Ways use your life insurance to pay your medical bills

We will start out by saying that you CAN use your life insurance to pay for your medical bills. There are many companies allowing you to “use” your death benefit while you’re still alive. We’d like to think of it as a modern life insurance policy.

In this guide, we will list when you can use your life insurance to pay your medical bills. Types of conditions eligible and most importantly, how can you upgrade your old death insurance.

What are living benefits?

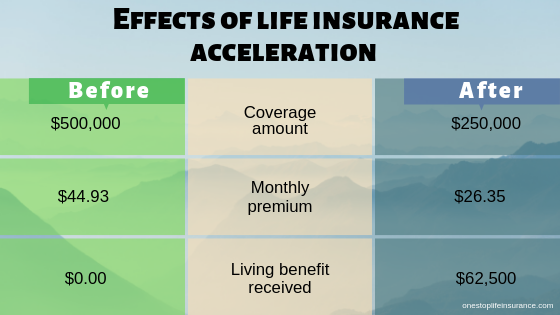

First off, we would start by explaining what exactly we mean. Many life insurance policies now include living benefits built into the policy. Living benefits allow the insured to file a claim against his or her death benefit and accelerate a portion of it. Simply put, an acceleration means to use it before he or she dies. The life insurance policy will have a lesser death benefit and the monthly premium will decrease as a result of it as well.

Here is an example, to demonstrate how acceleration works

In order to accelerate your life insurance death benefit, you need to be diagnosed with a qualifying medical condition. Different carriers have a list of different conditions that can qualify you to use your living benefits. Some of the most common ones are a heart attack, stroke, invasive cancer and etc.

You would need to file a claim with the life insurance carrier. The company will provide you with the forms you need to complete and request a copy of your medical records. Once they receive the claim package, they will review the information and assess the severity and your life expectancy. Afterward, based on the information provided, they will make you an offer. You have the option of accepting or rejecting the offer.

Insiders Tip:

You could also file a claim under your disability insurance to help compensate for any lost wages.

Here is an example:

Let’s meet Jane. She is 37 years old, non-smoker in average health. About 2 years ago, Jane purchased $500,000 term life insurance with built-in living benefits. Unfortunately, Jane suffers a heart attack. She survives it and is back home recovering.

Jane will not be able to go back to work for at least a few months and has tons of medical bills that her health insurance did not cover. She needs financial assistance. Jane files a claim against her life insurance and is able to accelerate a portion of her death benefit TODAY.

* Life insurance rates for $500,000 for a 20-year term policy for a female at average health. The effects on the policy after the acceleration for demonstrative purposes only. Every situation will be individually considered by the carrier.

Again, living benefits give you an option. We never know how exactly life would go and it is nice to have access to money if needed.

As you can see, Jane received $62,500 today which reduced her coverage down to $250,000. For many, this may not make any financial sense and means that she is getting pennies on the dollar. However, Jane has money today to cover the financial needs of her family and a quarter of a million left in life insurance. In several years past the heart attack, if Jane needs additional coverage, she could apply for a new policy.

Please keep in mind that every scenario, condition, life expectancy is different. There is absolutely NO way for someone to predict what offer will the company make you. If an agent tells you that some carrier will approve acceleration in certain terms – RUN!

Who gets the money – you, the hospital or the health insurance company?

The answer to that question is short – the insured receives the money. You then can decide what you need to spend it on. If you need, you can pay off hospital bills, health insurance deductibles / co-insurance, seek alternative treatment or simply help you recover your financial stability.

What companies are offering living benefits?

Many life insurance carriers are offering terminal illness rider, however here is a list of the carriers offering all 3 of the living benefits: chronic, critical, terminal illness acceleration riders:

This list is not all-inclusive. There are more carriers offering living benefits. These are just some of the companies we work with. We feel they’ve been in business long enough and have been providing tremendous value to their insureds.

>>ANICO – American National

>>Foresters

>>National Life Group

Each company has different guides outlining the triggers which qualify you for acceleration. Please reach out to us and we will gladly go over them for you.

What do you need to know before accepting acceleration benefit offer: Reduce your death benefit

Acceleration of your life insurance will reduce your death benefit.

You will be “using” a portion of it while still alive. In many instances, the use of life insurance to pay off your medical bills is the last resort option. However, we strongly believe that life is unpredictable and it is important to have this alternative if needed. Just be mindful of the amount you accelerate and the death benefit that is left for your family.

There is an administrative charge when using acceleration.

Companies will subtract an administrative charge from the acceleration benefit you receive. This is their cost to request, review and process your request. However, the accelerated payment will be less than the requested death benefit because it will be reduced by an actuarial discount and an administrative fee of up to $500.The charge varies from company to company. However, it is typically $350 to $500 to process the claim.

You don’t have to accept the acceleration offer.

We just wanted to advise you that just because you’ve been diagnosed with a qualifying medical condition and submitted a claim, it doesn’t mean that you have to accept the offer. Submitting a claim will not affect your existing policy. If you don’t like the offer, you can decline.

Accelerated benefit riders are different than cash value in life insurance.

We wanted to point out that even though both options may allow you access to cash, they are different. We’ve dedicated a separate post outlining the differences between living benefits and cash value.

There might be tax consequences.

Life insurance receives favorable tax treatment. However, accelerating your death benefit may fall into a different category. We are not CPAs or tax professionals, so we can’t even attempt to give you advice on the mater.

Bottom line: Can your life insurance pay your medical bills

The answer is: absolutely! To sum up, in many cases there is no additional cost to have life insurance with living benefits. Some companies would not even ask you to complete a medical exam and best of all: you could have options if your health declines. It is absolutely worth it to look into getting a policy with living benefits. Even if you never need to use them, it is reassuring to have the peace of mind that they are available at your disposal.