Are living benefits and cash value the same thing?

Have you heard the term: you don’t have to die to use your life insurance? What exactly does it mean? In what ways can you use your life insurance, while still alive. In this post, we will go in-depth outlining what are living benefits and cash value. We will explain what each means, list the pros vs. cons and basically how you can use your life insurance policy while still alive.

We’ve worked with many consumers, who were confused about the difference between cash value and living benefits. We felt it is important to explain these terms and advise you when you can use either of both of them.

Please feel free to reach out to us with any specific questions you might have. You can fill out the quote form on the page, send us an e-mail or give us a call. It will be our pleasure to assist you.

What we will cover

1. Current trends in the life insurance industry

4. Living benefits VS cash value [infographic]

Current trends

It is time to point out the insurance industry is slowly adjusting to people’s needs. Companies are realizing that in order to have a

The idea of death insurance is: you pay your monthly premium if you die – the companies pay. However, more often than not consumers wonder what happens if you don’t die. Did they just waste their money on death insurance?

This is why living benefits emerge. Insureds can benefit or use life insurance policies while still alive. We personally are big supporters of living benefits in life insurance. We believe it gives more control of the consumers and allows them to customize their life insurance.

There are 2 major ways to utilize your life insurance policy while still alive: By using the living benefits or the cash value built into the policy.

This is an important time to mention, that while many carriers offer living benefits, this does not apply for all insurance policies. If you are interested in finding out more about living benefits and cash value, just reach out to us.

What is cash value

Cash value is money that is building within your life insurance policy. You could let it accumulate over time, use it to increase your death benefit or borrow against it.

How it works:

When you pay your premium, the company will deduct the cost of insurance and expense charges. The resulting net amount, the net premium, will be allocated to the investment account where it will earn interest. Typically, whole life insurance policies build cash value and offer dividends to their policy owners. The owner could take out the dividends or use paid-up additions.

IULs on the other hand, do not offer dividends. Their earned interest could not

This is a huge advantage of the cash value accumulation policies. The guaranteed that if the market takes a downturn, your policy interest growth won’t be negative.

Example:

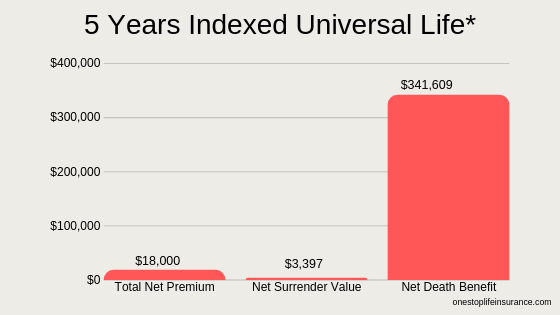

Let’s look at Arun. He is looking to secure a policy to protect his family while building cash value. Arun is currently 36-years old, non-tobacco and in good health. He decides to purchase a $341,609 life insurance policy for a monthly rate of $300, in order to maximize his cash value growth.

Below is a snapshot of how his policy could perform in year 5. He has paid $18,000 into his policy; his surrender value (if he decides to cash out completely his policy) is $3,397.

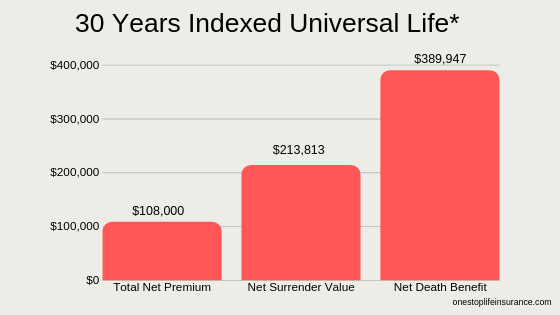

Now let’s take a

Please note the change in the death benefit as well!! In year 5, the death benefit is $341,609, while in year 30 – $389,947. It has increased by over $48,000, while the payment has remained the same.

*We do need to point out that these values are not guaranteed and actual results may be greater or less than those shown. They are used for demonstrative purposes only.

Ways to use your cash value account

Depending on the type of policy you have, there are several ways you can use your cash value:

- Loan against it – request the company to send you a check, using funds from your cash value account;

- Use it to pay for the policy premiums;

- Ask the company to cash surrender the policy and send you all of the funds available. In this scenario, you will be canceling the life insurance policy.

On a side note, some carriers offer a cash surrender option, often referred to as a return of premium.

Consequences in using the cash value

Any withdrawals made against the policy, are considered loans. These loans will be incurring interest. If you are not repaying the loans, any interest and the outstanding balance will be charged off against remaining and future growth.

Please be extremely cautious when using funds from your cash-value account. You need to ensure that your policy will still be funded properly to avoid cancellation.

Please note,

Should you pass away before you pay off the cash value loan back, the death benefit will be reduced by the outstanding balance plus any interested accumulated.

Policies offering cash value:

Typically, a

- IUL (Indexed Universal Life);

- Universal Life and

- Whole Life.

However, sometimes a term policy can build cash value as well in the form of the return of premium.

What are Living benefits

Living benefits allow the insured to use his or her life insurance while still alive. You are able to accelerate a portion off or the entire death benefit in certain events. Some qualifying conditions are

How to use

If a qualifying medical condition occurs, you need to reach out to the company. Please keep in mind that you need to act fast. In some instances, you have to file a claim within 12 months of occurrence.

The carrier will ask for your complete medical records, doctor statements, lab results to determine eligibility. Once the claims department reviews your case, they will reach out to you with their decision. At that time, you will have the option to accept or reject their offer. For more information on qualifying conditions, you can review are living benefits are worth it.

Consequences

Any acceleration will reduce your death benefit. You are telling the company that you need to use your death benefit NOW vs. waiting until after you die. Many people may consider that a disadvantage. We consider it having an option. It is hard to predict the future and sometimes it is essential to have a way to access money.

Policies offering living benefits

Living benefits are offered in various types of policies, such as

- Term policies, often in no medical exam life insurance

- Final expense/burial policies

- Universal life policies

- Whole life policies

Please reach out to us to find more information on the various living benefits available. We will take the time to understand your needs and recommend appropriate coverage.

Cash value and living benefits – comparison

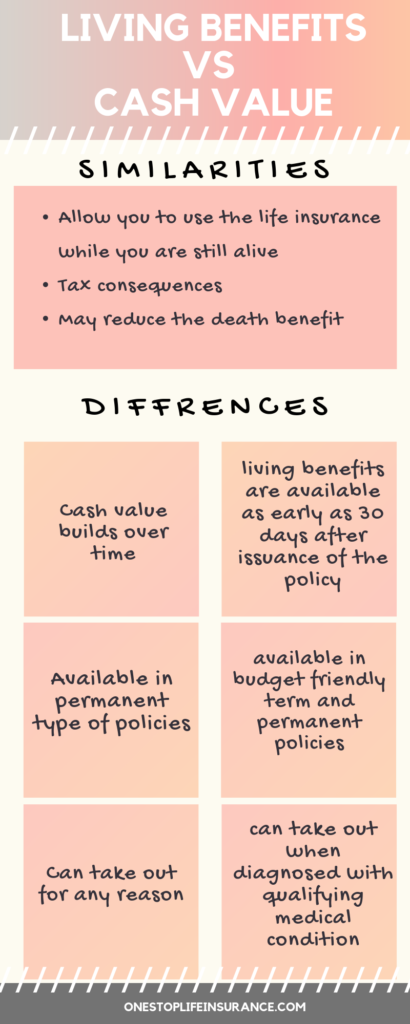

For easy comparison, we created this infographic outlining the similarities and differences between the 2 options

Similarities

Allow you to use the life insurance policy while you are still alive – you will have the flexibility to decide if you need to take advantage of this option.

May reduce the death benefit – if utilized, both options could result in a decrease in the overall death benefit. In many instances, life

Tax consequences – life insurance receives a very favorable tax treatment. The death benefit is generally tax-free for the beneficiary (some exclusion apply). Therefore, it is a highly regulated industry. Any use of insurance benefits while alive may create a taxable event. Please consult with your tax advisor to determine your options.

Differences

Cash Value

- Cash value builds over time (see the examples above);

- Primarily available into the permanent type of policies;

- Can take out for any reason.

Living Benefits

- Can offer living benefits as early as 30 days after issuance of the policy;

- Available in budget-friendly term and permanent policies;

- Can take out when diagnosed with a qualifying medical condition.

In conclusion,

Even though both living benefits and cash value allow you the option to use your life insurance while still alive, they are different. It is important to discuss your needs with your insurance agent and determine which one, if not both, is addressing your needs best. If you would like us to take a look at your personal situation, just reach out to us.

Thank you

2 Comments

Maria

Hi Zhaneta,

Is there an option to have a permanent insurance plan with cash value accumulation AND living benefits? If so, are the payments going to be more expensive than having just one (only cash value vs only living benefits) and will I be able to take money out at any time?

-Maria

One Stop Life Insurance

Hi Maria,

Thank you for the great question! Yes, there are products that build cash value and over living benefits. They are permanent insurance (whole life or universal life policies) and these types of policies are more expensive than term insurance. If a company offers living benefits, typically they are already included in the price. You can take out cash value at any time (just need to make sure you pay close attention to the future performance of the policy).

Feel free to reach out to me directly and I can run several different options for you, based on your needs and goals.

Thank you,

Zhaneta Gechev

Direct 702-342-8727

email:zhaneta@onestoplifeinsurance.com