Are there different types of no exam life insurance?

Do you dread applying for life insurance, because you don’t want to get your blood drawn? Do you need a policy issued for days rather than wait for months? We are noticing a growing trend among our customers. More and more of our clients prefer the convenience of a no-medical exam life insurance policy. Therefore, we decided to put together this guide outlining what are the different types of no-medical exam life insurance, processes, and advantages.

What we would cover

- What is a no exam life insurance policy

- Types of NO medical exam life insurance

- Are the no medical exam policies legit

- Process of securing

- Do no medical exam life insurance policies cost more

- What else I should know about no medical exam life insurance

If you have a question we did not cover in the guide, please feel free to reach out to us. You can fill out the instant quote form on the page, leave a comment, or simply give us a call. We strive to make shopping for life insurance easy.

What is a no exam life insurance policy

A no exam life insurance policy is a policy that companies approve without requiring you to see a nurse. The carrier has eliminated that additional step, making the process much faster and easier for clients. Now, we want to advise you that many life insurance policies are still fully underwritten.

What do we mean by that?

Even though there would be no medical exam required, the company would still ask you medical questions. They will run your Rx report (prescription check), MIB (Medical Information Bureau), and other sources of information. They still want to ensure that you qualify under their guidelines for coverage, we are excluding guaranteed issue products which we’ll explain below.

We’ve worked with clients who assumed that simply because a medical exam is not a requirement, they won’t have to undergo medical underwriting.

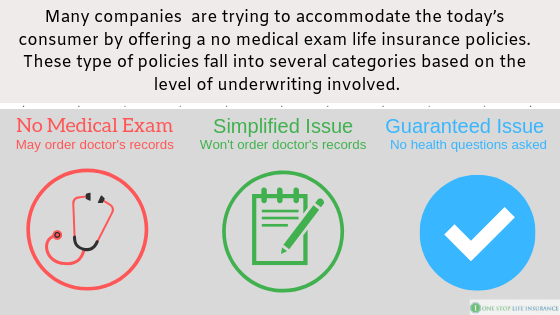

Types of NO medical exam life insurance

Based on the level of underwriting involved and actual coverage, we’ve outlined these 5 types of no medical exam life insurance policies:

- Accelerated underwriting

- Simplified life insurance policies

- No-med life insurance policies

- Final expense/guaranteed issue

- Accidental Death

Let’s cover each one briefly and help you understand the difference between each one.

Accelerated underwriting

These are types of policies that according to pre-set criteria you could be accelerated through. This means that the company received all of the information it needed through your application and third-party sources. They will not require a medical exam, or medical records to approve your policy.

Please keep in mind that this accelerated underwriting is at the discretion of the carrier and typically only the healthiest clients can expect to be accelerated.

We also want to point out, that the carrier may require you to complete a medical exam if you don’t meet their requirements for acceleration. Therefore, this is not a true no medical exam life insurance. However, due to the attractive pricing and the simplicity of the process, we wanted to advise you that in some instances, you might qualify for this option and get your policy approved much faster.

All of the other options are true no-medical exam options. The carriers will NEVER require a medical exam.

Simplified issue policy

This is the type of policy in which the company can issue a decision in a matter of days or even hours. They will either approve or decline your application. The process is very easy and straightforward. You need to complete the application for insurance. This typically takes 20-30 minutes to complete (some carriers allow you the option to self-complete at home on your own time). Once the application is completed, we send it for your electronic signatures, and then is submitted to underwriting. Again, typically we expect to receive a response within 24-48 business hours.

Simplified issue life insurance has only one health rating and companies have calculated in the premium, the cost of higher risk.

No-med life insurance policies

These types of policies are also truly non-medical options as well. The biggest difference is that if carriers seem necessary, they will require a copy of your medical records. In these instances, they will reach out to a personal healthcare provider and ask for a copy of your medical history. This additional step will increase the processing time. Typically, it may take several weeks to get the policy approval in hand.

Now, despite the possibility of a lengthier process, these types of policies are better priced. They allow for various different health ratings, allowing clients in good health to take advantage of savings.

Final expense/guaranteed issue

Final expense policies are another type of no exam life insurance policy. They are designed to ensure that your family would have enough funds to cover the cost of your burial cost plus any additional expenses you might leave behind.

Most of these options are a simplified type of no-medical exam life insurance policies. Simply put, they would not require a copy of your medical records. This equates to faster approval times. In many cases, they provide a decision within 24-48 hours.

It is a good time to point out that the majority of the final expense policies are whole-life policies. This means that you would have fixed coverage and premium till age 121. We find this to be a great advantage, as you don’t want to have an expiration date attached to it.

Based on the level of underwriting involved, final expense policies fall into one of these categories

Level policies – the coverage starts on day one. Offered to clients with minimal health impairments and in overall good health.

Modified/Graded – there still be medical underwriting involved, but the coverage would be structured differently for the first 2 to 3 years of the policy.

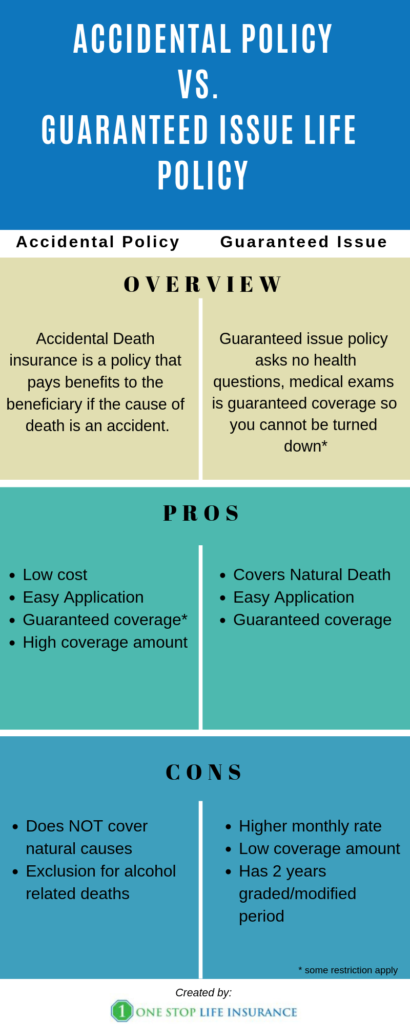

Guaranteed Issue – there will be NO health underwriting involved. The full benefit is payable after 2 years of the policy being in effect. A great option for people unable to qualify for another type of insurance due to current or past medical history.

Accidental Death

This is another type of no exam life insurance policy. It has very easy underwriting. Companies ask just a few questions to ensure you are not replacing an existing policy with an accidental policy. They are also priced very comparatively.

The biggest drawback is that they provide coverage only in the event of an accident. Should you pass away from natural causes or complications from an illness, the policy would not pay.

Are the no medical exam policies legit?

We wanted to take a moment and answer this concern. Many people fear that simply because there would be no exam, the policy of the company is not reputable. We want to rest you assured, that even though the underwriting is a bit easier on your part, no medical exam policy is legitimate. Most of the companies we contact are A-rated or better.

Process of securing

The process slightly differs among the various carriers, but generally is as follows:

Phone application – after we’ve confirmed your eligibility, we will proceed in completing your phone application. Based on the company, this should take approximately 20-30 minutes to do so.

Things you could do to speed up the process:

- Have your driver’s license available

- List your current or past medication

- Provide us with the name of your personal care provider

- Have your account/routing number available if you would be paying monthly for the policy

Signature and submission – after the application is completed, we will send you the application for your review and e-signatures. Once you sign, we will submit it to the carrier for review.

Underwriting – based on the type of no exam life insurance policy you select, these steps could be anywhere from a day to a few weeks. If the company needs more information, it will reach out to your medical provider for your health history and other requirements.

Decision and placing in force – once your policy is approved, we will move towards placing it in force. At this point, you would let us know if we need to make any changes and finalize the paperwork.

Cross getting life insurance off your list – you could rest assured that your family is financially protected should something happen to you.

Do no medical exam life insurance policies cost more

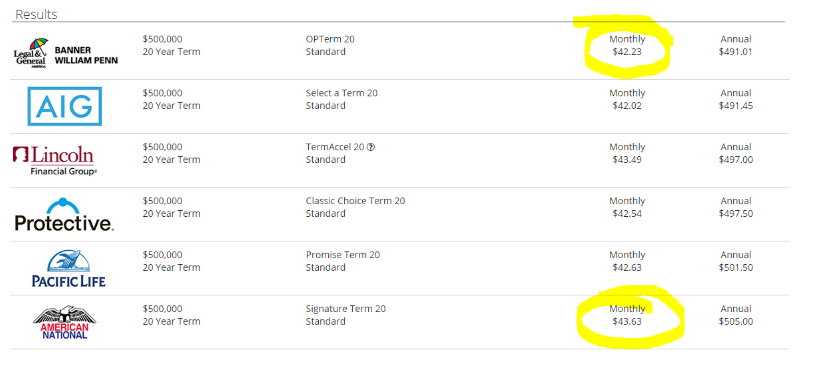

Yes and No. It really depends on the specific type of policy you need. Below is a preview of pricing for fully underwritten compared to a no medical exam policy.

Example,

As you see above, these are some of the sample rates from various different companies. American National is one of the companies that could accelerate your application right through and the monthly rate is just $1.40 more per month than the lowest-cost carrier.

What else I should know about no medical exam life insurance

We thought it is a good time to list some additional information for these types of policies

There is a limit on the amount of coverage you can secure

No exam life insurance policies have a limit to the amount of insurance coverage that is available. In most instances, it is up to $500,000.

Some companies offer living benefits

Accelerated Benefit Riders, or living benefits, allow you to use your life insurance policy while you are still alive).

You might be able to self-complete the application

This is another great convenience feature that many of our clients prefer. They are able to complete the application when it is convenient for them.

It is still a medically underwritten insurance policy

The company still will ask health and lifestyle questions to determine your eligibility. We are excluding accidental and guaranteed issue policies.

They come with a 20-30 day free look period

In other words, once you receive your policy and for any reason, you decide you don’t want it, you can cancel during the free look period for a full refund.

No medical exam policies also have 2 contestability period

This standard is among all life insurance companies. In other words, should you pass away during the first 2 policy years, every company reserves the right to re-open your medical application and ensure that no information was omitted during the application.

In conclusion,

There are 5 different types of no exam life insurance policies. Each one is designed to address different needs and eligibility. If you are not sure which one is the best for you, simply reach out to us. You can do so by giving us a call, filling out the instant quote form on the page, or leaving us a comment.

We hope you find this helpful. Thank you.