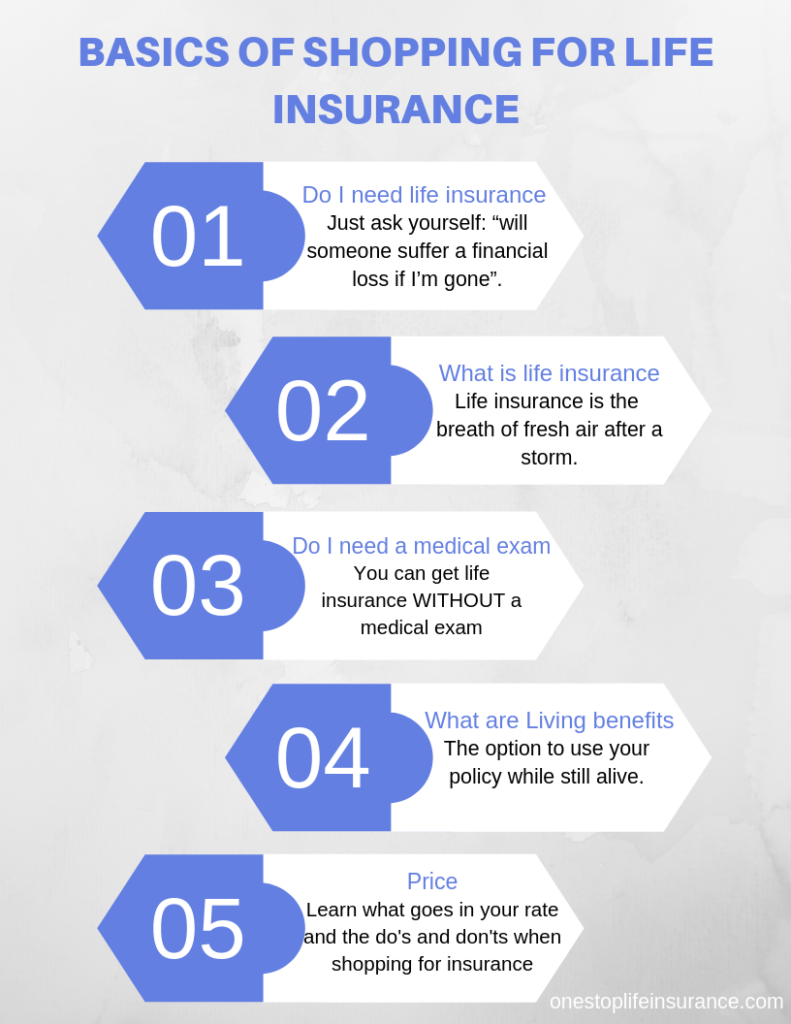

Know the basics of shopping for life insurance

Did you know many people avoid buying life insurance because they think it’s complicated and hard to get? They are leaving their families unprotected because of the many misconceptions surrounding life insurance. We noticed this and decided to create this complete guide and make life insurance simple to understand and secure. In this post, we would cover the basics of shopping for life insurance. For example, do you really need life insurance; is it expensive and can you get life insurance without a medical exam, and what are the exact steps to take in order to buy life insurance?

Life insurance is the greatest proof of love that we can leave our loved ones.

Tiago Melo

Life insurance made simple:

What is life insurance and some of the most common questions answered

Do you need a medical exam to get life insurance

- Are they worth it

- Are living benefits the same as cash value

- Can your life insurance pay your medical bills

Is life insurance expensive and how are is your rate determined

5 Do’s and don’ts when buying life insurance

The idea behind this post is after reading it, for you to have a pretty good understanding of how exactly life insurance works, what are some of the steps, mistakes to avoid and ensure your policy is not outdated.

If you have a question on any of the topics, please feel free to reach out to us. You can do so, by filling out the instant quote form on the page, send us a message or simply give us a call. Our friendly agents are here to help.

Here is the first topic we will cover:

Do I need life insurance?

This is a valid question. In reality, not everyone needs life insurance. However, the majority of us do. The simple test is to ask yourself: “will someone suffer a financial loss if I’m gone”. If the answer is yes, you need life insurance. Obviously, there is a bit more to it, and that’s why we’ve outlined the scenarios one may need life insurance and how to determine how much they need.

What is life insurance and some of the most common questions answered

Everyone knows that life insurance is a policy issued on one’s life. If the person passes away, his beneficiary will receive a check from the company. What many people don’t realize how important in fact life insurance is for families.

Should you pass away, your loved ones will need money to pay for your funeral (and as we all know, they are not cheap), possibly medical bills and personal time. We wanted to elaborate on personal time. A lot of people forget this one big factor. Our family can NOT go back to work on Monday as if they just didn’t bury you a few days ago. They would need time to comprehend their new normal and adjust to it. Time costs money. This is where normally life insurance comes in.

So, what is life insurance?

Life insurance is the breath of fresh air after a storm.

Another thing we wanted to address is some of the most common questions as the basics of shopping for life insurance. There are many factors to consider when shopping for the right life insurance, especially when deciding between a term or permanent policy.

Yes, the right life insurance. You would be amazed, how many times people were sold a wrong type of policy. The term products are not right for everyone, just as well permanent policy doesn’t always make the most sense. This is why it is crucial to work with an agent who will put your interests first, not his or her pocket.

Here are just a few of the most common questions we get:

- How much coverage do I need

- Who can be my beneficiary

- Are all term insurance policies the same

- When is the best time to buy life insurance

- What type of policy is right for me and etc

- What are the different types of universal life polices.

- Ways the policy will payout

- What is return of premium life insurance and is it worth it

One question stands out the most. We get this question ALL the time, so we’ve paid special attention to it….

Can you get life insurance without a medical exam

Life insurance with no medical exam is one of the easiest, fastest and most simple way to get life insurance. Some companies will approve and issue a policy within HOURS of submitting your application. It just doesn’t get any easier than this.

Here’s the catch:

You still need to qualify. Don’t think that just because there is no medical exam, the companies approve every application. The carriers will still ask you health questions and will still run the reports. It is all based on the type of no exam policy you select (there are 3 types).

What are Living Benefits

Another feature many of the no exam policies offer are living benefit riders. It is worth to mention that living benefits could also be part of a fully underwritten life insurance policy.

Many of our clients see a huge value of a policy with living benefits.

But wait, what exactly are living benefits?

Living benefits allow the option of the insured to accelerate (use early) a portion of the death benefit while still alive. In order for the living benefit to be triggered, the insured needs to be diagnosed with a qualifying medical condition such as invasive cancer, stroke, heart attack and etc. We’ve created a separate guide answering the most common questions about living benefits in life insurance.

This is the biggest difference between living benefits and cash value. Essentially, you have your term life insurance to pay for your medical bills.

This is HUGE because on average someone in the US will suffer from a heart attack every 40 seconds and many survive. They could use their life insurance while still alive to pay medical bills, co-insurance, or take time off work to get better. Most companies use an actuarial discount in calculating the available benefit.

In addition, your life insurance with living benefits could help you financially if you are diagnosed with diabetes or you have a chronic health condition. In other words, if you are not able to perform 2 out of the 6 Activities of Daily Living. However, not all life insurance with living benefits are the same. There are several differences you need to be mindful of.

In separate articles, we’ve outlined the process to file for acceleration and listed any waiting periods.

While many clients, compare it to a long term care policy, we want to stress out that it is life insurance with an accelerated benefit rider.

Interesting fact, life insurance can even help keep you out of jail.

Also, to provide you with a complete guide on life insurance with living benefits, we would like to advise you that there are some drawbacks you should be mindful of. The biggest negative is that accelerating your life insurance will essentially reduce or completely eliminate your death benefit.

Please take the time to review the information prior to making a decision.

This is truly life insurance and it is the thing that separates it from the plain death insurance.

Please note that in some states, there are additional requirements companies need to meet. Therefore, we’ve created a separate guide for life insurance with living benefits in California.

Is it expensive and how is my rate determined

Now, it is time to turn our attention to PRICE. You already have a better understanding of what life insurance is and what it can do for you. Now it is important to see how much it cost.

Do you know that according to LIMRA, the average consumer overestimates the cost of insurance? In fact, a large percentage of surveyed will not buy life insurance because of the cost. But here is the interesting part. The majority of the people overestimated the cost of life insurance, sometimes by over 300%.

This a common myth, so we created the guide on how your life insurance rate is determined and how you can find affordable life insurance.

Bonus tip:

We’ve worked with many families and we’ve seen the mistakes people make. So, we’ve compiled a guide outlining the 5 Do’s and Don’ts when getting life insurance. Take a second and go through it, it could save you a lot of money now and financial headaches in the future.

Bottom life,

Life insurance could be confusing. Ther many things to consider from the right coverage, policy type to the best carrier for you. Know the basics when shopping for life insurance, follow the best practices and avoid the 5 don’ts.

2 Comments

J.D.

Hello,

what is your policy for insuring people who use suboxone? This person, has no preexisting health conditions, under 40, on no medications for High BP or Cholesterol, non nicotine user, has not used alcohol in 9 years… This person was placed on pain medication after an injury, wanted to be on something for pain, without the addictive nature of Suboxone . This was a directive of a doctor. Now this person cannot get life insurance and is not a typical case for suboxone when you think of it. Generally used for heroin harm reduction or recover but it is not in this situation. Any insight would be greatly greatly appreciated. If you have time and if not, completely understandable . Thank you for you time today.

One Stop Life Insurance

Hi J.D.,

Thank you for reaching out. You are correct, many companies are not willing to consider Suboxone use for insurance. Based on the situation you outlined, we might have a good chance of approval. Feel free to reach out to me directly to discuss.

Best,

Zhaneta Gechev

Direct: 702-342-8727

email: zhaneta@onestoplifeinsurance.com