Requirements to get life insurance with H1B visa

Have you tried to secure life insurance with H1B visa? Have you been turned down for coverage because you are not a permanent resident? Well, if this is the case, you came to the right place. In this post, we will outline some of the key topics that every H1B visa holder should consider when securing a life insurance policy in the US.

We will cover this topic in length. You can use the quick links to take you to the part of the post that you are most interested in.

What we will cover

- The requirement to get life insurance as a visa holder in the US

- Options for coverage as a non-US citizen

- How we help you get covered

- What if you don’t qualify

This is a good time to mention that we specialize in helping foreign nationals find the coverage they need. We take the time to ask all of the right questions and match you with the right carrier the first time. It takes nothing but a few minutes to reach out to us and let us protect what matters the most.

Let’s dive in…

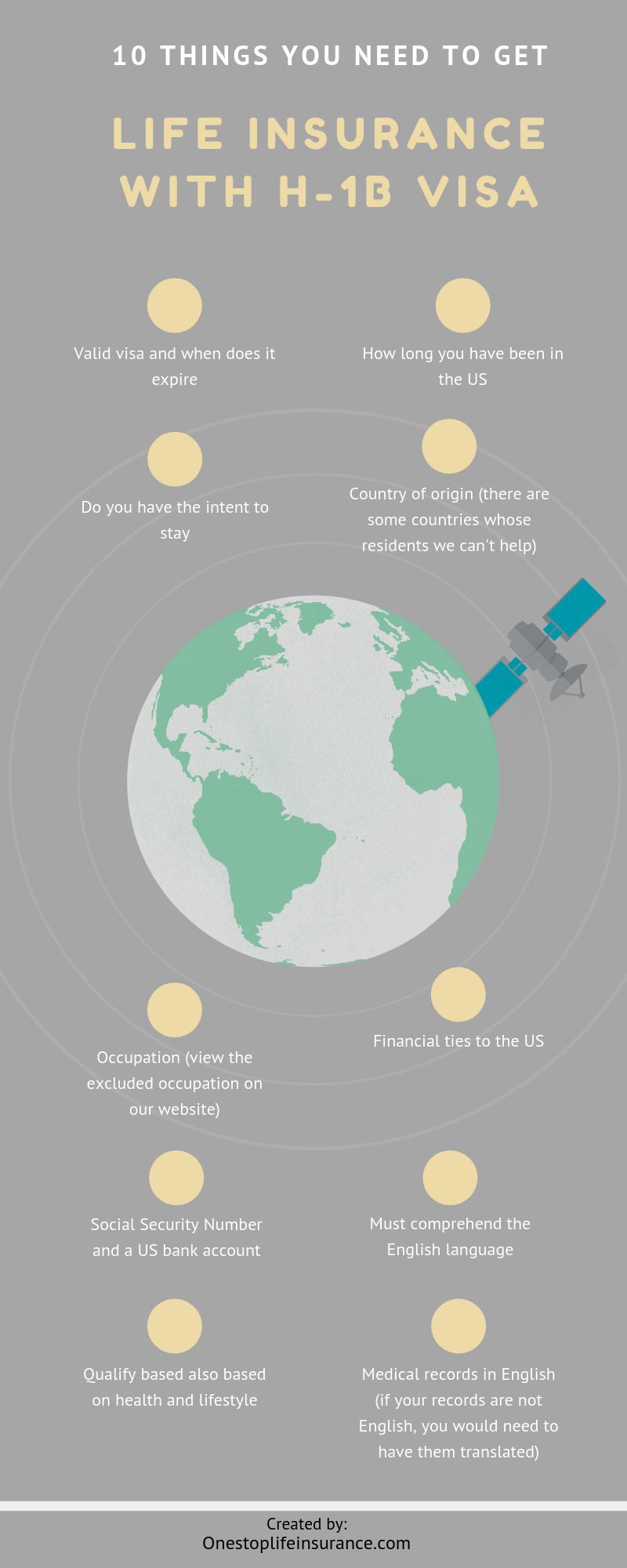

Requirements to Get Life Insurance with H1B Visa

In this section, we will break down all 10 things that companies will look into when approving your application.

Please note that every company is different, and it is important to work with an agency that understands the underwriting guidelines and will be able to match you with the best company for you.

Even though you meet the criteria of a company, this does not mean that it will be the best option for life insurance with H1B visa. Some companies will not offer you the best health class possible, while others may even deny your application.

1. Hold a valid H1B

To qualify for this type of coverage, your visa needs to be valid and expire more than 60 days from the application date. Oftentimes, companies will require to see a copy of your I -797 approval. Please know that there are companies who will be able to approve your application, even if your H1B visa has expired. Keep reading to learn more.

2. How long have you been in the US?

When underwriting an application for life insurance with H1B visa, companies also look at how long you have been in the US. Many of them will have a minimum requirement before they can even consider your application. With some companies, the minimum you need to be living in the US is 10 months, while for others it is 12 months.

- 0-10 months – we do not have a option for term insurance. You will be viewed as a non-resident for the purpose of insurance and only permanent products are available.

- 10-12 months – we have 1 carrier that can consider your application.

- 12-36 months– we have additional carriers that can offer insurance (term and permanent plans).

- 36+ months of residency in the US – many insurance companies can offer insurance. In fact, we have contracted with carriers that can even offer No-Medical Exam term life insurance if you have been in the US for 3+ years.

3. Do you intend to stay in the US or move abroad?

International travel is something that the companies look very closely at. If you are planning on traveling outside of the US or even moving abroad, you will need to disclose this on the application. We have created a separate guide on how international travel affects your life insurance.

Please note that in most cases, travelling to your home country to get your visa stamped or visit family is acceptable. The company will ask where you will be travelling to and get some additional information on the details.

4. What is your country of origin?

This is important for several reasons:

The first one is that there are countries not allowing their residents to purchase life insurance outside of their home countries.

The second reason is that there are countries that are considered too dangerous. In other words, there might be a higher risk. Residency or travelling to these countries may be a reason for a denial. Some of these countries are Afghanistan, Haiti, North Korea, etc.

*As 74% of the H1B visa recipients are from India, we would like to advise you that we have carriers that will approve citizens of India for coverage.

5. What is your occupation?

This is another important factor when companies are reviewing your application. They could deny your application if it falls into one of several categories:

- Politicians or government employees (including family and close business associates)

- Judges

- Public or private, police personnel

- Military personnel

- Trade union officials

- Journalists

- Missionaries or proselytizers

- Private pilots and/or crew members

- Celebrities, prominent, famous, or public figures

- Professional athletes (NFL, NHL, NBA, or MLB)

- Individuals listed on the Treasury Department’s Office of Foreign Assets Control (OFAC) list

6. What are your financial ties to the US

Companies take this very seriously. They want to ensure that you have financial ties to the US. Some of these include employment in the US, being married to a US citizen, owning a real estate property etc.

7. Social Security Number and a US bank account

You need to have an SSN to apply for a life policy. Several companies would accept an ITIN instead. ITIN stands for Individual Taxpayer Identification Number. You can apply online through the IRS website.

We have created a complete guide on life insurance with ITIN. Also, we have answered the question if life insurance with ITIN is more expensive.

Also, life insurance companies will require a US bank account that has been opened for more than 6 months.

8. Must comprehend the English language

Companies want to ensure that you understand all of the terms and conditions of the policy.

9. Health/lifestyle qualification

On top of foreign residency, you would need to otherwise qualify to purchase life insurance. In other words, companies would ask about your health, medical history, and lifestyle.

10. Copy of your medical records

It is a common requirement for companies to request a copy of your medical records. This requirement is irrelevant to your immigration status. They simply want to review your medical history for additional information.

If all of your medical records are from your country of origin, please keep in mind that you might have to request them and get them translated into English.

What Are Your Options for Life Insurance with H1B Visa?

As you may know, there are 2 big groups of life insurance available in the US: term life insurance and permanent life insurance. Below is a quick overview of the 2 major groups:

Term policies – As the name suggests, it offers temporary insurance. It provides you with coverage for a specific time frame—10, 20, or even 30 years. This is a very straightforward type of life insurance and is the lowest-priced cost option. There is an option that will offer a full refund of your premium payments if coverage is no longer needed (return of premium).

Permanent insurance—it provides lifelong coverage. There are several different types of permanent life insurance. Some can be focused on simply providing lifelong coverage at the lowest price possible, while others offer the feature of building cash value as well.

As a H1B visa holder, you can typically qualify for either of the options if you apply with the right company. Many clients have asked us which option is better: term or permanent. Therefore, we have created a very comprehensive guide on the best life insurance for H1B visa holders.

We’ve outlined a complete guide listing your life insurance options with an H1B visa. We’ve covered what your options are and things to consider and answered the most common questions.

What to Expect When Working With US to Secure Life Insurance as a Visa Holder

We specialize in life insurance for foreign nationals. Over the years, we have helped hundreds of families secure coverage whether they are here on H1B or H4 visas, F-1 visas, TN visas, or no visa at all. We have also created numerous guides to help clients secure a no-medical exam life insurance with H1B visa.

We understand that you have the option to work with other brokers, but here’s what makes us different:

- We specialize in finding foreign nationals to find the coverage they need. We’ve taken the time to research all of the available options and companies.

- Coordinate the entire process from start to finish – you will have an entire team working on your application. You can always reach out to us and talk to a person.

- We ask the right questions to pre-determine your eligibility. We are strong believers that by taking that extra time, we would save you a lot of time, frustration, and of course, money.

- We match you with the right company—this is where expertise, experience, and professionalism come together.

We have options. We can match you with industry-leading carriers that can offer living benefits built into their term insurance. Living benefits in life insurance will allow you to use your death benefit while you are alive in the case of a qualifying illness.

What if you don’t qualify based on visa?

If for some reason, you don’t meet any of the requirements or we discover you don’t qualify for a policy, we have 2 separate options that you might want to consider.

Solution 1:

If your visa is expired or you are not able to renew, we’ve created a separate outlining the available options for undocumented immigrants.

Solution 2:

Please keep in mind that if you are not able to qualify for coverage due to residency status, we have access to a carrier that offers global life insurance.

In conclusion,

When it comes to life insurance with an H1B visa, we have the company contracts and the answers. You will have options for coverage. It is important to work with an agency that specializes in life insurance for non-permanent residents so you can find the best carrier for you.

We hope you find this helpful. Please reach out to us and let us get you the coverage you need.

Thank you!

1 Comment

Bush Pola

Wanted AIG policy with living benefits. Iam H1B visa holder and age 40

cell 469-***-****