How to decide if a term or permanent policy is best

There is a lot of confusion today when it comes to what type of product should you secure. There are many experts trying to persuade you to buy one or the other. But, how do you know which one is right for you and not their pocketbook? In this guide, we want to give you the steps to decide if a term or permanent policy is best for you. We would list the things you need to consider in order to make the correct choice.

Below are the topics we would cover. If you have any additional questions or would like us to review your personal situation, simply reach out to us. You can do so by filling out the quote form on the page or giving us a call.

What we would cover

- Start from the beginning: what do you want to protect [Don’t skip this step!]

- Understand how each product works

- What is the cost of the various insurance options

- Are there any other features to consider

- Here is a solution many of our clients take advantage of

Let’s dive in…

Start from the beginning: what do you want to protect

We start here on purpose. We believe that having a clear vision of what you want to protect is a MUST when trying to decide if a term of a permanent policy is best for you. Why? Because your needs determine the type of insurance you have to look into. This is one of the very first steps in securing life insurance.

Let me explain:

Wanting to have protection in place to cover the mortgage should you pass away, is an example of a temporary need. Hopefully, at some point, you would either have the house completely paid off or have the ability to do so at any moment.

Starting a young family, we want to ensure that our loved ones would not have to worry about where they would sleep should I pass away. I want to make sure that their essentials would be taken care of. However, in most instances, this is a temporary need. Our children would grow up and be financially independent, they would not rely on our income for support.

Covering your final expenses, burial cost – now, this is an example of a permanent need. We will all die, it is inevitable. There is no question if, but rather when. Therefore, it makes no sense to cover a permanent need with temporary coverage.

Here is an example: if you secure a 10-year term policy to ensure that your funeral is taken care of. This essentially means that you need to die within the next 10 years, otherwise you would be out of luck!

In essence,

Consider your needs, why are you looking for coverage in the first place and what do you want to protect through life insurance.

Do not cover temporary needs with permanent coverage or permanent needs with temporary coverage.

Understand how each product works

This is where the rubber meets the road. This is where you and we decide which product or products best suits your needs.

We will give you a brief overview of the available options:

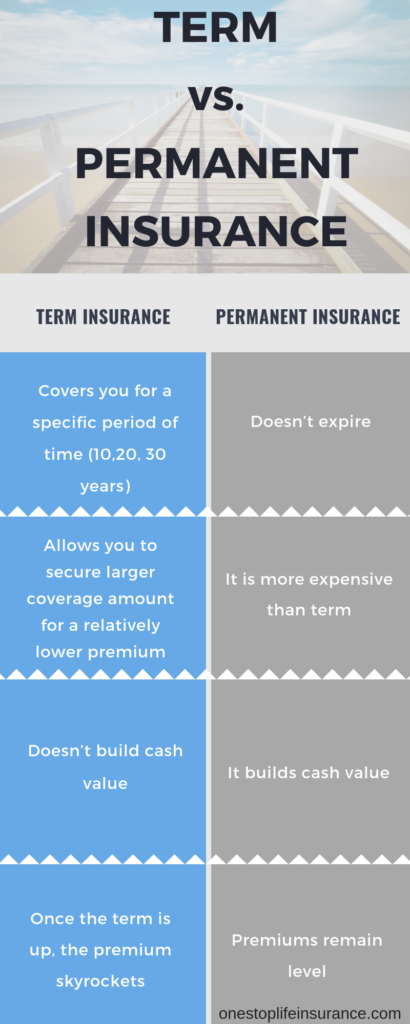

Term life insurance

This is a straightforward product when it comes to protection. You select right up front how long your policy will last, the coverage amount, and whether you need additional features such as riders. Your monthly premium will be level for the life of the contract as well as your coverage amount (this stands true for most insurance contracts).

Should you pass away while the policy is in force, your beneficiary would receive the payout. It is as simple as that. However, it bears the risk of outliving your life insurance and becoming uninsured.

Think of term life insurance as renting. While you pay your rent, you have a roof over your head. Should you stop making your payments or your lease ends, you need to find a new place to live.

This is a good time to make a quick side note. Not all term life insurance policies the same? Some plans offer a feature called living benefits. It essentially allows you to use the policy while still alive.

Permanent life insurance

Now, here it becomes more interesting!

There are many different types of permanent life insurance policies. You’ve probably heard the term whole life insurance. Well, this is one type of permanent protection, but there is also universal life insurance, guaranteed universal life insurance, index universal life insurance, variable life insurance, second to die life insurance and etc.

Q: So, how do you decide which permanent policy is best for your permanent needs?

A: By going back to your needs and wants.

Each of these policies is geared towards different features. One gives you the peace of mind of lifelong protection and a lower rate, but not cash accumulation. Others could give you lifelong protection, possible dividend payment, but a higher rate.

There are many different options to choose from. Don’t worry, you do not have to know how each one of these products is in and out to be able to make the decision. You simply need to work with an advisor who will understand what is important to you and match you with this product.

What we want you to take away, is the fact that you can customize your policy. In fact, a good agent will advise you to do just that. Don’t pick a type of insurance “off the shelf”, because this could hurt you and your family financially.

What is the cost of the various insurance options

Budget is a big decision factor when it comes to selecting a life insurance policy. We believe that if the cost was not an issue, most of our clients will decide to have the maximum coverage amount and a policy that offers many additional features, not just plain death insurance.

However, this is not the world we live in. Now, more than ever, we need to be mindful of our spendings and ensure that the policy we secure, not only protects our dreams, but it fits within our budget. The last thing you want to do is buy a policy that is financially unsustainable long term.

We’ve run into clients, who bought the idea of having a policy with great cash accumulation potential, however, the monthly premium was not something they can fit into their budget for more than 2-3 months.

This makes it the wrong policy for them!

Take a look at the simple table below. We wanted to demonstrate how much the different types of policy cost.

The assumptions are for a 35-year-old male in average (standard) health and non-tobacco. The coverage in all options is set for $250,000.

| Type of policy | Monthly Premium | Total Premium Paid in 20 years | Cash value in 20 years |

|---|---|---|---|

| Term | $24.03 | $3,460.32 | $0 |

| GUL (Guaranteed Universal Life) | $132.75 | $31,860 | $0 |

| IUL (Indexed Universal Life) | $281 | $67,500 | $86,507* |

| Whole Life | $233.33 | $53,602 | $46,327 |

*the number illustrated is a projection and it is used for demonstrative purposes only. It must be accompanied by a complete illustration that shows guaranteed elements, additional interest rates, and charge scenarios, and other important information. Any non-guaranteed elements are subject to change.

Are there any other features to consider

This is another section that is also important and you need to pay attention to when deciding the best life insurance policy for you. Different companies offer different features making their products stand out and be more attractive than others. Here are some examples:

No medical exam life insurance policies

There are groups of carriers who would approve your application without requiring a medical exam. There are different types of no medical exam life insurance policies. You could review the guide for additional information and the advantages of skipping the exam.

Living benefits or Accelerated Benefit Rider

We believe that having this feature in every policy could offer tremendous value. You can review our FAQs about living benefits and why they are gaining momentum. In a nutshell, living benefits allow you the opportunity to “use your life insurance while still alive, should you suffer a qualifying medical event. Living benefits could help you to financially survive what you are physically going through.

Option to customize your policy by adding riders

A rider is an add-on to your life insurance. It allows you to customize your policy to address your specific needs. Some of the most common riders are

- Child rider

- Waiver of premium

- Accidental death rider

- Conversion extension

- Return of premium option

Here is an article on Forbes, we were cited in outlining the available riders.

A solution many of our clients take advantage of

While every situation is different and there is no one size fits all solution, here is a strategy that many of our customers employ:

They secure 2 policies, often with the same carrier. One of the policies is a higher face amount term insurance and the other is a form of a permanent policy with a lower face amount.

Here is an example:

Tom is looking for a total of $500,000 in coverage. He evaluated his needs and understands that his need for the large policy is temporary (he believe his children will be financially independent in the next 15 years and the mortgage should be paid off in 20 years).

We run the numbers for him and he has several options:

Option 1: Secure the entire policy into term life insurance (the lowest cost option) :

$500,000 – 20-year term

Option 2: Secure the entire policy into Guaranteed Universal Life (the priciest option):

$500,000 -20-Coverage guaranteed till age 121

Option 3: Stack policies (priced in between and addresses temporary and permanent needs):

$450,000 – 20-year term

$50,000 – coverage guaranteed till age 121

We advise many of our clients to strongly consider option 3. Here are the reasons why we believe this is a great solution:

- It protects your temporary needs

- However, it also protects your permanent need

Should Tom pass away in year 15 for example, his family would receive the payout of both policies or a total of $500,000.

However, if he outlives his 20-year term policy, he would be left with his permanent need and coverage guaranteed for life. Upon his death, his family would have the funds to cover his final expenses.

While this may not be an ideal solution in every situation, it is a step you need to consider. We would also advise Tom to periodically review his life insurance policy and needs to ensure that they are adequately covered.

For example, one of Tom’s children suffers an accident and now would require care for the rest of his or her life, Tom might consider converting his term coverage into permanent. This way, he would have the peace of mind there would be funds available for the care of his child, even if he is no longer alive.

Life insurance is dynamic. It is tied to our needs and even though many don’t want to hear it, it needs to be reviewed periodically.

In Conclusion,

It is near impossible to decide if a term or permanent policy is best for you. It depends on many factors and on what is important to you. Our advice when trying to decide is to look at the pros and cons of each product and create a strategy that addresses all of your needs and concerns.

If you are not sure where to start, just reach out to us. This is our job and it has been for over a decade.

Thank you!