How to Get The Best No Exam Life Insurance for Non-Citizens

In today’s fast-paced world, where time is a luxury, many of us want solutions that are quick, hassle-free, and effective. That’s why the demand for no exam life insurance for non-citizens is skyrocketing. For those navigating life in a new country, the idea of skipping a lengthy medical exam to secure life insurance is a game-changer.

Thankfully, insurance companies are stepping up to meet this need, leveraging advanced technology to offer lab-free experiences that make protecting your loved ones easier than ever.

In this guide, we’ll walk you through everything you need to know about no exam life insurance. From understanding what it is, to exploring qualification criteria and available coverage options, we’ve got you covered. Dive in and discover how to secure peace of mind, no needles or paperwork required!

What we would cover

- What does no exam life insurance mean

- Why exam free is a better option

- Qualification for a no exam life insurance as a non-us citizen

- Available coverage limits

- Process of applying

Before diving into the details, it’s worth mentioning that we specialize in finding life insurance for foreign nationals. As life insurance brokers with access to over 20 different carriers, we’re here to ask the right questions and match you with the best option for your unique needs.

What does no exam life insurance for non-citizens mean?

Life insurance is an essential tool for protecting your family’s financial future. If you’re planning to stay in the US long-term, you already understand how critical it is to have proper life insurance and a reliable death benefit in place.

But what exactly does “no exam life insurance” mean? While it’s true that this type of policy skips the medical exam, you’ll still need to medically qualify for coverage. Let’s clarify this common misconception.

Some clients assume that no exam life insurance means there’s no medical underwriting—no health questions, no scrutiny. However, that’s not the case. Insurance companies will still ask health and lifestyle questions and may request third-party data reports such as:

- Prescription history

- MIB (Medical Information Bureau) report

- Motor Vehicle Report (MVR)

- Public records

The bottom line? No exam life insurance simply means you won’t have to complete lab work. However, you must still meet the company’s medical and financial qualifications to be approved for coverage.e felt it is important to start here and explain what exactly a no-exam life insurance policy means. Yes, it means a policy without a medical exam, however, you still need to medically qualify for the insurance.

Why exam free is a better option for non-citizens

There are two main reasons why no exam life insurance is often the best choice for non-US citizens:

1. Convenience

Scheduling a medical exam can be challenging, especially when you’re balancing work, family, and adapting to a new country. With no exam life insurance, you can skip the hassle and move forward with coverage quickly and efficiently. Some carriers can even offer instant decsion on term life insurance.

2. Cost Savings

Many insurance companies are adopting advanced technology to streamline the underwriting process. This allows them to reduce costs associated with medical exams and pass those savings on to you. Without lab fees and manual underwriting, you may find more affordable premiums.

Please note that not every company will offer no exam life insurance for non-citizens. For some, they will order lab work simply due to citizenship. This is why it is important to work with an agency that specialize in life insurance for global citizens.

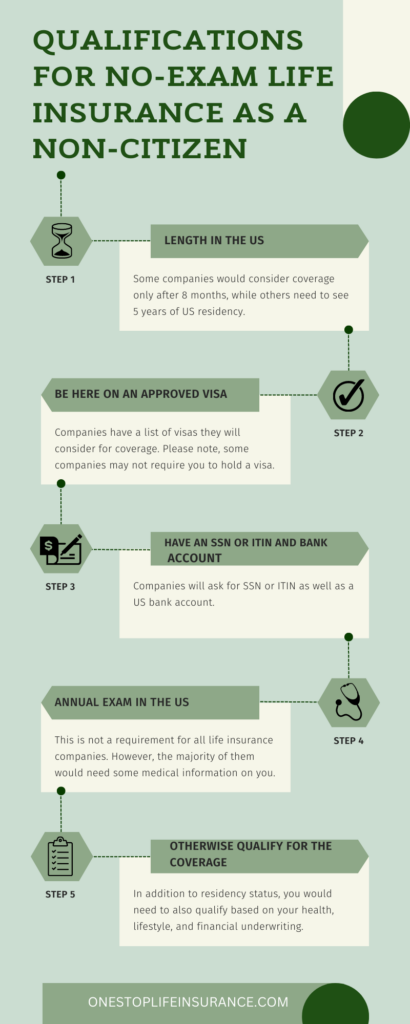

Qualification for no exam life insurance for non-citizens

Now it is time to turn our attention to what are the qualifications or requirements to get no-exam life insurance as a non-citizen.

Length in the US

Companies look at how have you been in the US prior to approving coverage. Some companies would consider coverage only after 10 months, while others need to see 3 years of US residency. This to them would demonstrate a substantial presence in the US.

Be in the US as a non-citizen on an approved visa (with some carriers this may not be a requirement)

When it comes to applying for life insurance, many companies would still underwrite your visa rather than your health. In other words, they would ask what type of visa you have in order to confirm your eligibility to get life insurance.

Here are some articles we have created on options for coverage if you hold the following visas. Please note more companies would ask for some sort of valid visa documentation to verify your residence in the US

- Life Insurance with H1B visa

- Life Insurance with a TN visa

- Life Insurance with an O-1 visa

- Life Insurance with a student visa (F-1)

Please note that if you are a permanent resident or a green card holder, the life insurance companies would offer the same options as a US citizen for coverage. With some companies, you would need to satisfy the length of residency in the United States.

In addition, if you are undocumented or your visa had expired, we have created a separate guide for this as well:

- Life insurance for undocumented immigrants

- Life insurance for a non-resident

- Life insurance without a social security

- Life insurance with EAD

Have an SSN or ITIN

While having a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is preferred, it’s not always mandatory. Some companies may still approve your application as long as other criteria are met.

Have a US bank account

Life insurance companies would ask for a US bank account when underwriting your policy for 2 main reasons:

- As a form of identity verification – opening a US bank account gives the company additional assurance that you have met the bank requirements to open an account.

- The second reason is that all premiums must be paid in US dollars. The account owner could be the policy owner, the payor, and/or the insured.

Seen a doctor in the US for an annual exam (not all companies)

Now, this is not a requirement for all life insurance companies. However, the majority of them would need some medical information on you prior to approving term life insurance with no medical exam. Please note, this is also true for citizens and permanent residents.

Some companies would look at age and overall health to determine if you qualify for lab-free life insurance, regardless of citizenship. Other carriers would consider when was the last time you had an annual exam or blood work done with your doctor.

Let us give you an example:

A company had come out and advised us that they would be able to consider up to $2,000,000 of term life insurance with no medical exam if the client had an annual check-up within the past 18 months. They are even taking a step further and advised us that if a client had completed a full blood panel, they would be able to take the results and use them in the underwriting.

Otherwise qualify for the coverage (based on health, lifestyle, and financial underwriting)

We felt it important to specify that life insurance companies are not only looking at your residency status in the United States, but you would need to qualify also based on your health, lifestyle, and financial underwriting.

Health/ medical history

The medical portion of the application. In this section, they would be asking questions about medical history, prescriptions, and any treatment recommendations.

Lifestyle

Life insurance companies take your lifestyle into consideration when approving your application. They look at things such as international travel, do you have plans to live abroad, and whether you have any public records against you, such as a criminal background.

Financial underwriting

Is another component of the life insurance puzzle. Companies want to ensure that the policy makes financial sense. They would ask questions about your annual income and use it as a qualifier to calculate how much insurance coverage you qualify for.

Driving record

You would need to provide your US driver’s license information (if you do not have a license, we need to explain why). It is a good time to mention that your driver record is closely reviewed. Things like multiple speeding tickets could negatively impact your insurance application.

Please note that companies would ask for your license, even if you are a citizen of the United States.

Employment

Companies would ask for the name of your employer and how long you have been in this line of work. Preferably they are looking for long-term employment, as it signals more stability.

How much no exam life insurance can non-citizens get

Since now you have a better understanding what are the requirements to obtain coverage, it is time to turn our attention to the available coverage limits.

Different companies have different guidelines when it comes to approving life insurance without a medical exam. However, here are some approximate guidelines. Also, please note that these could change at any time.

Age 20 – 60 – up to $2,000,000 of coverage without a medical exam.

We also contacted a carrier that can potentially approve clients under age 60 for up to $4,000,000 without an exam starting in 2025. Once we submit the application, they will send you a link to complete the medical portion of the application (answering a number of Yes/No questions).

Steps to Buying No Exam Life Insurance as a Non-US Citizen

Ready to apply? Here’s what to expect:

- Obtain a Quote Start by selecting the appropriate coverage amount and policy type. If you are not sure what is the best type of life insurance for visa holders, we’ve created a separate guide.

- Complete the Application Many companies offer self-service applications, allowing you to complete the process at your convenience. Simply answer basic questions about your personal information and health history.

- Medical Underwriting Even without a medical exam, companies will review your medical history and may request additional documentation, such as recent doctor visits or prescription records.

- Approval Once the underwriting process is complete, you’ll receive one of the following outcomes:

- Approval as applied

- Approved other than applied

- Denial (our agents will guide you on alternative options if this happens)

- Policy Issuance After approval, your policy will be issued, and you can begin enjoying the peace of mind that comes with knowing your family’s future is protected.

In conclusion,

The good news is that no exam life insurance for non-US citizens is not only possible but also becoming more accessible. The key is finding the right carrier that offers competitive rates and an easy approval process. Factors like your length of stay in the US, overall health, and financial profile will play a role in determining your eligibility.

We hope this guide has been helpful. If you have any questions or need assistance finding the best policy for your needs, don’t hesitate to reach out. We’re here to simplify the process and help you secure the protection you and your family deserve.