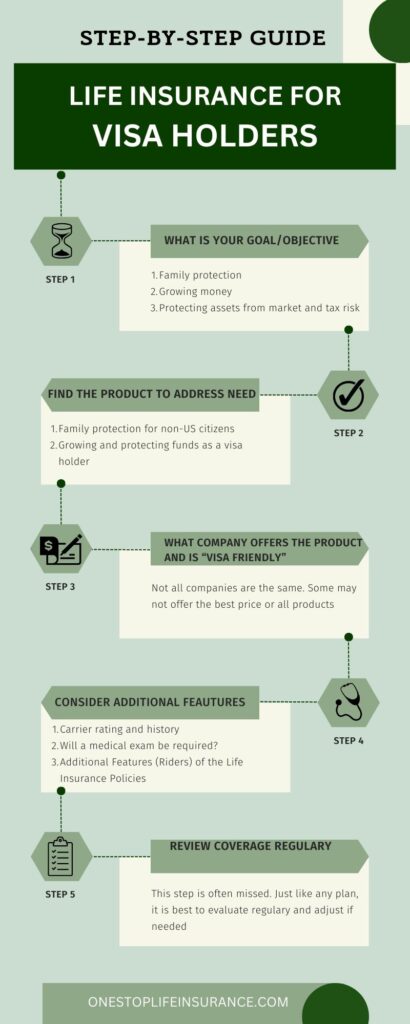

Step-by-step guide to buying life insurance for visa holders

It’s important to start every plan with your main goal in mind. Why are you doing this, and what would you like to accomplish? That’s the focus of this guide on buying life insurance for visa holders. We’ll outline the steps, types of options, requirements and share important things to consider when applying as a non-US citizen.

What We Will Cover (Feel Free to Jump to the Section That Interests You Most.)

- Assessing Your Current Situation and Objectives

- Choosing the Best Life Insurance Option for You

- Understanding Life Insurance Requirements for Visa Holders

- Important Things to Consider when Applying for Life Insurance

If you have any questions beyond the topics we cover here, simply fill out the quote form, and we’ll get in touch. Our goal is to provide guidance so you can protect your family.

Assessing Your Current Situation and Objectives as a Visa Holder in the US

Why are your objectives important? They determine the best product and design for you. Never buy life insurance off the shelf without customizing it to your needs. Otherwise, you may waste money and miss out on important features.

After talking to thousands of foreign nationals, we’ve grouped the 3 most important objectives people have:

Family Protection

One of the most common reasons visa holders and global citizens consider life insurance is to protect their families. Ensuring your loved ones are secure is a top priority, and life insurance can give you peace of mind. We recommend a product that’s well-suited for this. More on that below.

Growing Money

This is a growing trend in life insurance, especially on social media. Certain policies allow you to accumulate cash value over time. The money grows with compound interest and can be accessed later in life without age restrictions, minimum distributions, or penalties. We’ll discuss which product can accomplish this below.

Protecting Assets from Market and Tax Risk

This is a lesser-known feature of life insurance that only a small percentage of people take advantage of – mainly because they’re unaware of it. Here’s a quick overview: the cash within your policy is protected from market fluctuations, unlike 401(k), IRA accounts, or mutual funds. Life insurance guarantees a floor, meaning your account won’t drop if the market loses 10%, 15%, or 30%.

Additionally, when it’s time to access the money, you can do so income tax-free. With proper design, the cash in your policy can be accessed tax-free via loans and withdrawals.

To summarize: you can grow cash within the policy, earn compound interest, and avoid market and tax risk.

Choosing the Best Life Insurance Coverage for You

Once you understand your main goal, it’s time to select the best product.

There are two major types of life insurance plans: term and permanent. You can choose one or even both. We’ve created a separate guide on a strategy many visa holders use to set up their plans.

Family Protection for non-US citizens

If your goal is to ensure your family is protected in case something happens to you, term insurance is often a great fit.

Many young adults seek protection to pay off a mortgage or replace their income while their kids are minors. In most cases, this need is temporary.

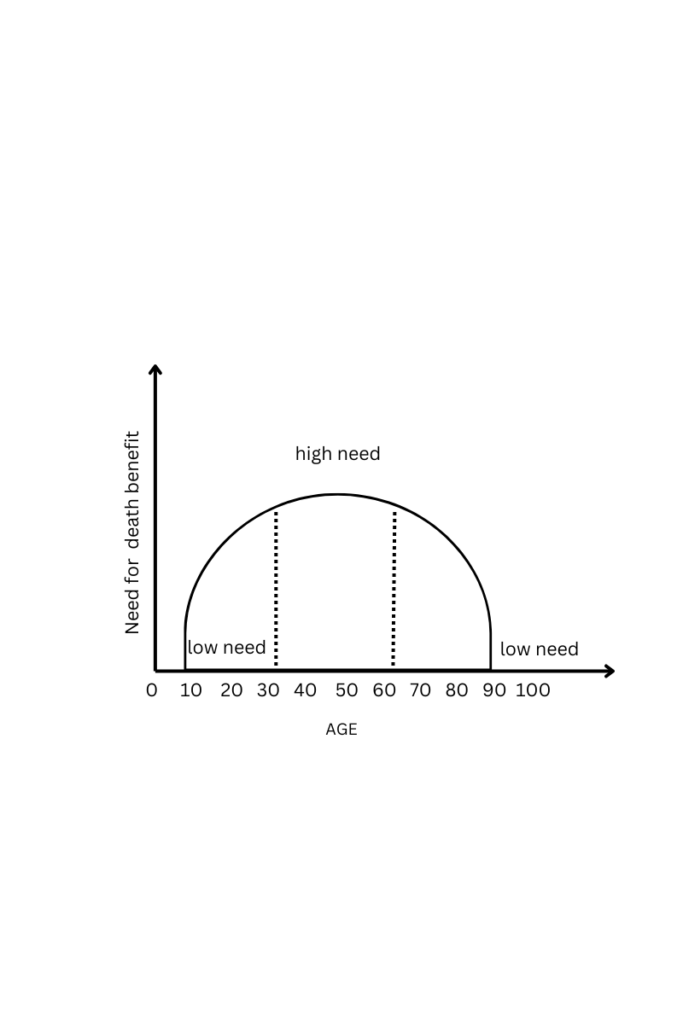

Think of your death benefit protection needs as a U-shape.

We typically need most coverage from 30s-60s while kids are little and have people counting on our income.

Of course, this doesn’t apply to every situation. Special circumstances, such as caring for a child with special needs, may require a different plan.

Why Term Insurance for Family Protection? It provides high coverage during the period your family needs it most, at the lowest possible rate.

If you want coverage beyond term life insruance, we have created an extensive guide on lifelong coverage for visa holders. No, it is not whole life insurance or IUL (Indexed Universal Life).

Growing and Protecting Funds as a Visa Holder

If growing and protecting funds is a priority, term insurance won’t work. You need a plan that accumulates and grows funds in a cash value account. This is where whole life or Indexed Universal Life (IUL) policies come into play.

Permanent life insurance plans can provide lifelong coverage and build cash value, but they initially cost more than term insurance. It’s important to share your priorities with your agent, whether they are:

- Lifelong protection

- Cash value accumulation

- A mix of both

Permanent life insurance is a very versatile financial tool, and it can help protect families while growing assets regardless if you continue to stay in the USA. The plan is very customizable and there are different products based on your specific needs and objectives.

Please note that improperly designed permanent insurance can cost you a lot of money and frustration later on.

Understanding Life Insurance Requirements for Visa Holders

We’ve covered this topic in depth in our guide on life insurance for foreign nationals, but here’s a quick overview of what insurance companies look for when underwriting non-US citizens.

Can visa holders get life insurance?

Let’s start here by answering this common question we get. Yes, visa holders are eligible to buy life insurance in the US IF they apply with the right company. We have covered some of the most common questions we’ve received over the years on the topic of life insurance for visa holders.

Visa type

Not all visas are viewed the same. The type of visa you hold does matter.

We’ve created customized guides on buying life insurance for visa holders. There you can find additional information on the visa requirements:

- H1B

- TN

- F-1

- O-1

- Parole in place

- No valid visa: life insurance for undocumented individuals

*Please note, we have helped many clients who are on a J1 visa to buy term life insurance in the US.

Length of time in the US

Insurance companies also consider how long you’ve been in the US. Generally, the longer your stay, the better your options. The more time you’ve been in the US, the stronger your financial ties, which improves the accuracy of underwriting. Here are some of the guidelines based on your stay in the US:

- 0–9 months: You may be viewed as a non-resident and have limited options, mainly for permanent plans.

- 10–12 months: One company may underwrite you as a US resident and offer term insurance.

- 12–36 months: Another carrier may consider offering coverage.

- 36+ months: Most companies that accept your visa type will offer coverage.

Financial ties to the US

Companies closely examine your financial ties to the US, including:

- Working for a US employer

- Owning a business or property in the US

- Having a US bank account or SSN/ITIN

- Paying US taxes

Every situation is unique. If you’re unsure about your options, just reach out. With nearly two decades of experience, we’ve helped hundreds of visa holders secure coverage.

How long does it take to get approved for life insurance as a non-US citizen?

The length of the application process will depend on the type of visa and the coverage options you qualify for. There are companies that can approve visa holders and even undocumented immigrants without a medical exam. However, most companies will require a medical exam when reviewing permanent residents or non-US citizens.

The application process can take anywhere from 2 days up to 6 weeks.

3 Important Things to Consider when Applying for Life Insurance Without a Green Card

Now that we’ve covered your needs, the right product, and carrier requirements, let’s focus on selecting the right company.

Carrier rating and history

This is important because, in some cases, it may be hard to replace life insurance if a carrier goes out of business. You want a company with a solid chance of being around in 20, 30, or 40 years.

A quick note: the insurance industry is highly regulated. If a company is bought out or goes out of business, a new company typically takes over servicing existing plans.

Will a medical exam be required?

As we mentioned above, not all carriers underwrite visa holders the same way they would a green card holder or a US citizen. Some insurance companies will automatically order a medical exam based on your citizenship status. We were able to secure contracts with high-rated insurance carriers that can offer the convenience of no-exam life insurance with some of the lowest term insurance rates in the nation.

Additional features (Riders) of the life insurance policies

Additional features in life insurance are called riders. Riders allow you to customize your coverage. Some popular options include:

- Child Rider: This feature allows you to secure additional coverage for all household children. The coverage ranges from $5,000 to $25,000 and it typically costs around $10-$12 per month.

- Accidental Death Rider: If you die in an accident, the company may double the death benefit or pay a flat amount. This is great for frequent travelers.

- Conversion Options: This allows you to convert term insurance into a permanent plan with no health questions asked, up to your current death benefit. This is important if you develop a medical condition that prevents extending your existing life insurance.

A key rider we advocate for is the Living Benefits Rider.

Living Benefits Rider

This allows you to use your life insurance while you’re still alive. If you’re diagnosed with a qualifying medical condition, you can access a portion of your death benefit in advance. The money is paid directly to you and isn’t tied to your health insurance.

We’ve dedicated an entire article to the topic of living benefits for visa holders.

Final Thoughts on Buying Life Insurance for Visa Holders

Securing life insurance as a visa holder comes down to a few key steps. First, understand why life insurance is important to you and what your goals are. This will help determine the best product to meet your needs. Lastly, based on the product type and your immigration status, we will match you with a company that offers the best value and easiest application process.

We hope you found this information helpful. If you need more information, feel free to reach out.

Thank you!