Guaranteed Universal Life: When it Makes Sense

With so many options for coverage, it is no wonder that choosing the right insurance plan may be challenging. In this article, we want to outline the advantages of a not very well-known option: Guaranteed Universal Life insurance, and why you might want to lock it now.

Here is what we would cover

What is Guaranteed Universal Life Insurance

When Guaranteed Universal Life insurance makes sense

The current trend among the life insurance carriers

5 important things to consider when it comes to Guaranteed Universal Life Insurance

Prior to diving in, we wanted to point out that we are life insurance brokers. We are not employees of any company and we have your best interest at heart. Our recommendations for coverage would be based on your eligibility and company features.

What is Guaranteed Universal Life Insurance

Guaranteed Universal Life Insurance, or GUL as often referred to, is a type of permanent life insurance. This policy is protection-oriented. In other words, the product is designed to provide lifelong coverage. It also builds cash value, but is very minimal, compared to whole life insurance for example.

The fact that the policy does not build much cash value, makes it very affordable and a great option for clients looking into a piece of mind that they would not outlive their insurance. In other words, if your main objective is to have some coverage when you pass away, regardless of when that might be, this is the plan to have.

Guaranteed Universal Life policy does not have a set expiration as term policies. Meaning you could have the same policy, at the same rate for the next 30+ years. Therefore, many of our clients prefer to lock this option along with their term insurance for more comprehensive protection.

We would cover that in more depth below:

When Guaranteed Universal Life insurance makes sense

Guaranteed Universal Life, just like any insurance product, is NOT one size fits all. There are some instances when securing a GUL makes sense and some when it does not.

To help understand if the Guaranteed Universal Life policy is the best fit, we start with reviewing the client’s needs. What is it that they are trying to protect through life insurance? Are they looking for protection when the kids are little, do they want to ensure that the mortgage is taken care of or final expenses are their main priority?

We have a saying that helps our clients get a better understanding of their needs and the type of policy they need to get in order to protect it:

Temporary need = temporary insurance (a.k.a. Term insurance)

Permanent need = permanent insurance (GUL, whole life, or other permanent product)

Unless you have unlimited resources, it does not make sense to cover temporary needs with permanent coverage. The higher cost, compared to a term policy, could be considered a disadvantage of the Guaranteed Universal Life Policy.

So, when does Guaranteed Universal Life make the most sense?

We’ve found several scenarios we recommend GUL to clients. To better illustrate the strategies, we would use examples:

Meet David: he is 37 years old in average health. He has 2 kids and a mortgage of $300,000. He has retirement accounts and savings. After going over his needs, we’ve determined that $1.25mil would be sufficient coverage. Now it is time to select the right product type.

Option 1:

David could secure all of the coverage into term insurance. This would definitely be the most economical way. However, should David outlive his term insurance, he would need to plan down the line for final expense coverage. This would cover the cost of his funeral, so he would not be a burden on his family.

$1,25 mil in a 20-year term is $92.65 per month

Option 2:

David wants to make sure he does not run into the problem faced in option 1 outliving his insurance, so he wants the entire cover to be permanent. And since he already has several retirement accounts, cash value growth is not of any interest to him.

In this case, we are looking at a $1.25 million Guaranteed Universal Life policy

$1.25 mil locked into age 121 – $871 per month*

*Coverage is calculated to age 121 at a standard/average non-tobacco rate class

Yes, when David does pass away, his family would receive $1.25 mil dollars, which would be income tax-free. However, the cost of the policy is unaffordable for most families.

Therefore, oftentimes, we present to the client the following solution. In our experience, it is a mix that addresses 2 types of needs while it keeps the price affordable:

Option 3:

Secure 2 policies. He would have term insurance for his temporary need for income replacement and a permanent policy for his permanent need.

Policy one is a $1mil 20-year term for a monthly premium of $75.14.

Policy two is a $250,000 GUL to age 121 for a monthly premium of $186.00.

What this would do is provide $1.25 to his family, should he pass away in the next 20 years, and $250,000 of the death benefit if he passes away after the 20th policy year. As you can see his monthly payment would be $261 and his family would get the protection they need.

This is a perfect example of saying: the best life insurance is the one you have in place when you die. We all would like to take advantage of a cash value building permanent policy, however, if the payments are unsustainable or the death benefit is too low for our family, are we really doing them a favor?

Look at your needs and budget to select the right policy plan for YOU.

The current trend among the life insurance carriers

Now let’s turn our attention to something really important: what is the current trend and predictions for Guaranteed Universal Life policies amongst the careers? Unfortunately, the low-interest environment we are in and other factors are causing carriers to discontinue this product. Just in the past year, we have been notified by 2 large carriers that they are no longer planning to offer this plan for NEW customers.

What does this mean to you? Well, if you have an existing policy in place, it means absolutely nothing. The company would continue servicing your plan and honor the contract.

However, for new clients, it means that the product would not be available and you would need to select either a different company, when possible or another product offered by the carrier.

In other words, if you are considering taking advantage of this strategy, NOW would be the time.

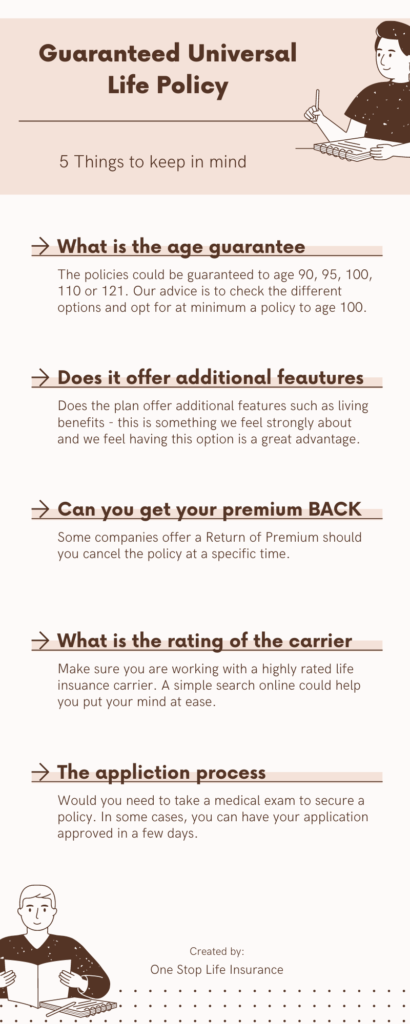

What are the 5 things you need to consider when choosing a Guaranteed Universal Life?

- Until when the policy is guaranteed – in some instances, the policies could be guaranteed to age 90, 95, 100, 110 or 121. Our advice is to check the different options and opt for at minimum a policy to age 100.

- Does the plan offer additional features such as living benefits – this is something we feel strongly about and we feel having this option is a great advantage.

- In addition – are you able to cancel your policy and get some or all of your premium back – Some insurance companies offer something called a Return of premium surrender policy at the 20-year mark. In other words, on the 20th policy anniversary, you could notify the carrier you would like to cancel the policy and they would send you a check returning ALL of your premium payments. We’ve outlined more information on Return of Premium here.

- Every time when selecting a life insurance company you would need to be mindful of their rating and years in business. Even though, as an agency, we are very selective of the carriers we represent, we would advise you to look up the carrier. We want to make sure you feel comfortable placing your trust in the company for the next 20, possibly even 50 years ahead.

- What is the process of obtaining a policy – now we understand that this may not be of extreme importance in the whole scheme of things, but it is something we would like to point out. There are policies that could be approved within a week, while others could take 4-6 weeks and require a medical exam. After speaking to our agents, we would advise you if a life insurance policy with no medical exam is an available option for you.

In conclusion,

There are lots of strategies you can employ when choosing life insurance protection for you and your family. When it comes to a guaranteed universal life policy, there are numerous advantages and this policy could make sense for you. Feel free to reach out to us and we would take the time to understand your needs and give you unbiased advice on what products you qualify for and what company could offer you the best rate and easiest approval process.

Thank you!