Are living benefits and long term care the same

The insurance world could be challenging at times. With many available products on the market, it is not always easy to know exactly which one is the best for you. We wanted to outline some of the major differences between the two important products to have: living benefits and long-term care insurance.

Now, when we say living benefits, we are referring to the accelerated benefit riders that some life insurance policies offer. In this guide, we will go over how each product could help you financially and what are the major differences between the two.

If after reading the guide, you have any additional questions, feel free to reach out to us. We would take the time to understand your situation and present you with a solution tailored to your needs. You can fill out the instant quote form on the page, or simply give us a call.

Topics we would cover

What does it mean to accelerate your benefits under a chronic rider

What is Long Term Care (LTC) insurance

Comparision of living benefits and long term care insurance

Prior to diving into the topic, we wanted to advise you of the importance of this guide, especially to the residents of California. The state has an additional set of rules and regulations, to ensure its residents are aware of the available products. This is why many insurance companies are either not offering or customizing their life insurance with living benefits in California.

What does it mean to accelerate your benefits under a chronic rider of a life insurance policy?

We’ve covered some of the most common questions and basic information of living benefits and whether are they worth it in separate guides. Feel free to take a second and review the information.

We want to briefly mention that the living benefits in life insurance allow the owner to accelerate (use in advance) a portion of his or her death benefit, should he suffer a qualifying health condition. Typically, the rider has 3 separate categories:

Critical – if the insured suffers a heart attack, stroke, invasive cancer, etc. It is important to mention that the different carriers have different qualifying conditions or triggers.

Terminal – the owner is able to accelerate the death benefit should the insured be diagnosed with a terminal condition and is reasonably expected to die in the next 12-24 months (again, based on the carrier).

Chronic – this is the part that we will focus on in this guide. Under the chronic trigger, the owner can accelerate a portion of or the entire death benefit, if:

- The insured is unable to perform, without substantial assistance from another person, at least 2 of 6 activities of daily living for a period of at least 90 days, due to a loss of functional capacity; (bathing, continence, dressing, eating, toileting, transferring)

- Requires substantial supervision by another person to protect the insured from threats to health and safety due to the Insured’s severe cognitive impairment.

We’ve created a separate guide outlining the exact process of acceleration.

What is Long Term Care (LTC) insurance

Long Term Care is a type of insurance, designed to help the insured cover qualifying long-term care services. These services can be temporary or permanent. An example of these services could be hospice care, adult daycare, care of a nursing home or assisted living facility, or help with the activities of daily living.

The plan could either reimburse the owner for the expenses (after providing receipts) or the owner could receive a pre-set benefit amount once he or she meets the qualification.

Long-term care is not health insurance and it could help cover some of the expenses that health insurance won’t.

Comparison of living benefits and long-term care insurance

Since now you have a better understanding of what each product can do for you, it’s time to focus on their differences. This way you can decide what product is more beneficial for you and your family.

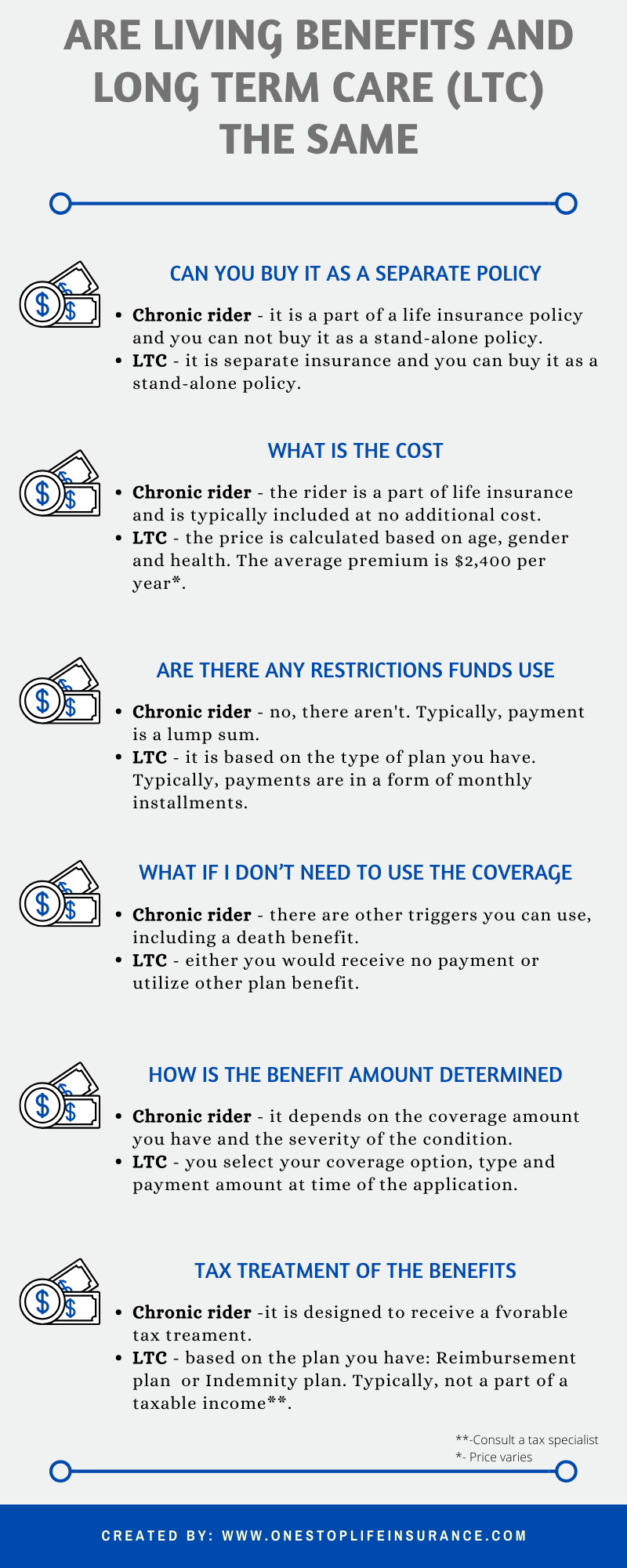

Can you buy it as a separate policy?

Chronic rider – it is a part of a life insurance policy and you can not buy it as a stand-alone policy.

LTC – it is separate insurance and you can buy it as a stand-alone policy.

Cost

Chronic rider – the rider is a part of life insurance and is typically included at no additional cost. Since the rider can be offered term life insurance, it could be secured at a fairly low cost.

LTC– long-term care policy is stand-alone insurance. While premium varies based on the type of plan you have, age, and current health, it is typically $2,400 per year or more.

Are there any restrictions on how to use the funds

Chronic riders – there are no restrictions on how to use the money. Typically, the funds from acceleration are paid in a lump sum.

LTC – it depends on the type of plan you have.

- If you have a reimbursement plan – payments are made based on eligible expense receipts submitted for LTC services received.

- If you have an indemnity plan – there are typically no restrictions on the use of the benefit amount received

At what age can I purchase the plan

Chronic rider – it depends on the company and the product you are interested in.

For example, some companies would not approve accelerated riders in the state of California for applicants age 65 and above.

LTC – is based on the company. However, the larger insurance companies stopped accepting applications for people age 75 and over.

What if I don’t need to use the coverage

Chronic rider – There are different conditions allowing you to file a claim. While you might not need to file a claim under the chronic rider, you might experience other qualifying triggers. In addition, the policy will pay out the death benefit to your family, should you pass away.

Some companies also offer the option to have your premium returned at the end of the contract or at the 20 year policy anniversary.

LTC– it is based on the type of policy you have. For example, standalone plans may end with no payment made to the insured (if no return of premium is available).

Others would allow you to “transfer” the premium as a life insurance policy and be a part of a life insurance payout.

What happens in you need to use the benefits

Chronic rider – you need to file a claim against your life insurance policy. The carrier would ask for supporting documents. It is industry average to have a waiting period of 90 days. In other words, you need to wait for 90 days before you are eligible to receive benefits.

Should you decide to accelerate your benefit, your life insurance death benefit will be reduced. In addition, if you decide to accelerate your entire policy, the life insurance will terminate.

LTC – a licensed health care provider needs to certify that you will not be able to perform the Activities of Daily Living in the preceding 12 months or meet additional criteria outlined in the policy.

How is the benefit amount determined

Chronic rider – The benefit amount is determined by the carrier, as they will take into account the severity of the condition, life expectancy, and other factors. Most of the carriers have a one-time administrative fee of $500. They subtract it when disposing of the payment.

The payment is typically a lump sum.

LTC – the policy clearly outlines the benefit amount, the waiting period (0, 30, or 90 days), and the duration of the benefit. Should you need to file a claim, simply reach out to the carrier and provide them with the necessary information.

The payment of benefits is typically distributed as monthly installments.

What is the tax treatment of living benefits and long term care

Chronic rider – Currently, per tax provision from the IRS, those receiving benefits under the Accelerated Benefit Riders will receive a favorable tax treatment. However, this might change and there might be state-specific regulations that you need to meet. Our advice is to consult with a tax specialist prior to taking advantage of this option.

LTC – typically the tax treatment received from a long-term care policy will depend on the type of policy you have:

- Reimbursement plan – proceeds are generally excluded from your taxable income.

- Indemnity plan – amounts provided are generally not taxable up to the extent of the per diem limitation.

Our advice would be to always consult with a tax advisor. In addition, receiving benefits under either of the options could affect your eligibility for other government assistance. Ensure that you have all of the information prior to making your decision.

In Conclusion,

We hope you find this guide helpful. Our goal is to ensure that you understand how both options work. Both, living benefits and long-term care insurance could be an important piece to your financial puzzle. It is crucial to take the time and weigh both choices.

Should you need any additional information, simply reach out to us. We are happy to help.

Thank you!