FAQs about living benefits in life insurance

As the term Living benefits is gaining momentum, more and more of our clients have a ton of questions about how exactly living benefits could help them if they are really worth all of the buzz.

In this guide, we would answer some of the most common questions about the living benefits in life insurance we’ve received. We want you to have all of the information in front of you and be able to make the decision if living benefits are right for you and your family.

We would strive to keep the answers short and to the point. However, if there is a topic we didn’t cover, or you need to see how much life insurance with living benefits costs, just fill out the quote form on the page. Our agents would reach out to you and advise you of your options.

Ok, let’s start….

1. What are living benefits in life insurance

This is one of the most common questions about living benefits in life insurance we get, so we felt it deserve the number 1 spot. Having living benefits, or Accelerated Benefit Riders, on your life insurance will allow you to use your life insurance policy while still alive. Should you be diagnosed with a qualifying condition, you could file a claim against your life insurance and accelerate your death benefit. In other words, you could use a portion of the entire life insurance while still alive to help pay medical bills or other expenses.

This is a good time to mention that in some instances, the way life insurance carriers process living benefits are state-specific. This is especially true for California.

2. Does every life insurance company offer living benefits

Unfortunately, the answer is NO. More and more companies are starting to add this feature into their products, but not every life insurance company offers living benefits.

In addition, living benefits vary amongst the different life insurance carriers. Here is a guide outlining some of the most common differences.

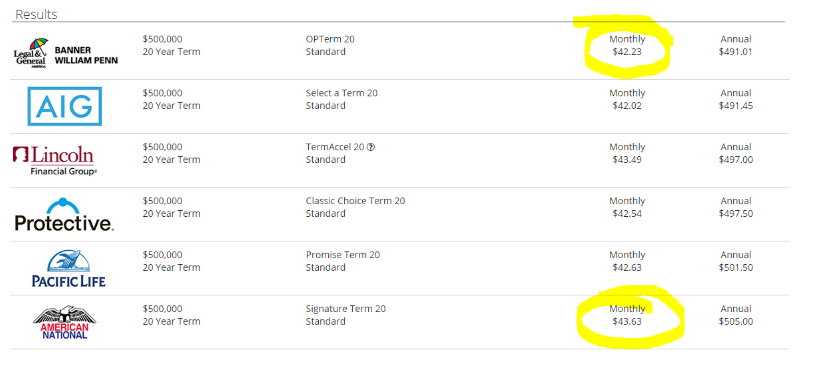

3. Are life insurance policies with living benefits more expensive, compared to traditional policies

The companies offering living benefits are less than the ones that do. Therefore, there are fewer companies to choose from, when it comes to living benefits. However, take a look at the image below. The first company does NOT offer living benefits, while American National does. The price point is $1.40 per month.

4. Are living benefits the same as cash value

We get this question a lot. The answer is NO. Unlike, cash value accumulation, living benefits are available on term insurance as well as permanent plans. In fact, we’ve dedicated an entire post outlining the differences between the two.

5. Do I need a medical exam to secure a policy with living benefits

It depends on the carrier you select. Some companies would require you to complete a medical exam, while others would waive it. During our initial conversation, we would present you with both options, if you qualify. Please let your agent know if you prefer a policy with NO medical exam AND living benefits.

6. When can I use the living benefits

Most companies have categorized the triggers that would qualify you to accelerate your life insurance into 3 major categories. They differ between the carriers and the state.

Critical illness – Every company has different conditions that they consider critical illness. Some of the most common critical illnesses amongst carriers may include:

- Heart Attack

- Stroke

- Invasive Cancer

- End-Stage Renal Failure

- Major Organ Transplant and ect.

As you can see, these are all very common conditions. Living benefits in life insurance is an option for many to afford continues medical care.

Chronic Illness – You could qualify to accelerate your policy if you are unable to perform 2 out of the 6 activities of daily living for a period over 90 days. These activities include bathing, continence, dressing, eating, toileting, and transferring.

Terminal illness – you would be able to accelerate your life insurance if a certified member of the medical profession reasonably believes you would die within the next 12 to 24 months (the timeframe is based on your state and the carrier).

7. Who receives the money

The money is payable directly to you. Even though the payment is triggered by a qualifying medication condition, it is not tied to your health insurance or medical provider. The best part is that you decide how you need to spend the money. You could higher extra help, pay your medical bills, the mortgage payment or simply put food on the table. You are in charge.

8. Do I get a lump sum or installments

Typically, companies would allow you to make that decision for yourself. You would need to assess the situation and determine if a lump sum payment or regular installments make the most sense for you.

You could change your initial decision, up to the moment the company is dispersing the payment. Once, they have your accepted offer and make the payment, you can not change the payment option.

9. Do I have to pay back the money

No, you don’t. Living benefits are not considered a loan against your life insurance. The money is taken from your death benefit and the option to accelerate it.

10. Do I have to report the living benefits on my taxes

Proceeds payable from life insurance are generally tax-free for the beneficiary. However, the tax code provision pertaining to payments from living benefits can be complex and we advise you to consult a tax advisor. Receiving payment through accelerated benefit riders (living benefits) can create a taxable event. It does make a difference under what circumstances you’ve accelerated your benefit:

Terminal condition – the benefits are designed to work with compliance with the Internal RevenueCode and are treated favorably in section §101(g). Generally, the benefit received through acceleration due to terminal condition is treated as a regular life insurance benefit.

Chronic condition – the tax code is providing limited favorable tax treatment for benefits received through chronic condition acceleration riders. The section in the Code outlining the treatment is Section 7702B (Treatment of Qualified Long-Term Care Insurance).

Critical condition – the benefit itself is not designed to receive a favorable tax treatment. However, the benefits received under the Accelerated Benefit Riders for critical illness may receive favorable tax treatment under Internal Revenue Code Section 105(b) and 105(c).

As we mentioned, the tax code treating living benefits is complex and we strongly urge you to consult with a tax professional.

11. How to file a claim to accelerate my life insurance benefit

The first thing you need to do is contact the company and advise them of the condition. They will provide you with a claim form and request your medical records, diagnosis and treatment history. Typically, you need to file a claim within 1 year (365 days of the diagnoses) to be eligible for the benefit.

If you live outside of the US, the carrier might require you to see a US doctor, in order to accelerate your benefit.

Once, the company receives all of the records, they will review your claim and if you qualify, they will provide you with an election form listing the offer of payment.

12. Is there any cost to file a claim

Many companies offer living benefits at no additional cost. However, there is a fee associated with the election to use the accelerated benefit riders. The fee could vary amongst the different carriers but is typical $500 per claim. The companies use the fee to cover the cost of obtaining your medical records, reviewing and assessing your claim.

13. What if I change my mind

You don’t have to accept the acceleration offer made by the company. If your situation has changed and you no longer believe that accelerating your policy is in your best interest, you don’t have to finalize the acceleration.

14. How long would take to receive a check if I use my living benefits in life insurance

Once the company receives your approval of the acceleration paperwork and you’ve advised them how you would like to payment, it takes approximately 5-7 business days for them to process the payment.

15. How long do I need to have the policy in force for the benefits to take effect

Depending on the carrier and the type of Accelerating benefit rider, benefit takes an effect immediately or up to 30 days of policy issue.

Please keep in mind that if you need to accelerate your policy due to a chronic condition, you would be eligible to file a claim after 90 days of diagnosis. As an example, on January 3rd you suffer an event leaving unable to perform 2 out of the 6 activities of daily living, the earliest you can file a claim is approximal March 26 (90 days after the diagnoses).

16. How is does the company calculate the benefit I’m eligible should I accelerate my policy

Every company is different, but they all follow a similar process when calculating the benefit.

They take your eligible death benefit and from it subtract an actuarial discount, the administrative fee (typically $500), and pro-rata percentage of outstanding policy debt. This gives them an accelerated benefit amount.

–

We want to point out that the actuarial discount represents the cost of paying the death benefit prior to the actual death of the insured. In other words, you would NOT receive a dollar for a dollar amount.

Here is an example,

If you have a $500,000 death benefit and you decide to accelerate your entire policy, you would NOT receive $499,500 (the death benefit less the administrative fee). The company would review your policy and will calculate the actuarial discount.

Please note, if anyone is guaranteeing you a dollar for dollar payment, RUN!! This is misleading and there is no set formula that is universal for every situation.

17. Do I have to accelerate my entire policy

No, you don’t. There are 2 ways you could accelerate your policy:

Partial acceleration – file against a portion of your death benefit. This option would mean that you could qualify for a payment today while leaving a portion of your life insurance active.

Full acceleration – file against your entire policy. Doing so would cancel the life insurance policy.

18. Will acceleration affect my eligibility for government benefits

Receiving an accelerated benefit payment may affect your eligibility for government payment. We advise you to consult with an attorney in your state to ensure that the payment would not put you over the income limit and disqualify you for a benefit. You need to weigh the pros and cons of each option, so you can make the best decision for you and your family.

19. Are there any limitation when it comes to living benefits in life insurance

Yes, there are several instances that could prevent you from accelerating your policy:

1)Accelerated benefits will not be paid for any conditions that are from a direct result from self-inflicted injury or attempted suicide.

2) You are not able to claim accelerated benefits for a condition that occurred prior to the policy taking an effect

3) There might be a limit on the maximum benefit you can accelerate (based on the company):

- $2,000,000 (issue ages 0 through 65)

- $1,000,000 (issue ages 66 or older)

For California residents, the chronic and critical illness riders are not available for applicants age 65 and older.

20. How to know if my policy offers living benefits

You can find out if your policy offers living benefits in 2 ways:

Read the policy – when your policy took effect, the carrier had sent you the actual policy. They may have either mailed it to you or sent it to you electronically. Our advice is going through the description of benefits and see if you could find any of the following terms:

- Accelerated Benefit Rider

- Critical Illness Rider

- Chronic Illness Rider

- Terminal Illness Rider

Call the company directly – if you are unable to find the policy or are unsure what it is included, you can always contact the company directly, provide them with the policy number or your SSN and they can look it up and give you an answer.

21. How to get life insurance with living benefits

This is the easiest part. All you need to do is to reach out to us and advise us that you are interested in a policy with living benefits. Our agents would get to work and present you with all of the options you qualify for. You can reach out to us by phone, email, or complete the quote page form on the site.

In conclusion,

In this article, we’ve attempted to answer some of the most common questions about living benefits in life insurance. While living benefits in life insurance are not the solution to every problem, we are strong believers that they might be an option you and your family could benefit from. Considering the cost of these policies, the availability and the ratings of the companies offering them, we believe they are worth it.

We hope you find this helpful and should you have any additional questions, we didn’t cover, please feel free to reach out to us.

2 Comments

miur arthur

Do you have recommdations of companies that offer insurance that offesr living benefits? Thanks

One Stop Life Insurance

Hi Miur,

Some companies are American National, Foresters and Ameritas. Feel free to give me a call or send me an email directly and I would evaluate your options.

Thank you,

Zhaneta Gechev

Direct 702-342-8727

Email: zhaneta@onestoplifeinsurnace.com