Are there cons of life insurance with living benefits

Have you ever heard of the term life insurance with living benefits and all it could do for you and your family? What does it mean and is it all good news? Well, in this article, we point out the cons of life insurance with living benefits.

The main goal of this article is to provide you with critical information, so you can make a decision whether to pursue life insurance with living benefits or not.

Here are the topics we will cover

List the 5 drawbacks of life insurance with living benefits

Answer the question is life insurance with living benefits worth it

Address some of the most common questions when it comes to the benefit

If you have any additional questions or would like us to review your personal situation, simply reach out to us. We would take the time to listen and ask you the right questions.

OK, Let’s dive in…

Cons of life insurance with living benefits

When reviewing the topic, we found 5 main points we want to bring to your attention. We believe that you should be mindful of them when selecting the right policy for you and your family.

Reduces the death benefit

This is the first point we would like to make. When discussing life insurance with living benefits without a client, we’ve realized that many were not aware of the decreasing death benefit. Let us explain more.

Living benefits, or Accelerated Benefit Riders, as referred into the policy, are allowing you to “use” your death benefit in advance under certain circumstances. In other words, to accelerate, your death benefit.

Here is an example outlining how would a client be able to accelerate his or her life insurance death benefits:

Meet Josh. He is 40 years old and has purchased a $500,000 life insurance policy with living benefits. Unfortunately, he suffered a heart attack and was hospitalized for 1 month. Josh survived and is on his long way to recovery. He is not able to go back to work and his wife had to reduce her hours at work to care for him and their 3 children.

Despite their health insurance covering a big portion of their medical bills, money is getting tight. The family was falling behind on their mortgage. Josh had a conversation with his agent and decided to file for a partial acceleration under his life insurance policy. He would like to accelerate $200,000 of his life insurance policy.

After filing a claim and the carrier reviewing his medical history, they have determined he is eligible for acceleration and made him an offer of $100,000. The company had applied an actuarial discount. You can learn more about how the benefit would be calculated in a separate article and video we created.

What does this mean?

It means that Josh could receive a check for $100,000 TODAY and he forfeits $200,000 of his life insurance policy. Going forward, his death benefit would be reduced to $300,000.

However, Josh would have some funds available to catch up with the mortgage. He can ensure that he and his family can focus on recovery instead of stressing over money.

The key point, we would like to make is that the $100,000 Josh received has been taken off his death benefit. Josh would NOT have to pay back the money and there are NO restrictions on how he spends it.

Life insurance with living benefits does not cover all medical conditions

Under the policy for every company offering living benefits, there is a pre-set list of eligible conditions. In order words, you could file for an acceleration ONLY if you are diagnosed with any of the listed health conditions.

Typically companies will divide them into 3 separate categories:

Critical Illness

- Major Heart Attack

- Stroke

- Invasive Cancer

- Major organ transplant

- End-stage renal failure

- Coma and etc.

Chronic Illness – if a client is not able to perform 2 out of the 6 activities of daily living (bathing, dressing, toileting, transferring, continence, eating). Please note, life insurance with living benefits is different than long term care insurance.

Terminal Illness – if a client is diagnosed with a condition that is expected to result in death within 12 to 24 months (based on the company).

As you can see from the list above, the conditions are typically limited. Most companies would have only 9, some 16 to 18 triggers under which you can accelerate your death benefit.

The thing to keep in mind is that while the list might be limited, it includes some of the most common health conditions.

The benefit received may be taxable on interfering with government assistance

We would like to advise you that we are not tax professionals and do not attempt to give you tax advice.

What we want you to be aware of is that benefits received under acceleration of your death benefit in life insurance are designed to receive favorable tax treatment.

When it comes to tax treatment, there could be a difference if you are filing under chronic, critical, or terminal illness.

Under section §101(g) of the Internal Revenue Code, benefits received under the qualifying conditions are designed to comply with the requirements for favorable tax treatment.

Typically, benefits received due to terminal illness are treated as a regular life insurance death benefit.

When it comes to chronic illness, the benefits may receive favorable tax treatment under IRS Section 7702B (Treatment of Qualified Long-Term Care Insurance).

Accelerated benefit payments under the Accelerated Benefit Rider for critical illness may receive favorable tax treatment under Internal Revenue Code Section 105(b) and 105(c).

You should consult with your tax advisor to determine how these limits apply to your situation.

A term policy with living benefits may cost more than a policy with NO benefits

Let us explain…

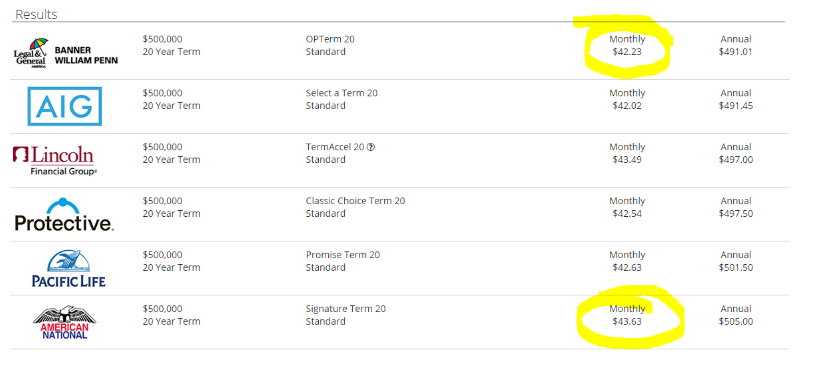

Please see the image below. It represents the rate of several different companies for the same terms of insurance. The example is for $500,000 locked in for 20 years at standard health. The lowest price option is $42.23 per month and the first company on the list offering comprehensive (all three riders) living benefits is $43.63 per month.

Now, while the option with living benefits costs more, we are only talking of $1.40 per month difference!

For us, it makes sense to pay the higher premium and to have the option to accelerate should you need it in the future.

There is an administrative fee to process the accelerated benefit payment

Companies have an administrative charge when processing the payment of an accelerated benefit in life insurance. The fee varies amongst the carriers and it is typically between $200 – $500.

While for some this may not be a dealbreaker, we wanted to make you aware of it.

We hope that now you have a better understanding of the major cons of life insurance with living benefits. To view your quote or to see if living benefits are right for you, click below or give us a call.

Should you buy life insurance with living benefits

We are strong believers in having options in life. Our recommendation is to review life insurance with living benefits and give it serious consideration.

The only certainties in life are death and taxes.

Mark Twain

We don’t know what is ahead, nor we can predict 100% of our future. Life insurance with living benefits could provide you with a choice and alternative course of action.

In other words, having the option to access your life insurance policy benefit could be life-changing. Not only do you have no restrictions on what the money is used for, but you do not have to pay it back.

Your main focus would be recovering and not the financial burden.

We have dedicated a separate article on whether we believe life insurance with living benefits is worth it.

Common questions when it comes to the benefit

The main objective of this article was to give you a better understanding of life insurance with living benefits. However, if you have any questions, such as:

- Is there a waiting period,

- How do you file a claim,

- Is the payment a lump sum and etc,

We strongly advise you to review our article on 21 FAQs of life insurance with living benefits.

In conclusion,

We want you to know that there are cons of life insurance with living benefits. Our belief is that the benefits outweigh the negatives. You should consider if owning a policy with this feature is beneficial to you and your family.

What we want you to take away is that there is more than pure death insurance. You do not have to die for your policy to pay. These policies offer more comprehensive coverage and could be the financial asset that helps you and your family.

If you would like us to review your options, simply reach out to us.

Thank you!