The only Return of Premium option we recommend

Many of our clients have expressed concerns that they want to receive something at the end of their policy term. They want to know that a life insurance policy can serve them in more than one way. Through this post, we want to share that it could. We would go over what is the return of premium life insurance and that is the only type of policy we recommend.

Life insurance is evolving. Make sure you have a kind that works best for you and can help you in more than one way.

We’ve divided the post into several topics. Feel free to go through each one or click the one that interests you the most. If you have questions or would like us to view your personal situation, simply reach out to us. Our friendly agents would take the time to ask what is important to you and present you with a tailored option.

What we would cover

What is a Return of Premium life insurance?

What are the downsides of a return or premium

The only option we recommend and 4 reasons why

Ok, Let’s dive in….

What is a Return of Premium life insurance?

We felt it is appropriate to start here and go over what is a return of premium life insurance. As the name suggests, this type of policy would return your premium payments at the end of the policy term. It is marketed as free life insurance since you would be getting all of your money back at the end of the term.

Think about it, you would purchase a 20-year term policy, pay your scheduled premium, and at the end of the term you get all of your money back. You not only had a life insurance policy for free but now you are getting a lump sum of money. It is a great idea, correct? Well, not to so fast.

There is a downside to this concept. We would go over some of the negatives it a little bit. But first, we wanted to touch on what is the exact process of securing a policy with a return of premium feature.

How to secure a policy

The process of securing a life insurance policy itself typically follow several steps, we would outline below. There is a rising challenge since nowadays there are not many carriers that are offering a return of the premium type of policy. Years ago, these types of plans were gaining popularity and there were many carriers offering them. Things have changed, the price of the product had to be re-adjusted and nowadays it seems like they are becoming obsolete.

So, how do you secure a life insurance policy with a return of premium?

During the initial conversation with our agents, just share that this is important to you. We would present you with several options and you can decide which one makes the most sense to you.

Fact-finding and quote

During this step, we would ask you several health/lifestyle questions to determine eligibility. Afterward, we would present you with several options and go over the pros and cons of each. That way you are behind the sterling wheel and advise us what is most important to you.

Application

This is the second step of the process and we can help you with that. Most carriers allow you to complete the application and sign it electronically. You can be done in less time it takes to catch the latest episode of your favorite show.

During this step, we would schedule a medical exam, if one is required.

Keep in mind that there are many carriers that can offer life insurance without you having to see a nurse. To learn more, review our guide on No Exam life insurance options.

Underwriting

During this step, the carriers are reviewing your application and make a decision. The carriers are running several different reports as a part of the underwriting. In some instances, they may require a medical exam or waive it, if they feel they’ve collected enough data to make accurate decisions.

Please note, we have a team of processors communicating with the carriers during this step of the process. We would reach out to you if there is anything you need to do or help clarify.

How long does the process take

The length of the process varies. It ranges from a few days to 4-6 weeks. The biggest delay would be obtaining medical records from your doctor, if necessary. After you complete your medical exam, typically carriers could review the results in a matter of days. However, it could take 1-3 weeks to get the results sent by your doctor and reviewed by an underwriter.

Please advise us if time is of the essence. We would advise you of the approximate timeline and try to find an option that accommodates your needs.

What are the downsides of a return or premium?

Since now you have a better understanding of what is a return of premium and how you can secure a policy, we want to turn our attention to the cons of this product. We believe that many of the reasons we would list below don’t make it a suitable option for the majority of our clients.

No Interest on the return

As we covered above, at the end of the term, you would receive all of your money back. While many may view this as some sort of savings, it is essential to point out that there is NO interest gain on the money. In other words, the money you would receive could have much lower buying power.

What do we mean by that? Well, quite simple. $10,000 today would not buy you what it could’ve 20 years ago.

Here is a Fun Fact:

The average cost of buying a new car in 1999 was $20,686; adjusted for inflation, that price today should be $31,874. However, according to Kelly Blue Book, the average cost of buying a new car in May 2019 was $37,185, 14% higher than the price when accounting for inflation.

You would have to wait till the end of the policy term

Oftentimes, you would need to wait till the end of the policy term. We consider this to be a disadvantage. In some cases, your needs may have changed and you no longer need the insurance, or you could no longer afford it. However, in order to get the full return of premium and not “lose” the higher premium, you would need to wait till the end of the policy term.

While this may never become an issue, it limits the options you have.

Cost

We can not ignore this big negative of Return of premium policies. In some instances, they could cost 50, 100%, or even 300% more than traditional policies, based on the carrier and other factors.

In other words, you are paying a lot extra for this feature. Your money may be better spent in a different manner than would bring you interest and be able to keep up with inflation.

Because of these and overall performance, many carriers are no longer offering a return of premium products in their portfolio. While this type of policy may be suitable for some, it is important to consider the pros and cons to ensure it makes sense for you.

With that being said, there is one option we believe it offers some advantages worth considering. Read below to see what is the only option we consider when it comes to returning of premium.

The only option we recommend and 4 reasons why

We went over why you should not get a return of premium life insurance, now it is time to turn our attention on the only return of premium policy type we recommend and list 4 reasons why:

We believe it is in our client’s best interest to secure a Guaranteed Universal Life policy with a Cash surrender feature.

Before we jump into the reasons why we would take a second explaining what is guaranteed universal life insurance.

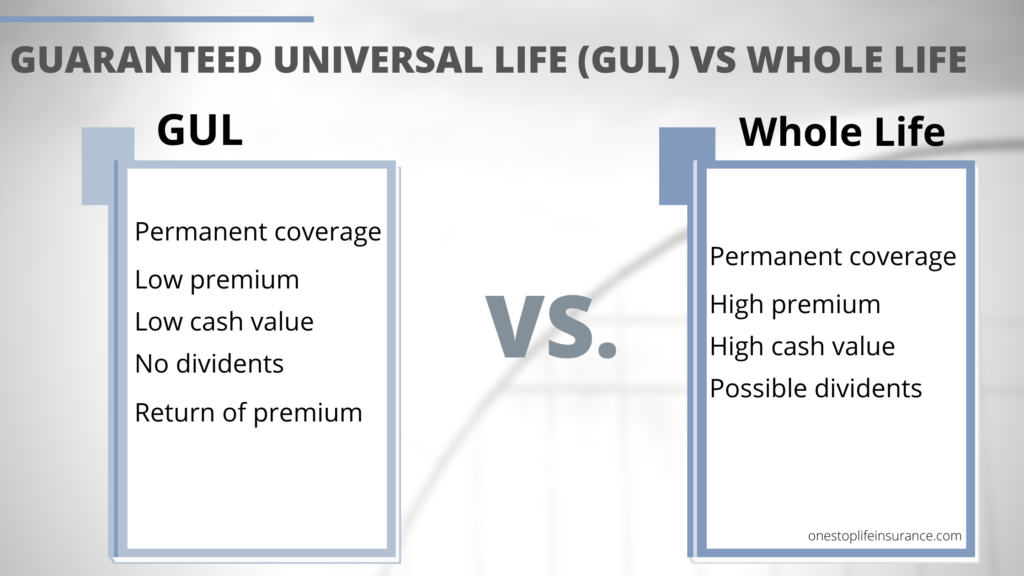

We’d like to think of this product as a hybrid between term and permanent insurance. It offers customizable lifelong protection, very minimal cash value growth, and a reasonable monthly premium.

You are in control of how long you would like the policy to last.

Typically, you can select coverage up to age 90, 95, 100, or even 121. This gives you the peace of mind knowing that your family would be protected.

In addition, this product’s focus is not building cash value and because of that, it makes it much more affordable in comparison to a whole life policy. If cash value growth is not your objective, this makes it a perfect product for you.

Take a look at the example below:

Meet Casey, he is 40 years old male in standard health. He is looking for lifelong coverage and it is not concerned with the cash value growth. Below are the rates for $250,000 in coverage for a guaranteed universal life policy and traditional whole life policy. Both options provide coverage up to age 121.

- Guaranteed Universal Life – $250,000 – $179.11 per month

- Whole Life – $250,000 – $307.30 per month

A whole life is almost twice the cost of a GUL policy!

Ok, now let’s turn our attention to why we believe a Guaranteed universal life policy with an option to cash surrender is a better alternative.

Cash surrender the policy for a full or partial refund several times.

You can surrender the policy for a partial return of premium (65% of the premium paid) at year 15, or for a full return of premium at years 20 or 25. In other words, you have more than one opportunity to take advantage of this option, should you decide to.

Gives you a choice

Life is unpredictable, having this option would give you the choice to either cash surrender the policy or continue. In some instances, it may make the most sense to keep paying for the coverage and know that your family would have financial resources should something happen to you.

Some carriers offer living benefits built into the product

If you have never heard the term living benefits in life insurance, or are unsure how they can help you and your family financially, we encourage you to view our guide and video on the topic.

Having this additional benefit included makes the policy that much more valuable. You can use your life insurance not only when you die, but should you suffer a qualifying medical condition. And, if you don’t experience either you decide you no longer need the insurance, you can get your premium returned.

It offers options on top of options! We love that. You never know what the future holds for us. Having a comprehensive coverage would prepare you for more of the unknown.

You can ever skip the medical exam

We believe this is an added bonus. In some instances, you could qualify for acceleration and have your policy approved without going through a medical exam.

In other words, the process of securing the policy would be fast, easy, and streamlined.

In conclusion,

There are many options to choose from when it comes to life insurance. Having the option to have a return of premium at the end of the policy term is very appealing to some. We would encourage you to go through the numbers and ensure that they make sense for you and your family. The key to selecting the right coverage is to address your needs and be flexible.

We hope you find this helpful! Do not hesitate to reach out to us if you would like us to review your personal situation and provide you with a customized coverage solution.

Thank you!