How to buy life insurance (steps and FAQs)

Life insurance is not an everyday purchase. In fact, for many its something they think of only 3-5 times during their lifetime. Naturally, there are many misconceptions surrounding the process and questions on how to buy life insurance. What are the process and the steps necessary to secure a policy? This is what we want to address today.

Our goal is to advise you of what you should expect when you apply for coverage and prepare you for the application. We’ve outlined 5 steps to buying the right policy for you and also included 9 of the most common FAQs when it comes to applying.

Topics we will cover

- Start with WHY you need life insurance

- Select an agent

- Discuss your needs, health, and budget

- Apply (how the process differs based on the policy)

- 9 of the most common FAQs during an application (straight to the point answers)

- Last step – decision and placing in force

If you have any specific questions we did not cover in the guide or would like us to take a closer look at your personal situation, simply reach out to us. You can do so, by filling out the instant quote form on this page or give us a call.

Ok, Let’s dive in…

Start with WHY you need life insurance

This is one of the very first things you need to ask yourself: Why am I doing this? Yes, we will all die. But, what do you want to protect specifically? What type of expenses would your loved ones have should you pass away? Are you looking for protection for your mortgage, to replace your income or simply ensure that your family would not have to “pass the hat” at your funeral service? It is one of the basics when shopping for coverage.

It is important to start with the WHY because this will determine down the line, how much coverage you need, and what is the best product for you.

There is no one size fits all in life insurance. You won’t go to the store and buy the same shirt as everyone else, without knowing if it fits you. Why would you do it for an important decision such as life insurance?

Therefore always start with the WHY.

Select an agent

We believe this is just as important as having the right policy. Unfortunately, there are life insurance agents, who for one reason or another could put you at a disadvantage. It might be a lack of knowledge, not having access to various carriers, or simply trying to complete their sales quotas for the month. It is important to have an agent, who has your back and best interests in mind.

So, how do you find him or her?

Here are several ways and things you should be looking out for:

- How long has she or he been in the life insurance field?

- Is this his or her primary job, or a sight hustle?

- Did you get his or her name of a referral, or a search online (are there any reviews and testimonials)

- Does he or she ask you questions, listen and present you with solutions tailored to you?

Discuss your needs, health, and budget

Once you have an agent and a clear understanding of why are you needing to buy life insurance, you are ready to proceed.

During your initial conversation pay attention to the questions, you will be asked. Again, you want to ensure that the option you will receive is tailored to you.

The agent should ask you what got you thinking you need life insurance?

What is your medical history (current and past treatment; family history)?

Lifestyle history and choices (yes, things such as felony, bankruptcy and motor racing affect your life insurance).

This is an important step. It ensures that you have accurate rates vs. generic quotes. You might wonder, do you really need to provide all of this to simply get a quote? My answer is yes. If you want to have the options and the life insurance rates you truly qualify for, you need to provide this information.

Every carrier would ask these questions during their application. You want to go in prepared and have an idea of the possible outcome of your application.

You can run a generic quote on the tool here on the website and you would see rates from almost 20 different companies based on your age, gender, tobacco use, and coverage selection. However, going through the prequalification process is narrowing down the companies and getting the true rate. During this stage, you are searching for the most accurate and best value rates.

Let me put it this way, taking these 5-10 minutes upfront will not only save you time but also money.

Apply (how the process differs based on the policy)

After you’ve selected a product that matches your needs, the next step is to apply. This is where the process can differ based on the type of policy you selected.

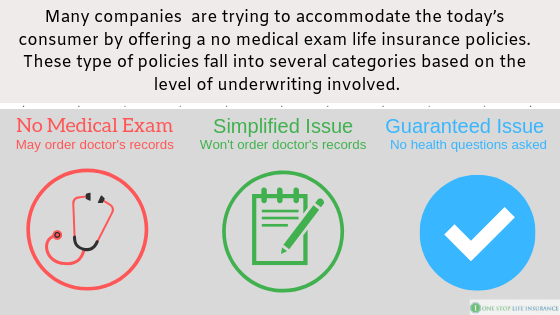

Life insurance without a medical exam

As you are probably aware, you can secure a life insurance policy without a medical exam. In fact, there are several different types of no exam life insurance policies.

If you’ve decided that this product is best for you, typically the process is as follow:

- You need to complete the application via the phone with an agent (a limited number of companies allow you to self-complete the application online). Afterward, an agent ensures that your application is in good order, locks it and sends it to you for e-signatures.

- The different companies have different e-signature processes they are using. However, in most cases is pretty straight forward you could complete using your phone or home computer.

- After your application is signed, we would submit it to the carrier for a review. Every company has an underwriting process they follow. Some might require a copy of your medical records, while others will skip the step.

If your medical records are required, we would handle that for you. We would get in touch with your doctor and follow up until the records are obtained.

Typically, it takes anywhere from 1 day to 4 weeks to have your policy approved.

Life insurance with a medical exam

If you believe that an exam option is better for you, we would move forward in that direction. The process slightly differs, as there is an extra step you need to complete.

- We would complete part A of the application with your basic demographic information and schedule the exam.

- An examiner would meet with you, at your home or at a lab facility near you. During the appointment, he or she will ask you the medical portion of the application (health questions and medical history).

- Afterward, an underwriter reviews your application and exam. Based on the findings, they can decide if they will request your medical records or they have all of the information they need to issue a decision.

Typically, it takes 3-8 weeks to have your policy approved.

9 of the most common FAQs during an application

We’ve outlined some of the most common questions in regards to life insurance in a separate guide. Below we’ve listed some of the concerns our clients had in regards to the process of buying life insurance:

Q: What information will the company need?

A: Every life insurance company will try to gather as much information as possible when underwriting your application (except guaranteed issue life insurance policies). They will ask you for personal information, such as complete name, residence address

- Date of Birth

- State of Birth

- Social Security Number

- Driver’s License Number and Expiration

- Employment Information

- Financial Underwriting Information (Income and Net Worth)

- Lifestyle information (Driving Record, Travel, Hobbies Posing Higher Risk, Bankruptcies, Felony Convictions and etc)

- Family History

- Health History

Q: How long is the application process?

A: It really depends on the company and type of policy you apply (with or without a medical exam). Typically, it takes anywhere from days to weeks to get your policy approved.

Q: Do I have to pay to apply for life insurance?

A: No, you don’t. In some instances, you have to provide your payment information in advance, however, no payment is required to apply.

Some clients want to have Temporary Insurance, while their policy is in underwriting. In these instances, you need to make a payment.

Q: Do I really need to disclose all of the information in the application?

A: Yes, yes, and yes. We can not stress this enough. Always answer truthfully on the application. Here is why… Chances are the underwriters will find out anyway. In addition, some companies are more lenient on their underwriting, if the client discloses the information they ask. In addition, providing misinformation on your application could give them grounds to decline a death claim, should you pass away in the contestability period.

On a side note, answer only to the questions they ask. Here is an example: if you had a DUI 6 years ago and the question reads “have you had a DUI in the past 5 years”, your answer needs to be NO.

Q: What if I change my mind after I submit my application?

A: Just communicate with your agent and let him or her know. He or she could pull out your application or put it on hold if that is what you want. It is easy and simple.

Q: Do I have to pay for the medical exam for a life insurance policy?

A: No, you don’t. Companies take care of the charges to schedule, process and review the medical exam.

Q: Can I get a copy of the results from my medical exam?

A: Yes, you can. In some instances, you simply have to request them.

Q: What if I get declined due to the results from my physical exam?

A: If you run across a situation, where your application was declined due to the result from your medical exam, you have 2 possible solutions:

1) Ask your agent to see if there is another carrier that would consider coverage. I’ve had clients declined by one company and approved by another. Different carriers have different guidelines for some conditions.

2) If no other option is available, consider a guaranteed issue plan. While the plan itself may have limited coverage for the first 2 years, some coverage is better than none. If you are turned down due to medical, chances are you need this insurance more than the average person.

Q: Can I reapply/replace my current policy if my health improves?

A: Yes, you can. Insurance is at-will participation. If there is a better product and/or price, why not take advantage of it.

Here are the things you want to make sure of:

- The replacement is in your best interest

- The new policy is in force, prior to canceling the existing one.

Last step – decision and placing in force

This is the last step of the application process. Once the company receives and reviews all of the requirements, they issue a decision. We would reach out to you and communicate the decision. If you have no additional questions and you do not want to make any changes to the application, we will advise the carrier and move forwards.

Based on the company, you would either receive a form to accept the policy and set up a payment plan or they will simply draft out of your account and send you the policy. It is that simple!

Here is an important thing!

Every company offers something called Free Look. A free look is a period of time when you can review the policy booklet and if for any reason you don’t want it, you can cancel the policy. The company will refund the premiums paid. The free look is different amongst the various states and it is between 10 and 30 days.

The reason we stress this to you is to give you the peace of mind that even after everything is set and done, you can change your mind. Some of our clients want to get a copy of the policy to review before a policy is issued or approved. We are not able to mail them a policy that is not yet existing or we don’t know if you could even qualify for. However, when you buy life insurance and you receive the policy, you still have the opportunity to make the final decision to keep it.

In conclusion,

There are several important steps you need to take when you are buying life insurance. The very first and crucial one is to have a clear understanding of why are you looking for coverage. This will ensure you are matched with the right policy type and have proper coverage.

We hope you find this helpful. Thank you!