Unlock the Power of Life Insurance with Living Benefits: Everything You Need to Know

Have you ever wondered if life insurance can offer more than just a death benefit? Imagine accessing your policy’s benefits while you’re still alive. In this guide, we’ll explore the powerful advantages of life insurance with living benefits and how it can provide financial peace of mind during challenging times.

What we will cover:

- How to Use Living Benefits: A Comprehensive Guide

- Why look into living benefits

- Real-Life Application: How Living Benefits Work:

- Costs of Life Insurance with Living Benefits

- Living Benefits vs. Cash Value: What’s the Difference?

Simply put, life insurance with living benefits allows you to use your life insurance while you are still alive. You do not have to die for your policy to pay out. Living benefits, also known as Accelerated Benefit Riders (ABR), offer additional features in your policy, often at no extra cost.

How to Use Living Benefits: A Comprehensive Guide

Living benefits in life insurance allow the insured to file a claim against his or her policy. The policy owner can access a portion of the death benefit, while still alive if a certain medical event occurs. The funds are directly payable to the owner and he or she decides how to spend it. This money is not tied to your health insurance or your medical bills.

Living benefits enable the insured to file a claim against their policy if a certain medical event occurs. The funds are directly payable to the policy owner, who decides how to spend them. This money is not tied to your health insurance or medical bills.

Qualifying Conditions:

- Chronic Illness: Diagnosed with an illness or condition that permanently affects daily life.

- Critical Illness: Conditions like major heart attack, stroke, or invasive cancer.

- Terminal Illness: Illness expected to result in death within 12-24 months.

Chronic – In order for the insured to qualify to use the accelerated death rider, he or she needs to be diagnosed, in the past 12 months, by a healthcare provider with an illness or condition that permanently affects his or her life. You can qualify to accelerate your policy if you are not able to perform 2 out of the 6 Activities of Daily Living (ADLs).

ADLs: bathing, dressing, toileting, transferring, continence, eating.

You can also qualify if you require substantial supervision by another person to protect you from threats to your health and safety due to severe cognitive impairment.

Critical Illness – different carriers have different qualifying triggers. Some of these illnesses or conditions are:

- Major Heart Attack

- Stroke

- Invasive Cancer

- Major organ transplant

- End-stage renal failure

- Coma etc.

Terminal illness– you would be able to accelerate your life insurance policy benefits under this rider if you have been advised by a physician that your illness or physical condition is likely to result in death within 24 months.

Please note that some companies would require a life expectancy of 12 months or less.

One thing to be mindful of is that each category has a different waiting period. We have dedicated a separate guide on what is a waiting period of life insurance with living benefits.

Why look into living benefits and how they can help you?

Companies are understanding that people are living longer. More and more people are surviving critical conditions such as heart attack, stroke, invasive cancer, etc. Life insurance carriers are seeing the need to address this trend and provide better value products to their insureds.

Did you know that there are almost 800,000 heart attacks in the US per year? This is about 1 heart attack every 40 seconds! The numbers are more than alarming. More than 800,000 lives are affected every year because of this condition alone. 1 in every 4 deaths in the US is due to a form of heart disease.

Just the thought alone is enough to give one’s chills.

Luckily, not every heart attack or heart condition is a death sentence. With medical advancements, people can survive and go on with their lives. However, what happens if you survive a heart attack?

If you are lucky, your health insurance would cover the cost of treatment, procedure, hospital stay, medications etc. However, it would not cover any changes in your quality of life.

What do we mean by that?

There still would be bills, mortgages, childcare, and lost wages that need to be addressed. And if you are no longer able to go back to work, your financial situation could change drastically. You might not be able to maintain your family’s standard of living if you were financially impacted by a serious illness.

Half of the bankruptcies filed occur due to medical reasons. Medical expenses are the leading cause of bankruptcies in the US. It represents job loss, divorce, and disaster combined.

Having a medical emergency could not necessarily result in bankruptcy. Many families are forced to move out of their homes or deplete their savings accounts.

This is where having life insurance with living benefits could come in handy. It could provide the peace of mind that you will be able to overcome some health challenges financially.

We want to point out that the process of securing life insurance with living benefits is easier than ever. Many companies can offer this product without the need of a medical exam.

Real-Life Application: How Living Benefits Work:

In a nutshell, if you have suffered a qualifying illness and want to take advantage of the coverage, you need to file a claim. We’ve dedicated a separate post on how to file a claim and accelerate your life insurance benefits.

Here is an example:

Jason, 35, buys a $500,000 life insurance policy with living benefits. At 45, he suffers a major heart attack and files a claim to accelerate $250,000 of his benefit. The insurer offers him $125,000 cash now, leaving his policy with a $250,000 death benefit. This money helps Jason recover and maintain his family’s financial stability.

Jason was able to use the money to recover from his condition and take some time off work while having the peace of mind that his family was financially taken care of.

If you have any questions about life insurance with living benefits, we have created a separate guide answering 21 Frequently asked questions about living benefits.

As an insurance agency, we strive to stay current with events and provide you with accurate information. When we were researching some of the benefits, we came across an article on how you can use your life insurance with living benefits to keep you out of jail.

Costs of Life Insurance with Living Benefits

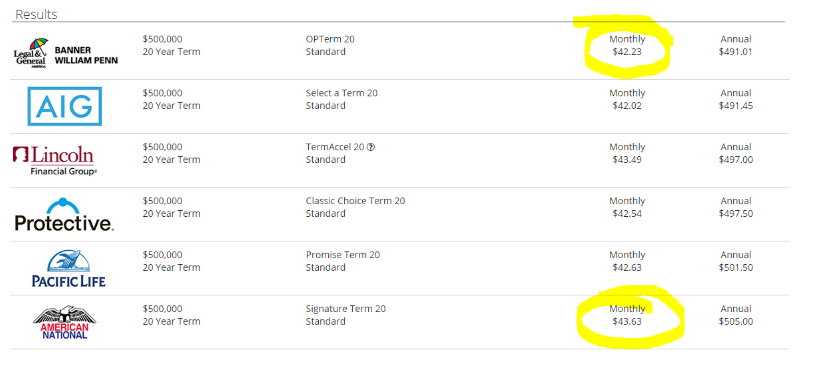

Surprisingly, a policy with living benefits can be very affordable. In our example above, a $500,000 20-year term policy for a 35-year-old male non-smoker might cost just $1.40 more per month than a standard policy.

Many clients we work with are surprised to hear that a life insurance policy that includes living benefits is about the same price as one without.

Just look at the image below:

We’ve dedicated a separate post on how companies determine life insurance rates. You could review all of the factors that come into play.

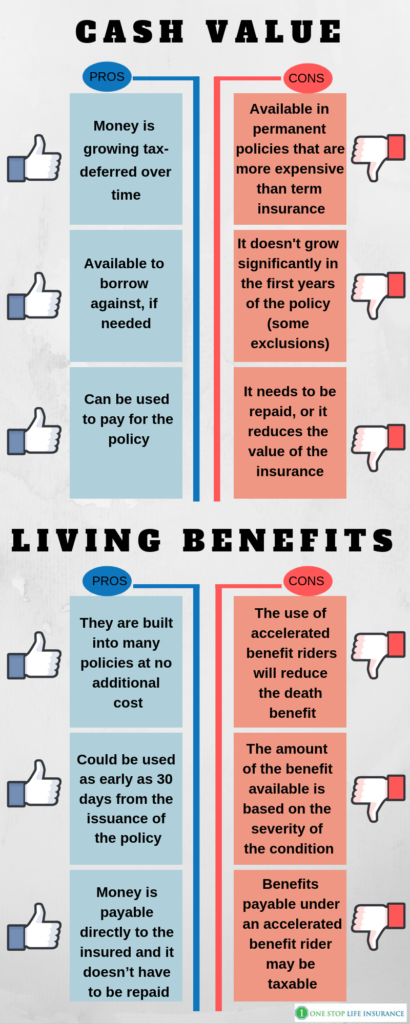

Living Benefits vs. Cash Value: What’s the Difference?

Here a quick summary of living bnefits and cash value:

Living Benefits:

- Available in term and permanent policies

- Payable directly to the insured

- Help cover costs during severe health conditions

Cash Value:

- Builds up in permanent policies like whole life insurance

- You can borrow against the cash value and pay the premium

- Grows tax-deferred over time

Cash Value Life Insurance

The life insurance industry is slowly evolving and adjusting to match the needs of today’s consumers. More companies are offering life insurance policies without a medical exam, fast self-complete applications, and policies with living benefits.

When purchasing a policy building cash value, the insured/owner of the policy could use the funds to help supplement his or her retirement income or to help with other financial goals. Typically, permanent policies such as whole life insurance and universal life policies build cash value. Below are the pros and cons of the option:

Pros:

- Money is growing tax-deferred over time

- Available to borrow against, if needed

- Can be used to pay for the policy

Cons:

- Only available in permanent policies that are more expensive when compared to term insurance

- It does not grow significantly in the first years of the policy (some exclusions apply)

- Depending on the product type, there might be very limited guarantees as to the policy performance

Life Insurance with living benefits

Secure term insurance with living benefits. The riders are available in term and permanent life insurance policies. They are helping with the cost of critical, long-term chronic, and terminal illness conditions.

Pros:

- They are built into many policies at no additional cost

- In some instances, they are available to use as early as 30 days from the issuance of the policy

- Available in term policies as well

- Money is payable directly to the insured and it doesn’t have to be repaid

Cons:

- The use of accelerated benefit riders will reduce the death benefit

- The amount of the benefit available is based on the severity of the condition

- Benefits payable under an accelerated benefit rider may be taxable (it is best to consult with a tax professional)

In conclusion,

We believe that life insurance with living benefits is worth it. There is never one solution that

If you are not sure if you could qualify for a policy with living benefits or if you have any additional questions, please feel free to reach out to us. You can do so by filling out the quote form on the page, sending us a message, or simply giving us a call.

Thank you!

3 Comments

Carolyn

I would like more information on The Living Benefits

Debra Bell

I am requesting information about living benefit s I have a policy with the Government and another policy

One Stop Life Insurance

Hi Debra,

Thank you for reaching out! I sent you an email.

Best,

Zhaneta Gechev