tend to avoid topics that we don’t want to think about and then come up with justifications about why we don’t need to worry about it.

Please reach out to us if you would like us to take a look at your personal situation. You can send us a message at info@onestoplifeinsurance.com or simply fill out the instant quote form on this page to get rates in seconds. Please keep in mind that your information is kept confidential.

What we’ll cover

1. What do you need to know about life insurance?

2. How much life insurance do I need?

3. Who doesn’t need life insurance?

4. Do I need life insurance if I’m single?

5. Do I need life insurance to get a mortgage loan?

6. Do I need life insurance if I’m a stay at home parent?

7. Do I need life insurance after retirement?

What do you need to know about life insurance?

We feel it is important to know the basics of life insurance, Life Insurance 101, so to speak, in order to make the best decision for you and your family.

The legal definition of life insurance is:

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefit) in exchange for a premium, upon the death of an insured person.

Or in other words, life insurance is a promise to your family that you will be there for them even if you are gone. It is as simple as that.

There are 2 big types of life insurance policies: term and permanent.

Term insurance – provides you with coverage for a specific period of time or term. It could be 10, 20, 30 or even 35 years. It is less expensive than permanent and it allows you to purchase a high amount of coverage for a relatively small premium.

Permanent insurance – there are different variations of permanent policies. The main concept of all of them is to provide you with a lifetime of coverage. Many policies also build cash value. This is a nice feature of permanent insurance. The only downside is that a permanent policy will cost more compared to the term. However, in the long run, it may be a better fit for some.

How much life insurance do I need?

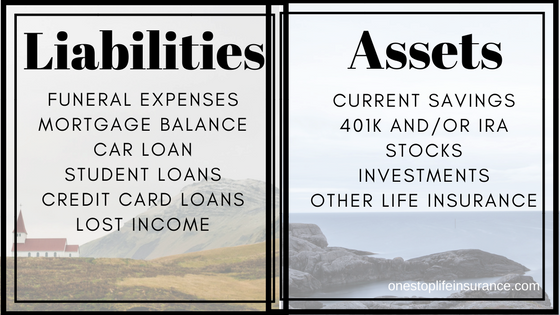

The answer to this question is: “It depends”. There are many factors that you need to consider. There is no one-amount-fits-all type of approach. In order to estimate how much coverage you need, you need to take into account your assets vs. liabilities.

Let’s look at a table:

There are various types of calculators out there. They all input the information above and calculate the difference. One of those calculators is the LIFE example:

L – living expenses (car loan, credit card balance, mortgage and etc.)

I – income replacement (usually 10x the annual income)

F – final expense (the average funeral in the United States vary between $5,000-$10,000)

E – education (college fund for the kids)

Who doesn’t need life insurance?

The reality is that not everyone needs life insurance. There are people who simply don’t. In other words, should something happen to them, there will not be any financial burden to no one. These people have no financial dependents and have enough assets to cover any expenses left behind.

For example:

Meet Tom. He is 55 years old. His kids are all adults and financially independent from him. Tom is single and has $85,000 in savings. Should something happen to Tom, he has enough savings to cover the final expenses and not leave any liabilities to his kids. No one depends on his income and no one will suffer a financial discomfort due to his passing.

Now let’s look at another example:

It’s still about Tom, but instead of being single, he is married. Tom and his spouse are approaching retirement. His wife is counting on his income to continue their current lifestyle. If Tom does not have life insurance in place and something happens to him, she will need to make lifestyle adjustments.

As you can see, a little change to the circumstances can lead to a big change in the need for life insurance. That’s why we strongly believe that every situation is unique and there is not a single solution best for everyone.

Pro Tip:

When working with an agent to find the best coverage for you, make sure that he or she is asking you questions. You want to have an insurance advisor who is invested in your best interest and takes the time to understand and address all of your insurance needs. If your agent is not asking you questions, you need to ask yourself: “Is he the one for me?”

Do I need life insurance if I’m single?

This is a common question people may have. Currently, you are single and there are no kids or other people depending on you financially. It is natural to think that you don’t need life insurance. And yes, you are right… to some degree. However, you will need to consider if you will be leaving any expenses behind and who will be responsible for them.

For example:

Let’s meet Jason. He is 23 in perfect health, single, no kids and he rents an apartment with his best friend. He just graduated from college and has $20,000 in student loan debt. Jason wants to start a family someday, but not in the near future. Therefore, he believes that he doesn’t need life insurance. Unfortunately, he is badly injured in a car accident. He spends a couple of days in the ICU and dies. His parents use savings to cover any medical expenses, cost of the funeral and possibly his student loan. Jason needs some life insurance. Based on his current needs, he may want $50-$100,000 in coverage. His monthly premium would be around $15 per month.

Do I need life insurance to get a mortgage loan?

Most banks will NOT require you to purchase life insurance in order to secure a mortgage. You don’t have to have life insurance to be able to purchase a home. However, you definitely should look into it. Especially, if you need 2 incomes to cover the monthly payments, as is the case for many households. Please refer back to the life needs calculator to estimate how much coverage do you need. Don’t include only the balance of your mortgage. There are additional factors that you’ll need to take into account.

Do I need life insurance if I’m a stay at home parent?

We get it. Just because you don’t draw a paycheck every month, it is easy to think that you don’t need life insurance. Well, we are sorry, but we’ll have to tell you that you are WRONG. Stays at home parents bring so much value to their families. Think about it… if you are not around taking care of the household, running the kids to all kinds of activities, your partner will have to hire someone to do that. In fact, according to Salary.com, an average stay at home parent earns over $113,000 per year! So, don’t ever think that just because there is not an actual paycheck, your family will not suffer a financial loss should something happen to you.

Do I need life insurance after retirement?

Again, it depends. We understand that the kids are on their own, the house may be paid off and you may feel that you no longer need to have life insurance. And yes, you are right to some degree. You would need to ask yourself the following questions:

Will someone experience a financial loss when I die? – If the answer is no, then you don’t need it. For example, your kids are out of the house, your spouse will have access to all of the pensions and/or other retirement income; there are enough funds to cover funeral arraignments.

Do I want to have insurance? – Even though no one may experience financial loss due to your passing, you still may want to leave something to your children, family or charity.

How much life insurance do I need? – Your needs have changed. You will need to go over your policy and see if you need to make any adjustments.

Will my estate have to pay estate taxes? – This is another piece of the puzzle that you’ll need to figure in. In some instances, your family may have to pay estate taxes on the assets you pass on to them. It is a good idea to consult with an accountant and discuss if this will be something that applies to you. Many people secure life insurance as a form of the estate planning tool.

Bottom line:

When determining do you need life insurance, there are many things that need to be considered. Everyone is different and the different stages in your life call for different insurance needs. However, the answer remains the same: if someone will suffer a financial loss due to your passing, you need life insurance. It is a matter of finding the exact coverage amount and the right policy to fit your budget.

Please don’t hesitate to reach out to us, so we can help you navigate the world of insurance. We have the tool and the knowledge to make the process fast and as simple as possible.

Thank you!