How is your life insurance rate determined

Have you ever wondered how exactly is your life insurance rate determined? What factors are considered and how they affect your premium? Well, in this post we will dive deeper into life insurance rates and go over the basic factors determining your premium.

First off, we would like to start by clarifying that there are 2 groups of factors determining your rate. One of them is client-controlled or client based and the other is company dependent.

If you’ve ever wondered how much your life insurance rate would be, you can run a quick quote using our instant quote tool.

Client controlled factors determining life insurance rate

We will list some of the most important factors determining your life insurance rate. Every company will weigh them differently. This is why you see different companies offering different rates for the same applicant.

Age

This a major premium determining factor. It is due to mortality calculations and the likelihood of the applicant filing a claim. Basically, the older the applicant, the more expensive his or her life insurance would be. This is a big reason why you don’t want to put off securing life insurance coverage.

Gender

Yes, life insurance companies can discriminate based on gender. Typically, males pay more for life insurance than females. This is because of the different life expectancy between the genders.

According to data compiled by the Social Security Administration:

- A man reaching age 65 today can expect to live, on average, until age 84.3.

- A woman turning age 65 today can expect to live, on average, until age 86.6.

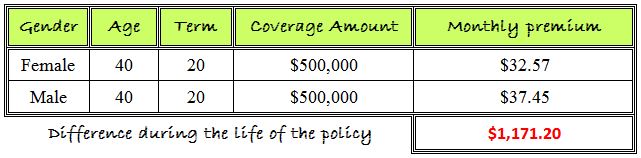

Below are sample rates of males and females

In our example, a 40-year-old female and 40-year-old male in above-average health are shopping for a 20-year term policy. As you can see, with everything else being equal, the male applicant will pay approximately $1,200 more during the life of the policy.

Type of policy

This is another big component in determining your life insurance rate. It makes a difference what type of policy you would like to have. You would need to select a term, permanent or some form of combination between the two. For some information on the difference between the types of policy, you can review our 5 step guide to getting the best life insurance rate.

Coverage amount

This is also a determining factor in calculating your life insurance rate. Most of the time, the higher the coverage, the more expensive the life insurance premium would be. We say in most cases because there are some instances where it is cheaper to get more coverage.

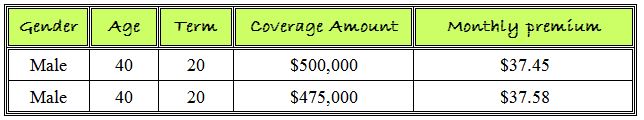

Example: the same 40-year-old male in above-average health shopping for a 20-year term policy. Below are his quotes for $475,000 and $500,000 in coverage.

*As you can see, there is a slight increase if he wants to go with lower coverage.

Just keep in mind that this is due to rate bands or tiers. Life insurance companies are using rate bands to calculate rates.

Tabaco use

The use of tobacco products really affects your life insurance rate. In many instances, the premium could double if you smoke or use Tabaco. There are countless statistics out there advising against smoking. Saving on your life insurance is one more reason that can be added to the list.

The health condition of the applicant

This is another major rating factor when it comes to life insurance. Healthier a person is better classification he or she can get. Typically, life insurance companies can place an applicant into several health classes, based on the factors below:

- Height and weight – companies are using charts for height and weight when reviewing one’s application.

- Current medical and vitals exam results – when applying for life insurance, it is not uncommon to have to take a medical exam. Typically, an examiner will come to your home or workplace and do vitals (blood, urine, blood pressure, weight, and height). The carrier will take into consideration the combination of test results and current health when determining your life insurance rate.

Please keep in mind that you might be able to qualify for a non-medical life insurance policy. In this instance, you won’t have to do an exam.

- Medical history – during the application process, the companies will ask a series of health questions. Carriers want to know about past surgeries, medications, diagnoses and etc. This information will be inputted into the application and used to calculate your insurance premium.

Please be completely honest about your medical history. This will help us have a better understanding of your unique situation and help us select a carrier that looks more favorably at you. This can not only help get a policy approved but also save you money.

- Family history – this is also a component of the “rate determination puzzle”. Life insurance carriers want to know if you have any family history of conditions such as cancer, heart attacks and etc

Lifestyle

Life insurance companies also would like to know about the applicant’s lifestyle and what kind of activities he or she is involved in. Below we will list just some of the lifestyle questions a carrier might ask about:

- Occupation – there are reasons why a company may ask about your occupation. They would like to know about your annual income, in order to determine if the coverage amount you are applying for is too high. They also would like to ensure that your occupation doesn’t put you in greater underwriting risk.

- Hobbies – examples of hobbies and activities companies are asking about are skydiving, car racing, scuba diving and etc. Again, if you are practicing any of these activities, please advise us ahead of time. This will help us pre-select a carrier that will look at your interests most favorably.

- Bankruptcy – yes, bankruptcy matters when it comes to your life insurance rate and eligibility.

- Driving record – this is another major component in one’s application. It is not uncommon for life insurance carriers to deny an application due to recent DUI or too many moving violations. For life insurance companies this is an indicator of disregard for your safety and therefore they take driving record seriously. The statistics on the subject are overwhelming. According to the Centers for Disease Control and Prevention:

“Every day, 28 people in the United States die in motor vehicle crashes that involve an alcohol-impaired driver. This is one death every 51 minutes.”

Life insurance companies will run a Motor Vehicle Report (MVR) and check your driving record.

Typically, if you have no major violations in the past 5 years, you can get the most favorable rating excluding the other rating factors. DUI, DWI, reckless driving and suspended license (due to driving record) are considered major violations.

- If you have 1-2 tickets in the past 3 years, you can still qualify for companies’ best rating class.

- If you have more than 2 moving violations in the past 3 years, most likely your life insurance rates will go up.

- And if you have more than 4 moving violations in the past 3 years, you could be declined by most carriers.

Life insurance rate factors not controlled by the client

Life insurance companies are business entities like many others. They have operating expenses that they are incurring. These expenses are passed on to the clients when applying for life insurance. Some of those expenses are:

Interest expenses

Companies take client’s premiums, pool them together and invest them. This is how they are able to provide coverage and have funds to pay claims. Life insurance companies are also dependent on the economy and how their investments are performing.

Policy expenses

For you as a consumer, the application process is free of charge. In other words, you can apply for coverage and you start paying the premium once you accept the policy offered by the company. This is not the case with life insurance carriers. They have expenses working on your application. They need to pay for some of the following:

- Staff to review and manage your case

- Medical exam

- Medical records

- Ordering MVR (Motor Vehicle Record)

- Order and review your background

- Order and review your Rx (prescription history) and etc.

Mortality rate

Even though this is not a direct expense, it has a major role when companies are setting their life insurance rates. Life insurance companies are following closely life expectancy, health condition trends and etc. Based on the data, they are able to make predictions and determine rates.

In conclusion, there are many factors coming to play when life insurance companies are determining your rate. This is why it is essential to work with an agency that specializes only in life insurance. This allows us to select a carrier that best fits your unique situation.