Survivorship life insurance for foreign nationals

There are various life insurance products, addressing different needs. There is one type of policy that it’s not well known and we consider it the “hidden gem” – it is survivorship life insurance or second to die policy. In this post, we would list what exactly this product does, its benefits, and why survivorship life insurance for foreign nationals is an essential part of one’s estate planning.

What we will cover

- What is Survivorship Life Insurance

- What are the benefits

- Who should consider Survivorship Life Insurance

- Qualifications for foreign nationals to secure Survivorship Life Insurance

- Why residency matter

- Strategies to maximize the benefit

- Are there any disadvantages

If after reading this guide, you have questions about the product and is it right for you, simply reach out to us. We specialize in life insurance for foreign nationals and are here to answer to you questions.

Ok, Let’s dive in…

What is Survivorship Life Insurance

We felt it is appropriate to start here. As we mentioned, this is not a product that many of our clients are even aware of. Survivorship Life Insurance or Second-to-Die, or Survivorship Universal Life (SUL), whatever you call it, is a type of policy that covers the life of 2 people. The idea of SUL is to insure the life of a husband and wife and pay out the death benefit when both of them pass away. In other words, 2 people have 1 policy, 1 premium and 1 death benefit. If one of the spouses passes away, the other one will continue making the payments, if any. The policy will pay out only after the 2 have passed away.

Why would foreign nationals want a policy like that? What are the benefits of this product? We would look at that below...

What are the benefits of survivorship life insurance for foreign nationals? (5 reasons)

The main benefit as to why families are looking into this product is estate planning. They are aware that when they pass away, any funds they leave become part of their estate and taxed at a high rate. The idea that Uncle Sam would tax the same money twice, in some instances, even more, makes a lot of people uneasy.

On a side note,

This product could create a plan for care for a loved one with special needs. The death benefit can help to fund a trust, providing continuous care for a loved one with special needs.

So, why get a policy that would pay only after both people pass away? And furthermore, why would a foreign national consider this exact product?

1. Price

This is an important one; It is more affordable to secure this type of policy vs 2 individual ones.

Let’s look at an example:

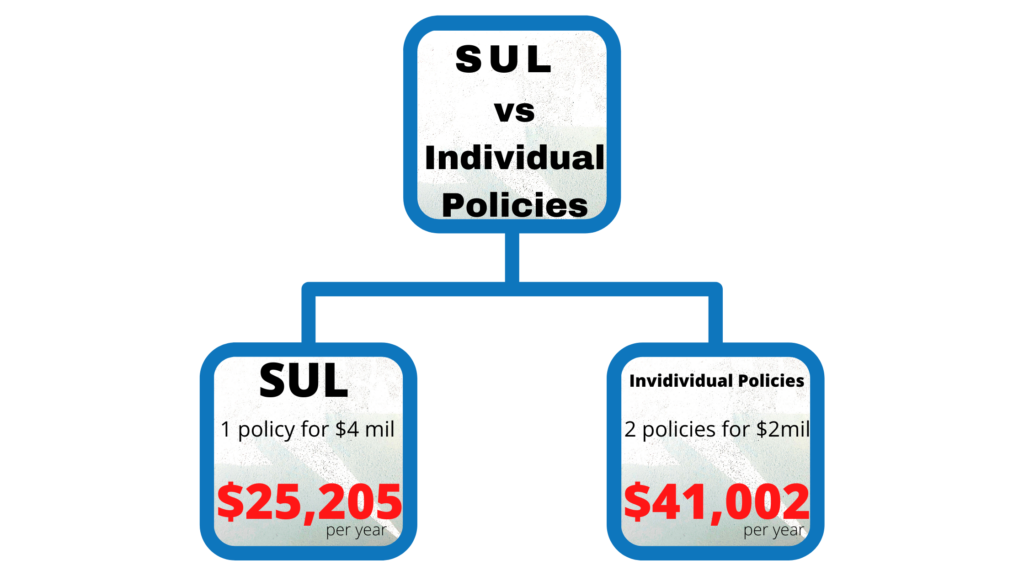

Below are the rates for a 50 year-old couple in prefereed health. If they purchase a Survorship Universal Life Policy (SUL) for $4 mil, their annual rate would be $25,205.

On the other hand, if they purchase 2 separate 2 million policies on each one of them, their combined annual rate will be $41,002. This is a difference of over $15,000 per year!!!

2. The objective

The idea of this policy is to provide benefit to the estate, not the surviving spouse. It is a way to transfer wealth and preserve it as much as possible. The assumption is that the surviving spouse does not need the death benefit.

Preserve your family business – the policy’s death benefit can help pay any estate taxes, fees, and other expenses. This could help you avoid having to sell business assets to pay for them.

3. Permanent product

The need is permanent and having a second to die allows having 1 policy on the life of 2 people.

4. The death benefit is in US dollars

The US dollar is a worldwide form of currency and it is considered to be one of the most stable forms of currency.

5. Tax advantages

Life insurance is generally tax-free to the beneficiary. In other words, if the estate is structured properly and trust is set up, any person, including a foreign national, could benefit from the favorable tax treatment of this product.

Please note, it is crucial to consult with an international tax advisor to ensure what rules apply to your country of origin and are there any treaties in place between the country and the US.

Who should consider Survivorship Life Insurance

Now, after you know a bit more about this product and its benefits, it is time to turn our attention to who should consider securing a survivorship life insurance

This product is designed for couples with large estates and for people who want to protect their assets in a private way. Oftentimes, clients create a trust and the trust owns and controls the policy.

Our advice is to reach out to an experienced estate planning attorney to help you decide if this strategy is right for you.

Another common scenario we run into when discussing needs with foreign nationals is property owned abroad. This may increase their taxable estate if they are US citizens.

Recently, we worked with a couple, who are foreign nationals and had become US citizens years ago. They had inherited a large estate in Europe. Now, owning this property has put them above the exempt threshold for estate taxes, currently set at $11.58 million, and they’ve created a plan to minimize the tax obligations when they pass away.

It is imperative to work with professionals, experienced in international tax and planning.

There are several strategies that could have helped the couple to preserver the majority of their assets. However, since a big portion of their estate is in a different country, that would’ve put them at a disadvantage with the other country. They had to weigh the pros and cons of each strategy against the rules of the two countries.

Qualifications for foreign nationals to secure Survivorship Life Insurance

In this section we would turn our attention to the things life insurance companies would be looking at when determining eligibility:

You need to be in the US to apply

There is no exception here. If you want US life insurance and want to take advantage of all of the benefits it has to offer, you need to apply in the US. The insurance is a highly regulated industry and there are no exceptions to this rule.

You need to have financial ties to the US

We’ve covered what are financial ties to the US in previous articles. The main idea is that you need to show why a policy in the US makes financial sense; what is your connection to the country. It could be that you own a property here, a business or you are a US citizen. You can not simply buy life insurance in the US without a sufficient nexus.

You need to need the coverage

In other words, do you financially qualify for this coverage? Under financial underwriting, the companies would be looking at some of the following:

- Income

- Estate

- Assets

They want to make sure that you can not only pay for the policy, but you actually need the protection.

Country of origin

This is another thing that life insurance underwriters consider. There are several reasons for it.

- The country of origin could pose a higher risk

- There might be legal restrictions to see to the residents to a specific country

Please reach out to us and we would advise you if your country of origin is approved or not. We’ve had carriers advising her that a client could not qualify for life insurance simply based on the country of residence.

Have a ITIN or SSN

In order to qualify for coverage, you need to have either SSN or an ITIN. There are some carriers that can offer you coverage even without an ITIN or SSN, however you need to meet additional criteria.

You can reveiw our guide on life insurance ith an ITIN here.

Qualify based on your health and lifestyle

The company would require a medical exam and would review your complete medical history. Now, this could slow down the process a bit, especially if your medical records are in another country or not in English.

Let us know if this applies to you and we would advise you of your options and next steps.

Why residency matter

We slightly touched on this above, but carriers look at your residency very closely. When it comes to applying for life insurance as a foreign national, the key is to work with the right company. What do we mean by the right company? Well, every company has an idea of their “ideal client” and they assign risk and premium determination based on this. For some carriers, underwriting someone with a visa or possible residency abroad could pose a higher risk and decide to not approve at all.

On the other hand, there are carriers that are more open to global citizens and have created separate departments to handle the needs of foreign nationals or expats.

A question on the application is: do you currently reside in the US and do you have any plans to travel or live abroad in the next 24 months.

The company would want to know what your plans are so they can better assess risk.

In addition, if you are living outside of the US, you would be considered a non-resident for the purpose of life insurance, regardless of your citizenship. The life insurance company would assess the risk of the country, access to health care, government advisory, and decide if it is considered an approved country of residency or not.

Strategies to maximize the benefit

Second-to-die life insurance could be a very powerful financial tool in your overall estate planning strategy. However, it needs to be set up properly in order to maximize its benefits. Here is what we mean by that:

- Meet with an estate planning team. This could include attorneys and or accountants (make sure you reach out to ones experienced in international tax law, especially if you have any assets abroad).

Based on your circumstances, here are some of the additional things you might need to consider:

- Setting up an Irrevocable Life Insurance Trust (ILIT), make the trust the owner and beneficiary of the policy.

There are steps that your team needs to follow to ensure that you have all of the benefits of the trust. It is slightly beyond the scope of explaining the benefits of the actual life insurance, so we would not go into too much depth. What we want you to take away is that in order to truly maximize your estate, there are particular steps you need to take.

Regardless if you have your assets in a trust or not, you could consider another strategy to maximize the benefit of survivorship life insurance for foreign national:

- You can pay off the policy sooner.

In other words, rather than paying off the policy for life, you can have it paid off in 15 years for example.

This would mean that you would be making slightly higher payments and gain the peace of mind that this policy is completely paid off.

The key is to look at the IRR (internal rate of return) to see if it makes financial sense to do so.

Disadvantages of this product

Now, it is unrealistic to believe that there might not be any drawbacks to setting up survivorship life insurance. Here are some to consider:

You need to medically qualify

Just as with any life insurance, you would need to answer health/lifestyle questions, complete a medical exam and allow the carrier to review your medical records.

If your health is not that of an Olympic athlete, you might have to pay a higher premium or not qualify.

Lack of flexibility

Typically SUL does not allow for much flexibility. Its main focus is the death benefit at the time of the second death. Insureds do not like the fact that they don’t have ownership of the policy and limited benefits while they are alive (the lack of cash value growth).

On a site note, please let us know if cash value growth is important to you. We would look into alternative options for you.

Payment paid after the second death

In other words, if you have the husband pass away, the wife would still need to be making the exact same payment and not receiving a penny from the policy. Which brings us to the fourth disadvantage…

Death reminder

To continue from the disadvantage above, every year when the wife receives the bill for the policy, she would be reminded of the loss of her husband.

Continuous maintenance of the strategy

When securing this type of policy and setting up a trust, there are procedures that need to be followed. We are referring to the process of gifting when it comes to premium dollars, sending out Crummey letters, and filing the proper form with the IRS.

In conclusion

Survivorship life insurance for foreign nationals is essential. If structured properly, it could be a powerful estate planning tool. It pays death benefits in US dollars and it provides peace of mind to the insured. It is a way of passing assets to heirs, regardless of where they live. There are several things you need to consider to truly maximize the benefits of the policy. Therefore, it is extremely important to surround yourself with professionals working with foreign nationals.

We hope you find this helpful! Do not hesitate to reach out to us if you have any questions.

Thank you!