5 Dos and Don’ts when buying life insurance

Buying life insurance is an important decision. It is unfortunate that it is often overlooked. In many instances, people dedicate more time to buying a car vs. selecting the right coverage for them and their families.

Why having life insurance is so important? Because your loved ones will depend on it during the most difficult time in their lives. In this post, we would like to share the 5 Dos and 5 Don’ts when buying life insurance. Please take the time and go over them. This will ensure that you will get the best value product out there and avoid some of the most common mistakes.

If you would like us to help you navigate the world of life insurance, simply give us a call or send us an e-mail. We will provide you with a personalized quote and an honest review of your situation.

DON’TS of buying life insurance coverage

Don’t shop for the best price but for the best value product

What does this mean? Price is important; however, you need to look at the features of the product to determine the value. For example, there are countless life insurance companies offering term insurance. By running a quick quote on yourself (you can use the life quoting tool on this website), you will find out that the price is different. Partially, this is because some companies are offering more benefits built into their products.

There are features such as living benefits, terminal illness, riders and etc. It all comes down to what is important to you.

Do you want to have a policy that costs about $20 per month or one that costs $25 but can be issued without a medical exam?

Don’t just pick a rounded number for your coverage amount

This comes back to knowing your actual needs. You can be under or even over-insured if you don’t take the time to see how much coverage is right for you. Even if you don’t purchase that, at least you’ve educated yourself and made the decision. It is important to understand the basics when shopping for life insurance. That way you would make the best decision not only for yourself but for your family as well.

Don’t just sign away, review the policy and ask questions

This is true in every situation. Just keep in mind that for a policy to be issued, you would need to sign all of the pages of the application and any subsequent forms. However, you want to know exactly what are you getting. Ask questions. Let your agent know if some of the information is incorrect. A good agent will address all of your concerns and make sure you are comfortable with your policy.

Don’t view the buying process of life insurance as once and done

Things in your life change, so as your needs. Your life insurance policy needs to reflect those changes. It could be as simple as updating your address on file or more complex as changing products. You need to take the time to review your policy with your agent to ensure that it is still meeting your needs. Typically, it is good to go over your insurance at a minimum once every 1 to 2 years. Make sure that the contact information is correct, the beneficiaries and that the coverage amount is adequate. Let your agent know if something has changed in your life. Don’t assume that just because you already have life insurance, you can completely forget about it.

Don’t put off buying life insurance

You may not feel ready to commit to life insurance and this is OK. We all tend to procrastinate and buying life insurance is easy to put off. In fact, according to a recent study, only 44% of American households have individual life insurance. At One Stop Life Insurance, we understand that thinking about death may be unpleasant. However, leaving your loved ones financially stranded while coping with your loss is more devastating. Talk with an experienced agent and review your options. You might find that securing life insurance coverage for your family is not as intimidating as you may think. Review our complete guide on how to buy life insurance.

We covered some of the dos when buying life insurance coverage, now it’s time to cover the don’ts.

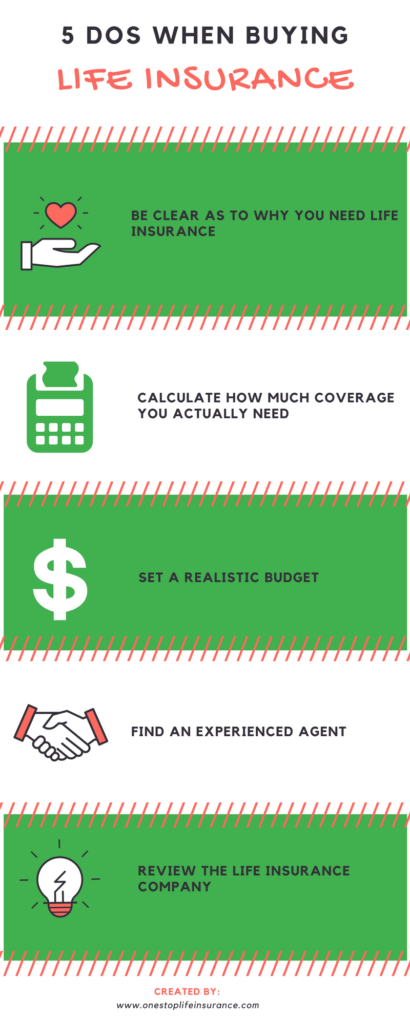

DOs of buying life insurance coverage

Be clear as to WHY you need life insurance

Answering this question will save you a lot of time, money and help you pick the right product for you. When you know the reasoning behind your decision, you will pick the correct term, type and coverage amount for you.

For example, John wants to buy life insurance to protect his little girl if something were to happen to him. Most likely, he will need to have coverage for 20 years with a higher face amount. On the other hand, Steve has a vehicle loan out and wants to make sure that the car will be paid off if he dies prematurely. In this case, Steve will need a 5 or 10-year term policy with a lower face amount.

Both of them have different needs and therefore they need different products.

Calculate how much coverage you actually need

This is crucial. Many people simply say: “I want $100,000, $200,000 or $500,000 in coverage”. When we ask them how they came up with the amount, the most common answer is: “It sounds reasonable”. Even though those are nice round numbers, you may be way off from your actual needs. Nowadays, there are countless need assessment calculators out there. An experienced agent will take the time to go over your needs and ensure your coverage is adequate. You can also learn more about the LIFE calculator and get an idea of how much is right for you.

Set a realistic budget

You need to be reasonable with your expectations. Simply put, your life insurance rate is based on you. If you are not an athlete in perfect health you need to be rational. Some of the advertised rates on TV may not be what you can qualify for. The main thing is to be completely honest and upfront about your health and lifestyle.

Find an experienced agent

This is a very important one: Find an experienced agent who will work on your behalf finding a product that meets your needs and is within a budget. This comes back to the top 3 dos. If your agent takes the time to understand your needs and budget, he or she will be more prepared to find the best company for you. At One Stop Life Insurance, we will ask you these questions to ensure that you are not over or underinsured. We want you to have the peace of mind that the coverage you are getting is tailored to your specific needs. And in case the premium is more than you are looking to spend, we will work with you to make appropriate adjustments.

Review the life insurance company

It is very important to take time and research the carrier. You want to make sure that the company has been in business for a while and that will be in business for a long time to come. A good choice of an insurance company will be one that is an A or at least B rated and has a solid financial history.

In Conclusion,

Buying life insurance is an important decision. You need to take time to research and compare your options. Avoiding some of the Don’ts we’ve listed will not only help you save money, but they would also ensure that you have sufficient coverage.

Thank you!